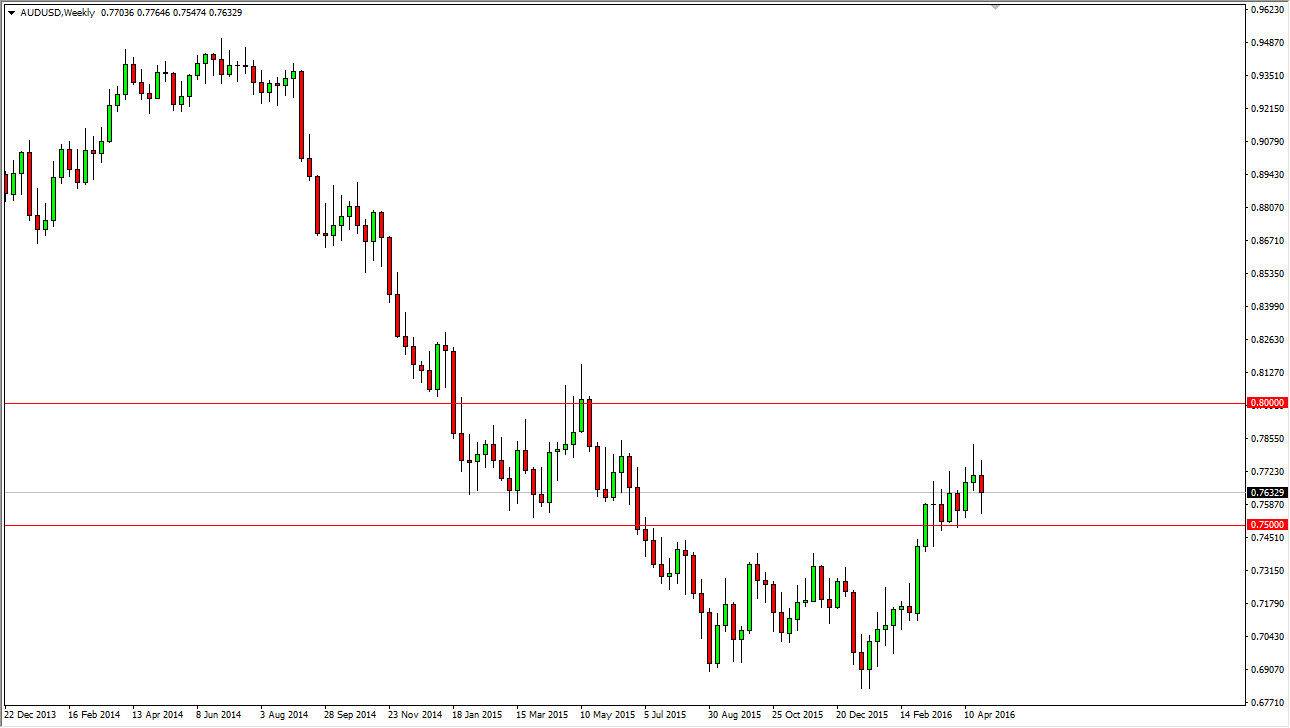

The AUD/USD pair initially found quite a bit of positivity during the course of the month of April, but at this point in time it appears that the market is starting to struggle. With this, it appears that we will have quite a bit of volatility during the month of May and the Australian dollar, and of course the shooting star that formed in the middle of April suggests that the sellers are just as interested as the buyers are. However, at this point in time I have a couple of areas that I am paying attention to.

Massive support

I think that there is a significant amount of support in the range of the 0.75 and down to the 0.74 below. Because of this, I think the pullbacks will continue to attract buyers, and it is probably only a matter of time before we do grind higher overall. However, that’s not to say that it’s going to be easy to continue the move higher. I think this will be a very volatile several weeks, as we should then reach towards the 0.80 level over the long-term. Also, you have to keep in mind that the gold markets have quite a bit of influence when it comes to the Australian dollar, so if they can start rallying again, I think at this point we will see the Aussie continue to go higher.

I am paying attention to the gold markets and whether or not we can break above the $1300 level. If we can, I think we have a real shot break above the 0.80 handle, which is a massive area when it comes to the longer-term charts. This was an area that during the financial crisis a few years ago offered quite a bit of resistance. Once we broke above there, the Australian dollar took off, as did gold simultaneously. We could see quite a bit of the same but it is going to be a fight that could take much longer than just the month of May.