USD/JPY

The USD/JPY pair fell during the day initially on Monday, but found enough support below to turn things back around and form a bit of a hammer type candle. Because of this, the market looks as if it is ready to bounce, and as a result it appears that the market is trying to reenter the previous consolidation area that extends all the way to the 114 handle. This is not going to be an easy move, but I believe that every time this market pulls back there should be buyers coming into it. I think as long as we can stay above the 110 level, that will be the case.

Having said all of that, there is a significant amount of resistance between the 114 and 115 levels. Because of this I think that we will struggle to get above there, but if we do it should be a rather explosive move and more or less a significant “buy-and-hold” situation going forward.

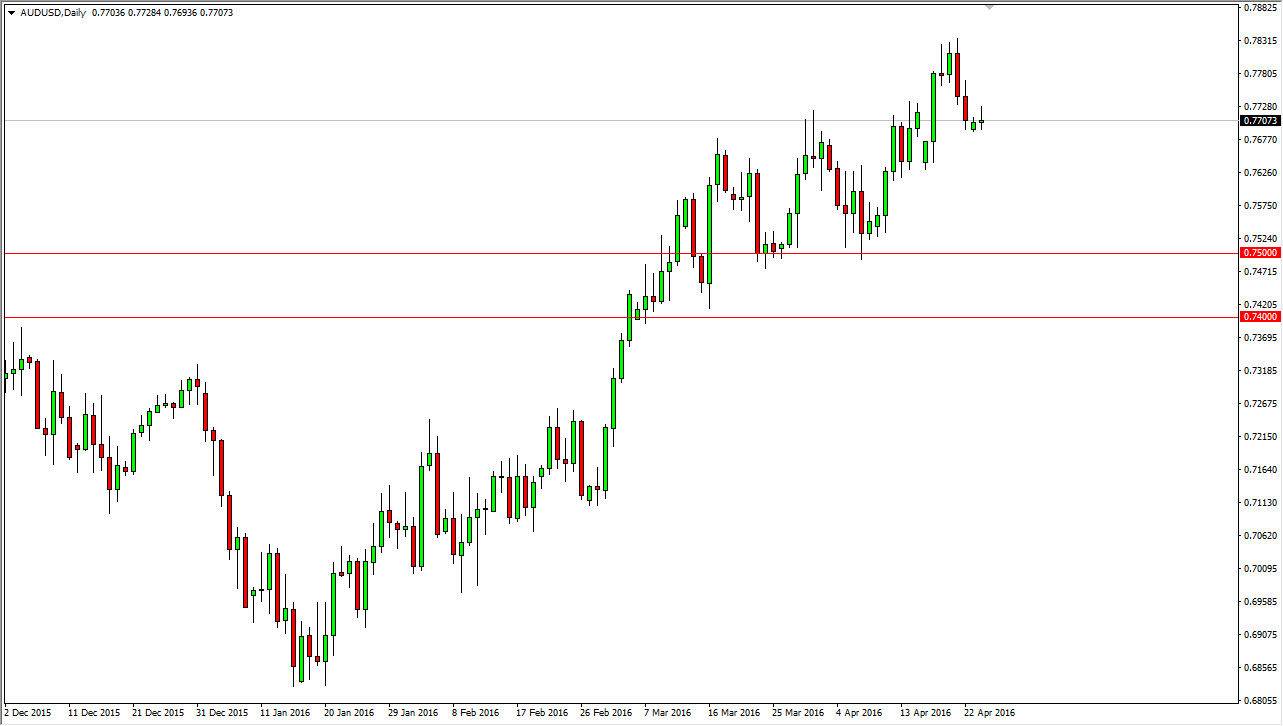

AUD/USD

The AUD/USD pair tried to rally during the day on Monday, but fell flat. Because of this, the market should continue to struggle but I think there’s enough support between here and the 0.75 level that even if we get all the way down there, it’s going to be a very slow move in general. It is not an easy move to make, but it does appear that the market is trying to favor the US dollar at this point.

Longer-term however, I feel that the buyers below will continue to push the market to the upside. Ultimately, I believe that the 0.80 level will be targeted, and of course that will be it’s move. However, you have to look at the gold markets as well, because they can quite frankly move this market as well. Having said that, I believe that this pair does grind higher the longer term, but it is going to be very difficult to deal with.