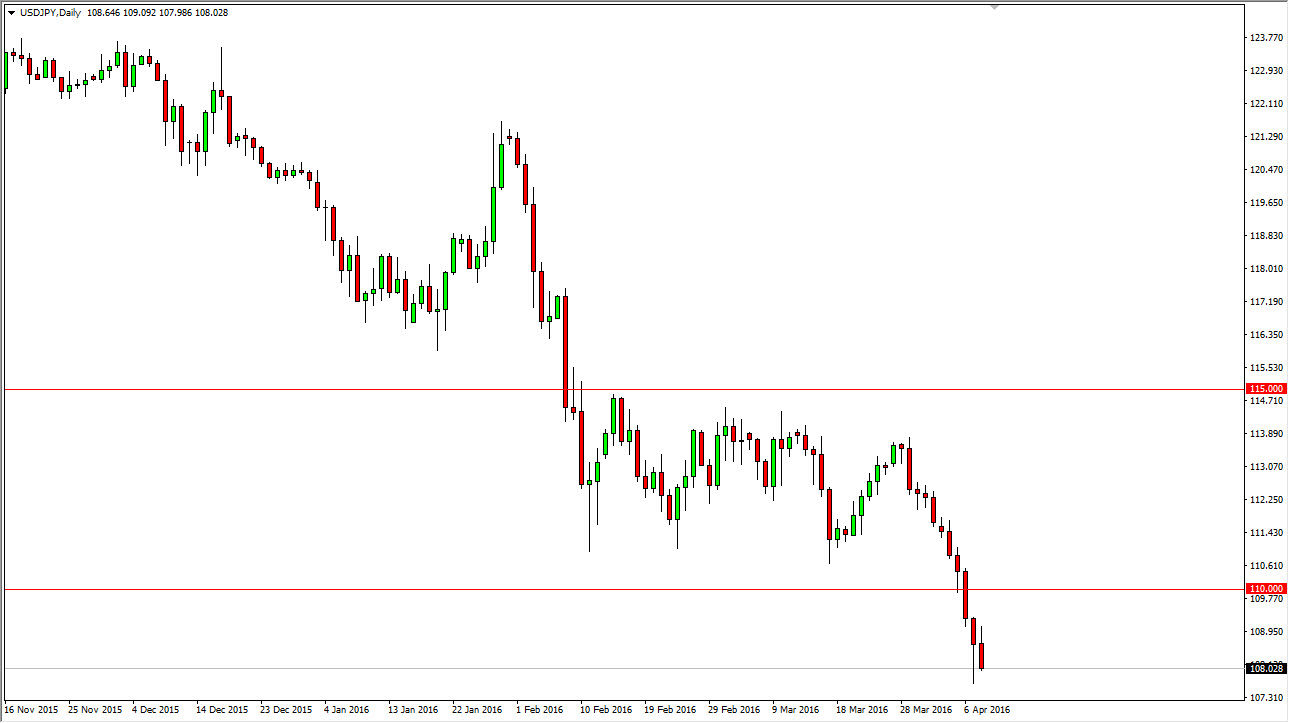

USD/JPY

The USD/JPY pair initially tried to rally during the course of the session on Friday, but turned back around to form a fairly negative candle. However, we have not broken down below the bottom of the hammer from the Thursday session, so it is not technically a sell signal yet. Short-term rallies would be a nice selling opportunity as well, so at this point in time I have no interest in buying. I believe that the 110 level is massively resistive, and essentially the “ceiling” in this market right now. Eventually, I feel the market will reach down towards the 105 level, and most certainly we are starting to see lots of concern overall, which of course favors the Japanese yen as it is considered to be a safety currency.

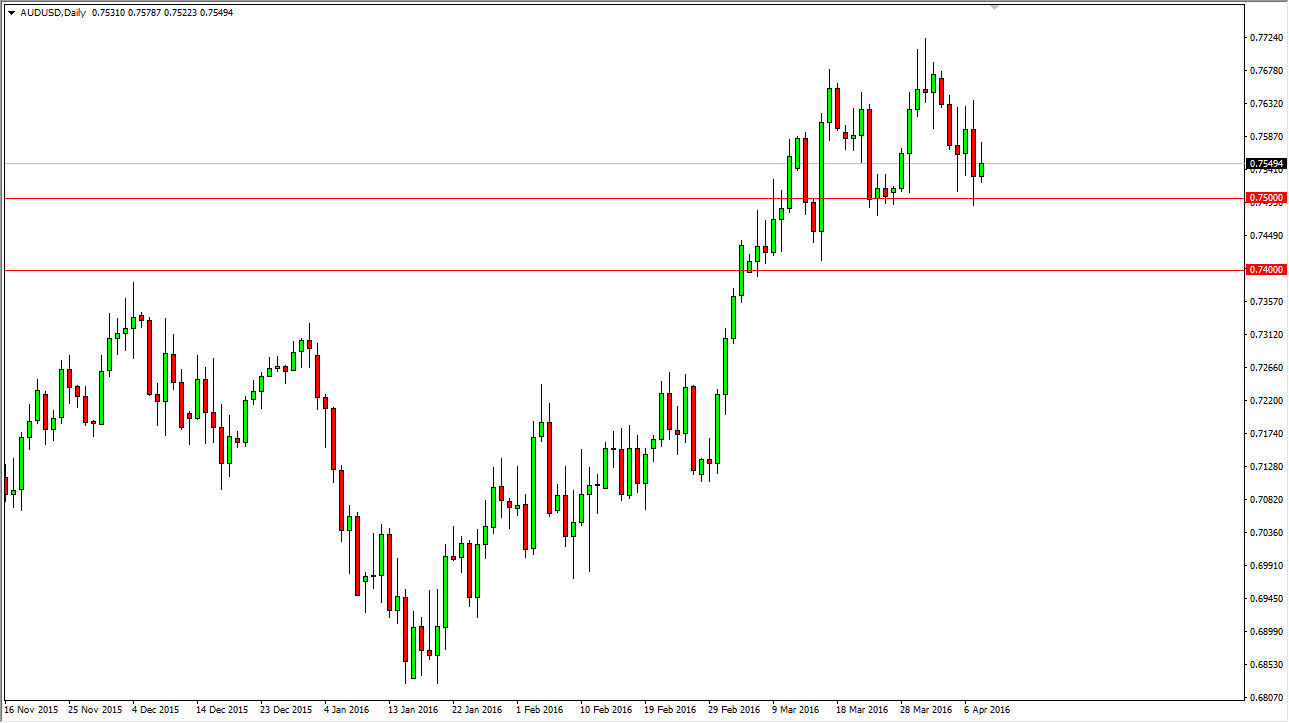

AUD/USD

The AUD/USD pair initially tried to rally during the course of the day on Friday, but turn right back around to form a shooting star. The shooting star of course is negative, and the fact that we have the 0.75 level just below that offers quite a bit of support makes me hesitant to sell this market. I also recognize that the support level extends all the way down to the 0.74 level, so given enough time I believe that a supportive candle will make itself appear, and we will of course be able to start buying this market again. On the other hand, if we can break above the top of the shooting star, the market will then reach towards the 0.77 level.

The gold market often will drive the Australian dollar in one direction or the other, so if we get a rally in the gold market, that should push the Australian dollar higher. I have no interest in selling until we get well below the 0.74 level, and at that point in time I do have to reevaluate the entire situation.