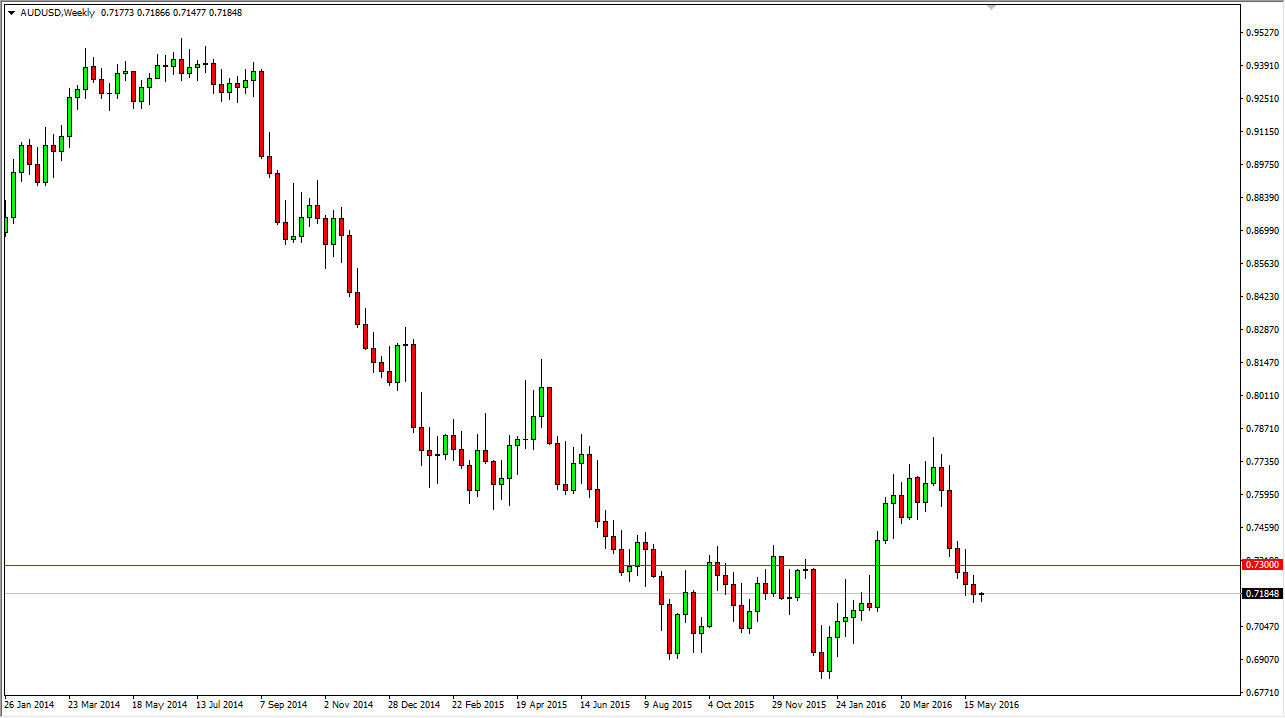

The AUD/USD pair has drifted a bit lower during the course of the last several weeks, but I believe that we are more than likely going to see a bit of a bounce from here as we are probably oversold at this point in time. The Australian dollar of course is highly influenced by the gold markets, and we are starting to approach pretty significant supportive levels in that particular market. In fact, the $1200 level appears to be a bit of a “line in the sand” when it comes to the gold market, so as long as we can stay above there I think there is still hope for the Australian dollar going forward.

Oversold?

At this point in time, looks like the Australian dollar simply oversold. It’s not necessarily that I think we can go in the lower over the longer term, it’s just that recently we’ve seen far too much bearishness to continue the overall downtrend without at least getting some type of pullback. Ultimately, those pullbacks should continue to be violent, as this pair tends to be rather volatile from time to time. After all, the Australian dollar is highly sensitive to risk appetite around the world, and of course commodities in general as the gold market will influence the currency, but so will copper and other commodities in general has Australia is the supplier of so many commodities to places like Asia.

I think that there is a significant amount of resistance at the 0.73 level, so what I anticipate is that we will get a bounce to somewhere just above that area before the sellers return. At that point in time, we may try to continue the downtrend, but if we can break above the 0.75 level, then the market will start to look like one that is changing the overall trend at that point in time.