Gold prices ended the week down nearly 1.45% to settle at $1252.62 an ounce, as worries that the Federal Reserve is set to raise U.S. interest rates next month prompted investors to step back from their bullish bets on the precious metal. The market started the week on a positive note but failed to break through the anticipated resistance in the $1290/87 area and reversed its course.

Earlier in the week, Federal Reserve officials continued to flag June as a likely time for interest rates to rise and the Fed's April meeting minutes released Wednesday showed that a majority of the FOMC is ready to pull the trigger if incoming data are consistent with economic growth picking up in the second quarter. The recent price action underlines the difficulty gold has in rallying when there is expectation of higher borrowing costs. Since last week, I have been warning that the short-term outlook the short-term outlook for gold was skewed to the downside.

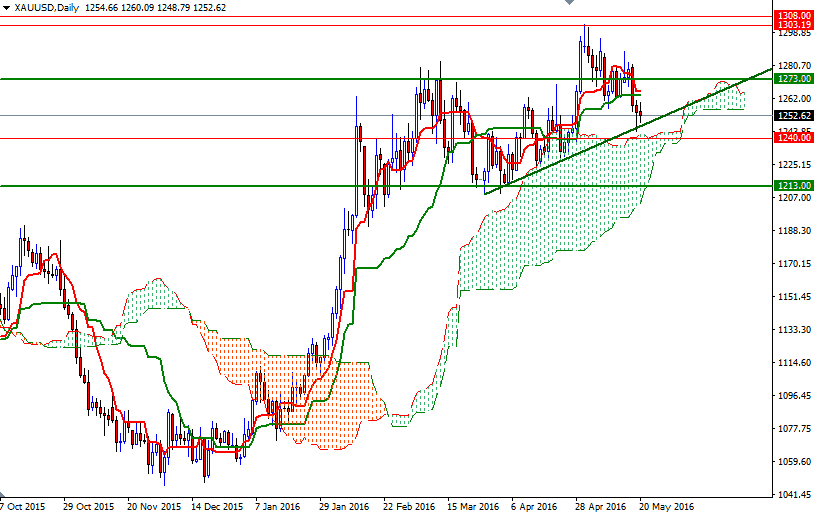

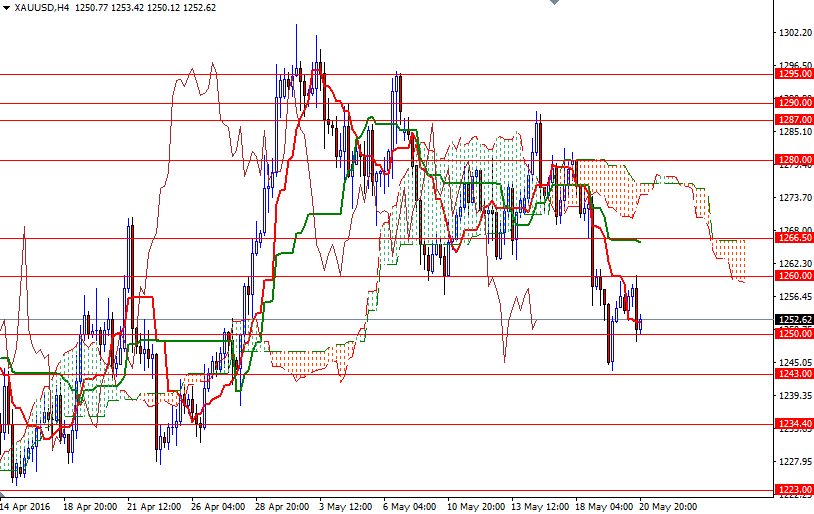

The XAU/USD pair currently resides below 4-hourly Ichimoku cloud, plus we have a negative Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) cross. Adding to the bearish outlook is the Chikou-span (closing price plotted 26 periods behind, brown line) which dipped below prices and the Ichimoku cloud on the 4-hour frame. The short-term bullish trend line seems to be in danger but we are not far from the daily cloud so I will pay close attention to the 1243/0 area. If this support remains intact, expect a bounce towards the 1266.50. Beyond that, there are critical hurdles such as 1273 and 1280. A break up above 1280 would be a very bullish sign and pave the way for a retest of 1290/87 (or even 1295). A break down below 1243/0, on the other hand, would suggest that the market will have a tendency to test the supports at 1234.40/1231 and 1225/3. Below that, I see the next significant support at 1213.