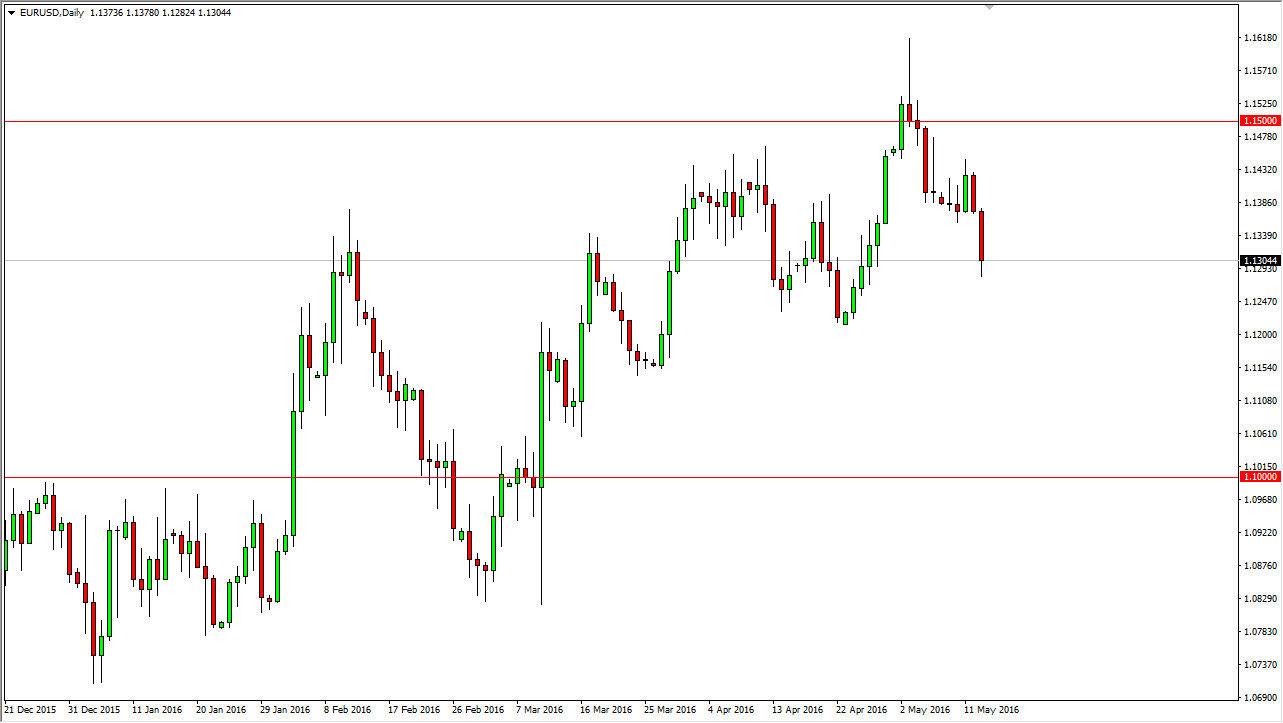

EUR/USD

The EUR/USD pair fell during the session on Friday again, as we continue to see the area near the 1.15 level offered quite a bit of resistance. Because of this, it looks as if the market should continue to go lower, especially considering that we finish towards the very bottom of the range for the session on Friday. However, I do see quite a bit of support at the 1.12 level, so I don’t know that we’re going to go lower with any type of momentum. I feel that this market is going to be somewhat negative but without any real conviction over the next several days. To be honest, I would look for short-term rallies that show signs of exhaustion to perhaps scalp to the downside at this point in time.

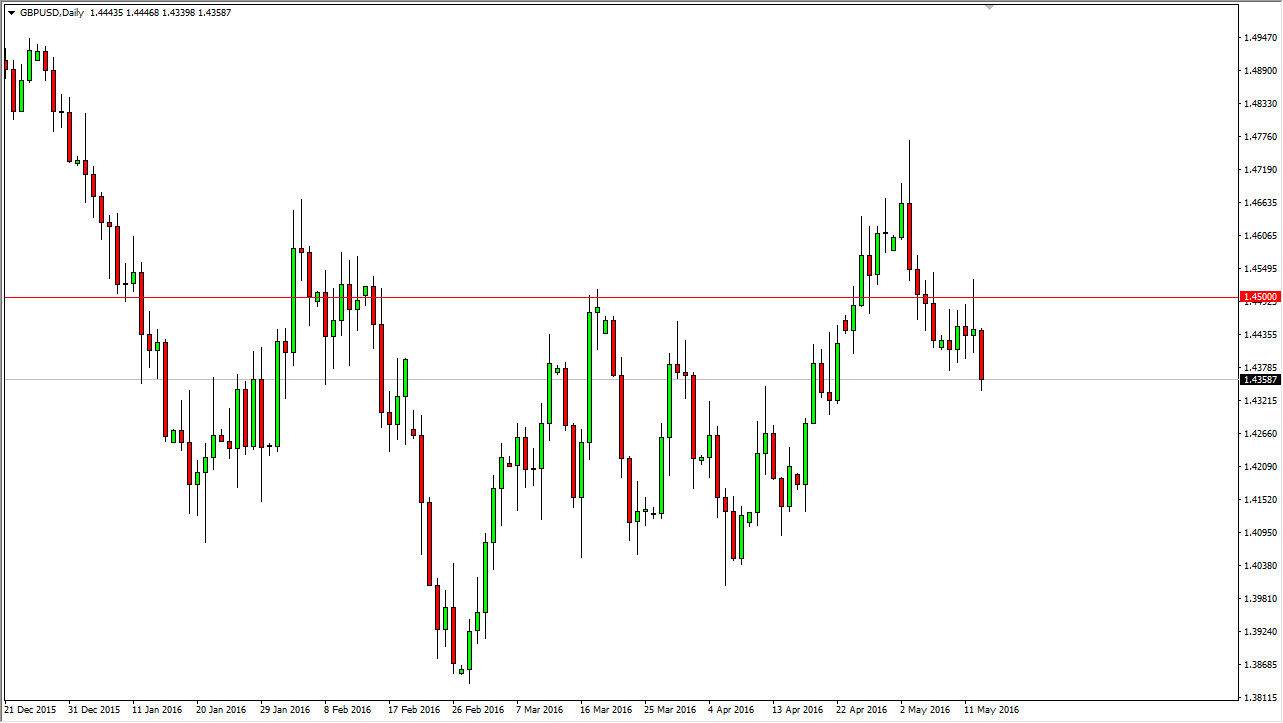

GBP/USD

The British pound fell a bit during the course of the session on Friday, as we finally broke down below the 1.44 handle. With this being the case I think that we are going to continue towards the bottom of the previous consolidation area which I see as being a move towards the 1.41 level over the longer term. It’s probably going to take several sessions though, because I’m not necessarily convinced that we are going to fall apart, rather this is just a general malaise when it comes to the British pound in general. After all, a lot of the concerns about leaving the European Union will be around until June, so I think this is more or less the market saying that it isn’t comfortable purchasing the British pound, but not necessarily that it’s willing to sell at hand over fist.

You also have to keep in mind that the Federal Reserve has done the US dollar no favors lately, as it seems to have balked at the idea of 4 interest-rate hikes this year, as the market had previously expected. With this, expect a general move lower, but nothing out of the ordinary.