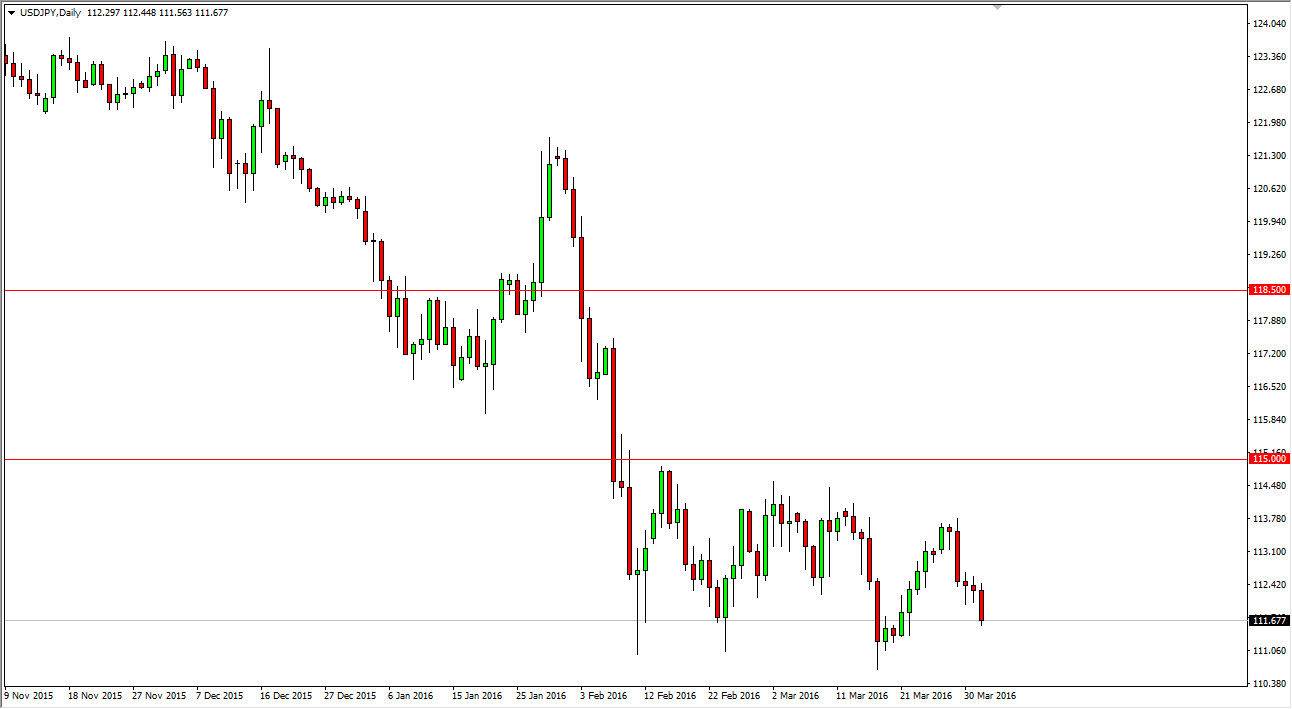

USD/JPY

The USD/JPY pair fell during the course of the session on Friday, as we continue to see negative pressure in this market. I don’t really think that it’s time to start buying yet, but somewhere just below we should start to see significant support that could turn this market back around again. I would have to see some type of daily supportive candle to consider buying, as I think we could be trying to reach the 110 level sometime relatively soon. Keep in mind that this pair tends to be very sensitive to the stock market movements, so will have to see what happens next in certain indices, like the S&P 500 for example. With this, the market should continue to be volatile, but perhaps with a little bit more of a negative tone than anything else.

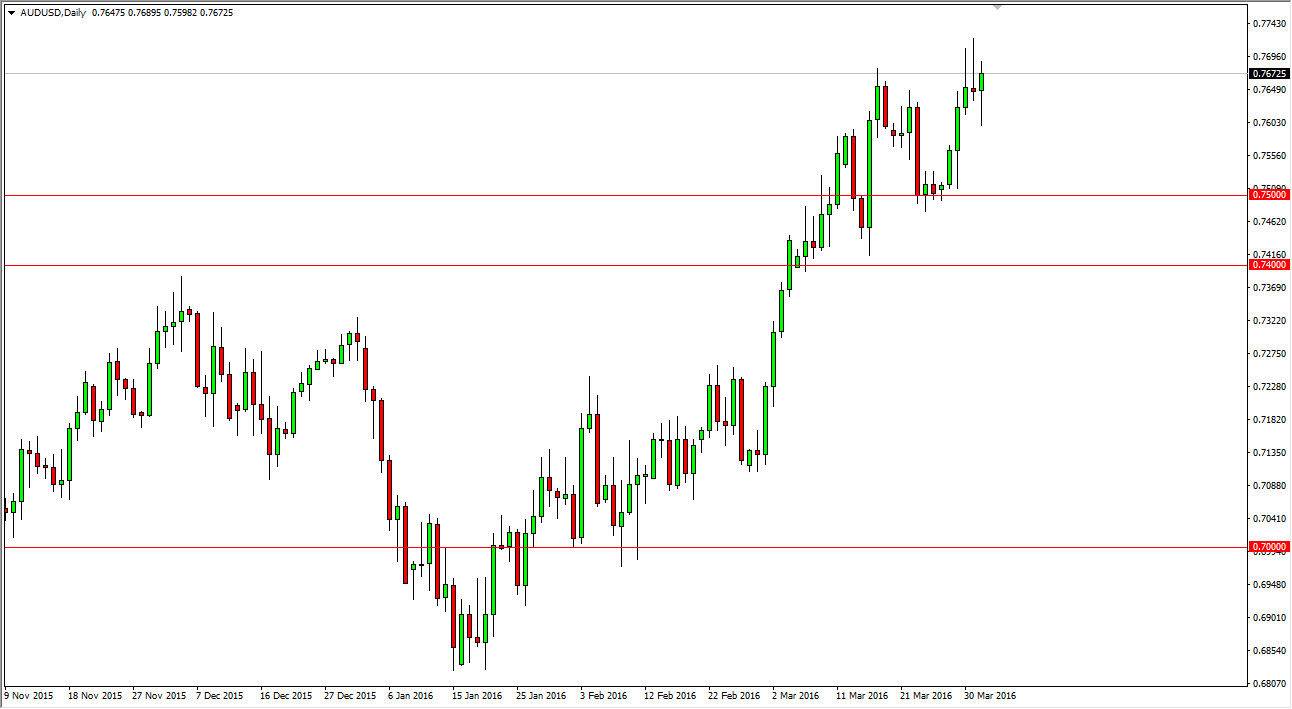

AUD/USD

The AUD/USD pair initially fell during the course of the session on Friday, but turned back around to form a bit of a hammer. The hammer of course is a very bullish sign, but it was preceded by a shooting star so I think we’re probably going to be bouncing around in this general vicinity for a minute. However, the market most certainly has a bullish tone to it, so I’m not necessarily interested in selling, as I believe pullbacks will continue to offer perceived value in the Forex market. With that, the market should then go to the 0.80 level which is my longer-term target.

I think that there is a massive floor in this market somewhere near the 0.75 level, and that any pullback to that area is going to have to deal with buying pressure sooner or later. Because of this, I remain bullish and recognize that we will have to pay attention to gold as well in order to get a signal as the 2 markets seem to be working in congruence again.