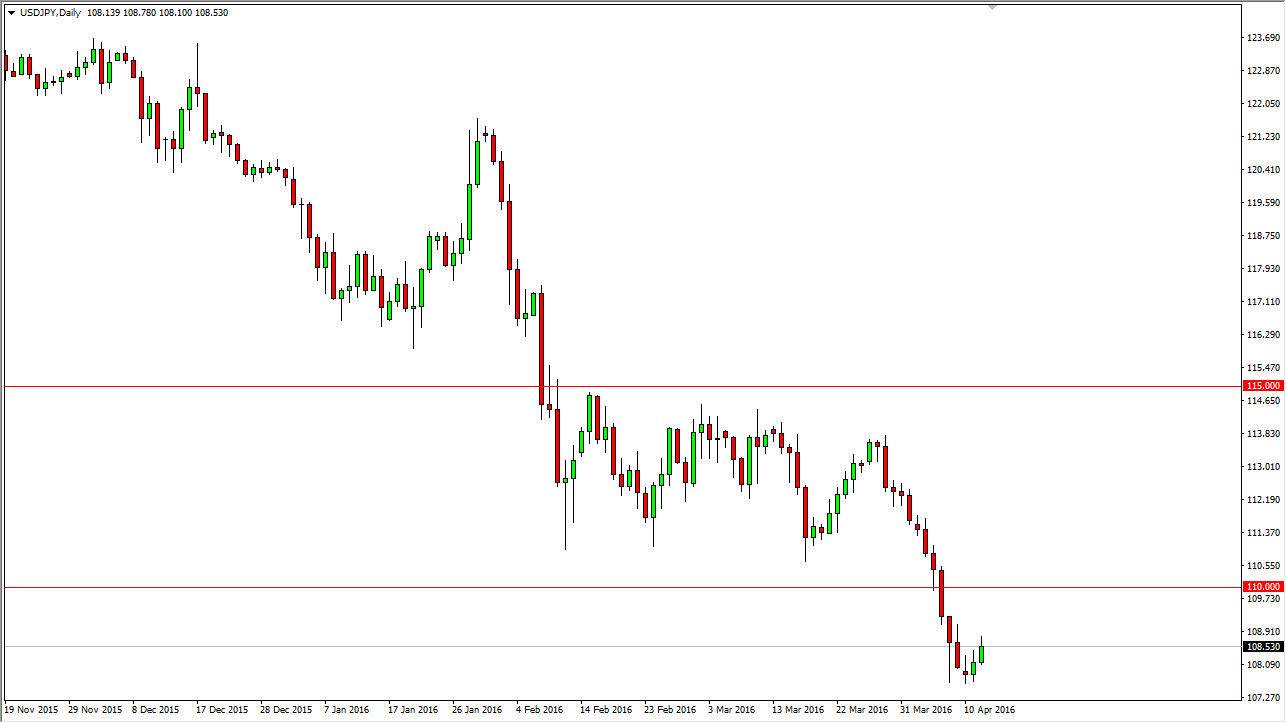

USD/JPY

The USD/JPY pair broke higher during the course of the day on Tuesday, clearing the top of the shooting star from Monday. But being that the case, it looks as if the market is going to perhaps try to reach towards the 110 level, an area where we see quite a bit of resistance. I think it’s a short-term buying opportunity at best, as there has been a significant amount of interest in the 110 area. On top of that, there is a lot of concern in the marketplace as far as global growth, and that of course tends to send this market lower. On top of that, I see quite a bit of resistance all the way to the 111 level, so it’s not until we break above there that I would be comfortable buying. Any resistive candle between here and the 110 level should be a selling opportunity.

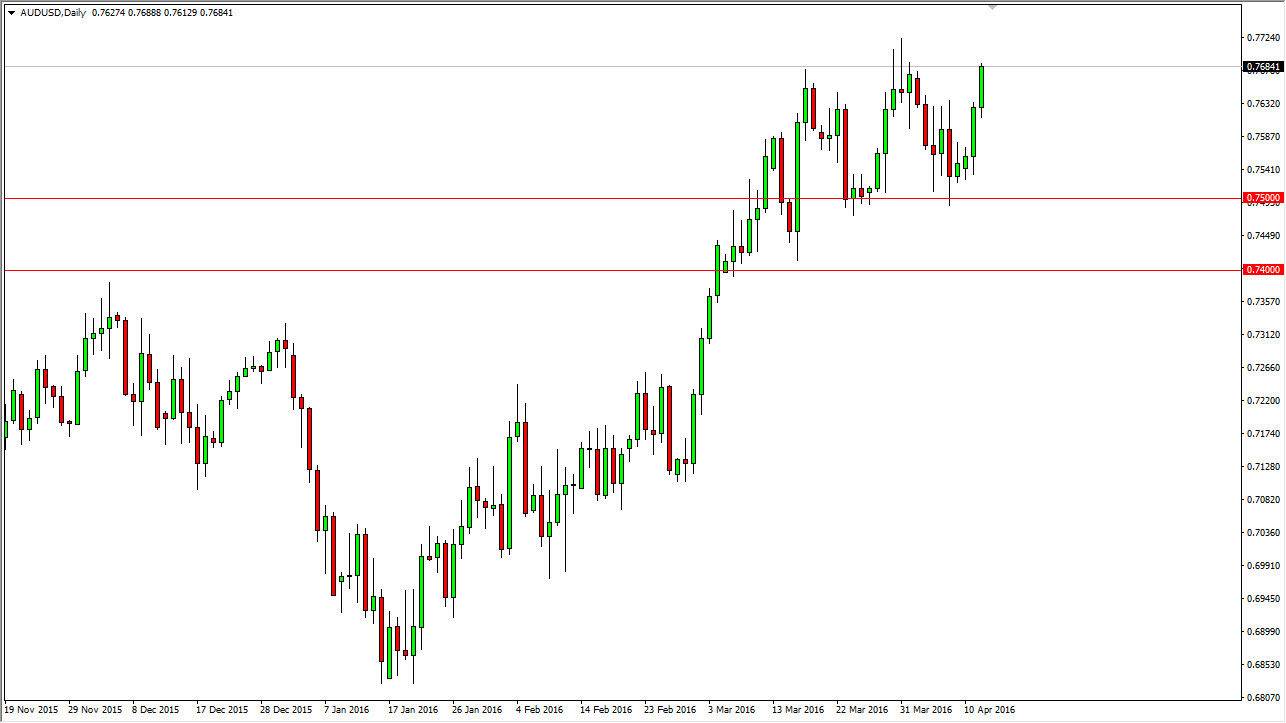

AUD/USD

The Australian dollar rose during the course of the session on Tuesday, testing the 0.77 level. If we can break above that handle decisively, I feel that this market will then be able to make a move to the 0.80 level that I have been thinking about for some time. I think that short-term pullbacks should continue to be buying opportunities on short-term charts, but I think this is a market that is trying to break out overall. The 0.75 level below is massively supportive, and it extends all the way down to the 0.74 handle.

Having said that, the last couple of candles are very strong, and it suggests that there is a real pressure to the upside underneath. Ultimately, the gold markets will also have quite a bit of influence on this market, not to mention the fact that the Federal Reserve is looking more dovish than it previously had. With this, I believe that this is a “buy only” market now.