Gold prices fell $8.30 an ounce yesterday, down for the ninth straight session to $1204.94, as worries over an imminent rate hike by the U.S. Fed persisted. The XAU/USD pair fell as low as $1199.71 an ounce, the lowest since February 17, before finding some support. Positive economic data, along with hawkish comments from several Fed officials, have stirred fears that the Fed might deliver a rate hike in the coming months.

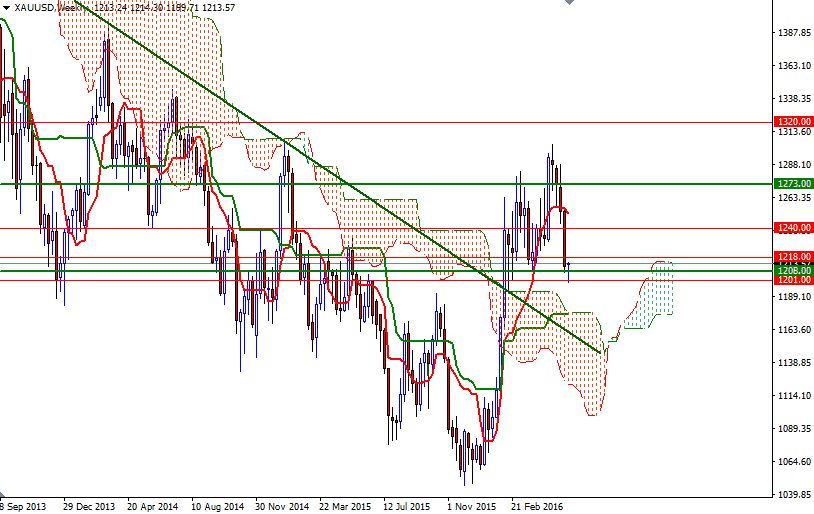

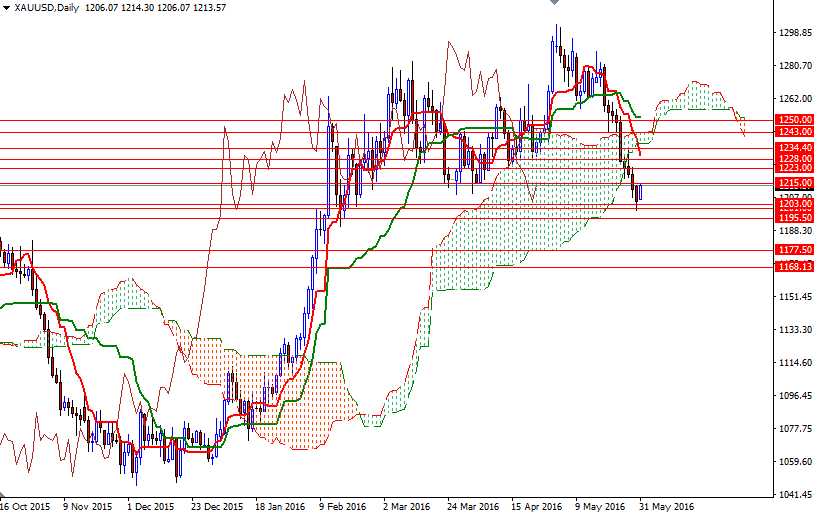

The XAU/USD pair is trading not too far from the 1218/5 resistance ahead during today's Asian session. Apparently the support in the 1203/1 zone fueled some short-side profit taking but how far this rebound will go is debatable as prices are below the Ichimoku clouds on both the daily and 4-hour charts. Technically speaking, the Ichimoku cloud indicates an area of resistance (or support depending on its location) so expect sellers to step up pressure as prices approach the clouds.

The hourly cloud currently occupies the area between the 1218 and 1215 levels. The bulls will have to convincingly push the market above 1218 so that they can tackle the next barrier at the 1223 level. A daily close beyond that level could see XAU/USD revisiting the 1228 level. However, if the hourly cloud prevents the market from going higher and prices drop back below 1208, it is likely that we will test the 1203/1 zone again. Breaking down below this support would open up the risk of a move towards 1195.50.