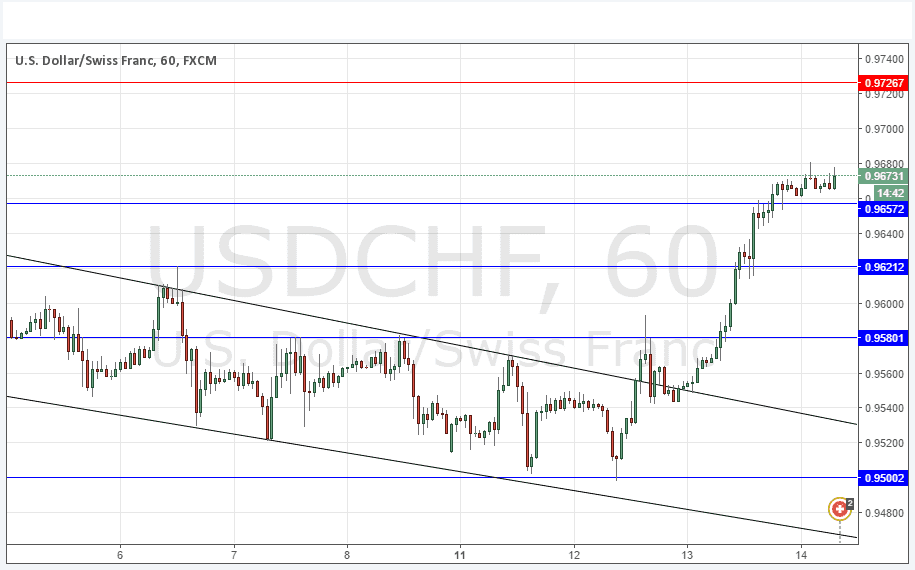

USD/CHF Signal Update

Yesterday’s signals were not triggered as there was no bearish price action at either 0.9580 or 0.9621.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 0.9657 or 0.9621 or 0.9580.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9727.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

Yesterday saw a very strong bullish move which cut very cleanly through three levels that had been expected to act as resistance. In fact this pair was the big story of the day. The move seems to have been driven primarily by U.S. Dollar strength, even though the key U.S. data releases yesterday were actually more negative than expected. This is typically a very bullish sign, so if the U.S. data due later today is equal to or stronger than expectations, a further rise would seem to be very likely.

It is possible to look for a long trade following a pullback to 0.9657 but as this was broken very recently, special caution should be exercised there.

There is nothing due today regarding the CHF. Concerning the USD, there will be releases of CPI and Unemployment Claims data at 1:30pm London time