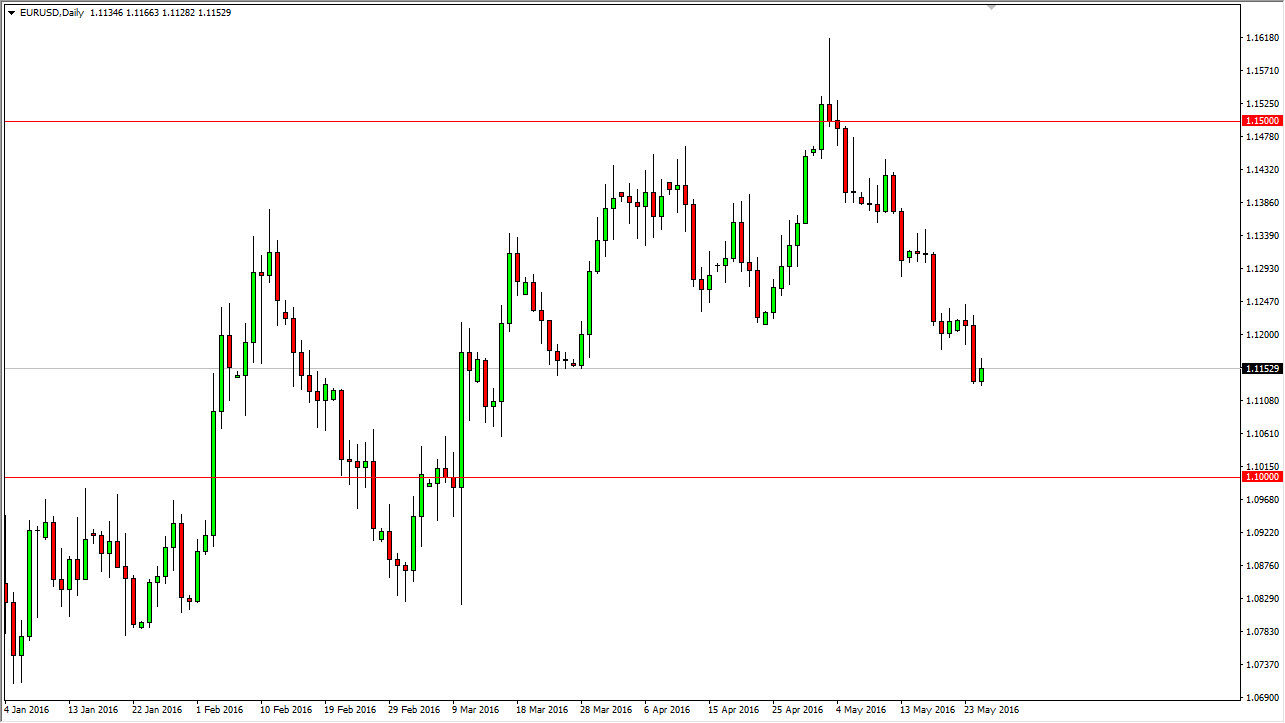

EUR/USD

The Euro had a slightly positive session during the day on Wednesday, as the market continues to grind away in general. We have been falling for the most part, but it hasn’t necessarily been easy. We have more or less falling, and then have a couple of days of consolidation, and then falling again. It looks as if we are going to enter another couple days of consolidation, so I would not be surprised at all if I don’t place any trades for the next session or so. I think that rallies at this point in time will be selling opportunities, as not until we break above the 1.1250 level that I would consider buying. I don’t expect any type of meltdown; I just think we are trying to drift down to the 1.10 handle.

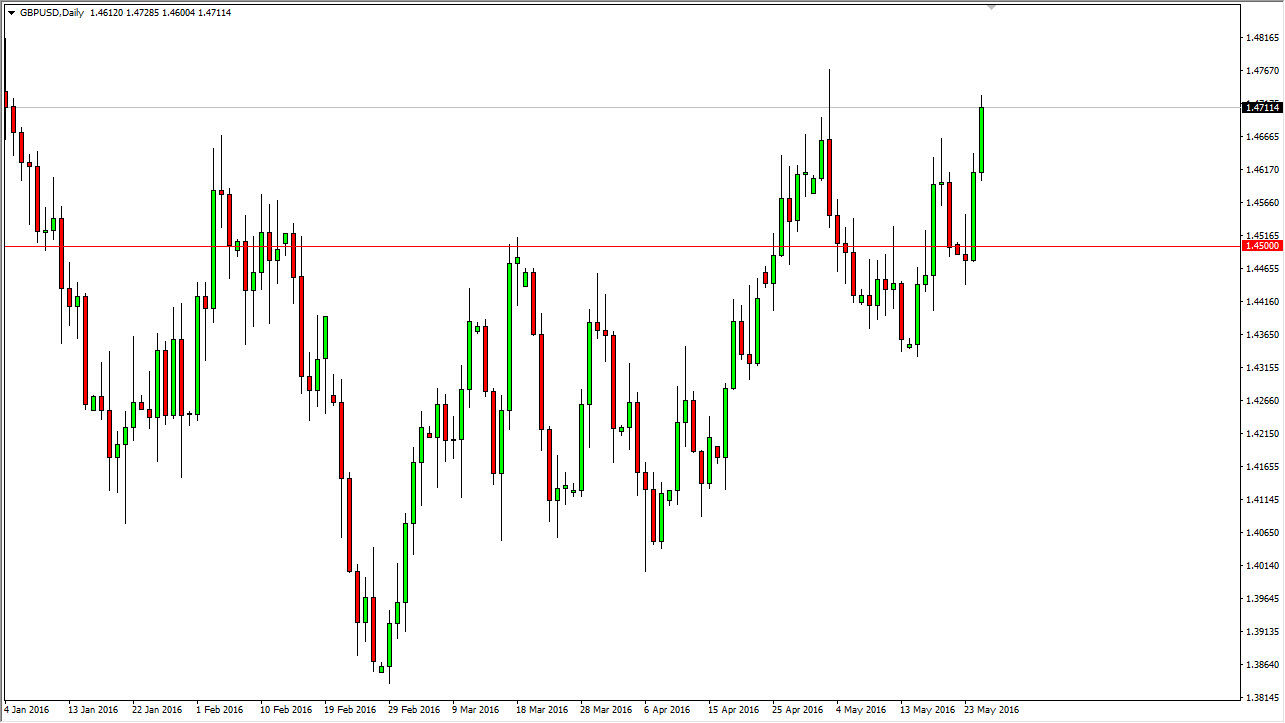

GBP/USD

Over in the British pound, we had a positive session as we broke above the 1.47 level. That shows that the British pound is definitely going to be the stronger of these 2 currencies against the US dollar, and of course this was confirmed by the fact that the EUR/GBP pair fell during the day. Ultimately though, the question now becomes whether or not the buyers will come in and pick up the British pound every time it pulls back? At this point, I believe they will, and that the “floor” for this action is somewhere near the 1.45 handle. If we break out to the upside, I believe that we will test the 1.48 level, and then eventually reach towards the 1.50 level which has a large psychological significance on not only this chart, but also longer-term charts. After all, there are many other handles that are more “round” than the 1.50 handle.

Keep in mind that there will be a lot of noise due to the so-called “Brexit” vote coming in June, so be prepared to deal with the volatility.