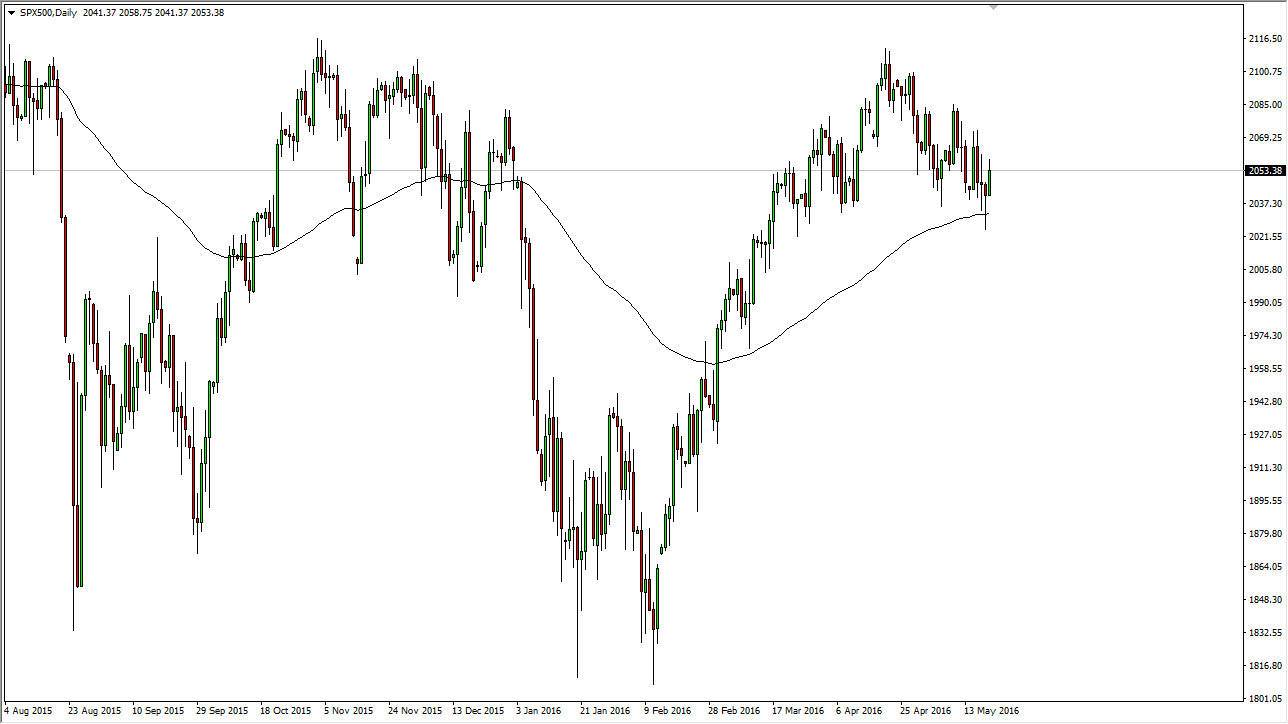

S&P 500

The S&P 500 rallied during the session on Friday as we broke above the top of the hammer from the Thursday trading session. Because of this, it looks as if the market is ready to continue going higher but we also have quite a bit of noise just above. I believe that it is only a matter of time before buyers enter the market on short-term pullbacks, so that’s how I prefer to trade this market in general. I believe that supportive candles on short-term time frames will be the best entry signals, and it’s not lost on me that the 100 day exponential moving average is sitting just below. Because of this, and the fact that we have been in such an uptrend over the last several months, I am a buyer and not interested in selling this market. I believe that as long as we stay above the 2000 handle, it’s going to be difficult to sell.

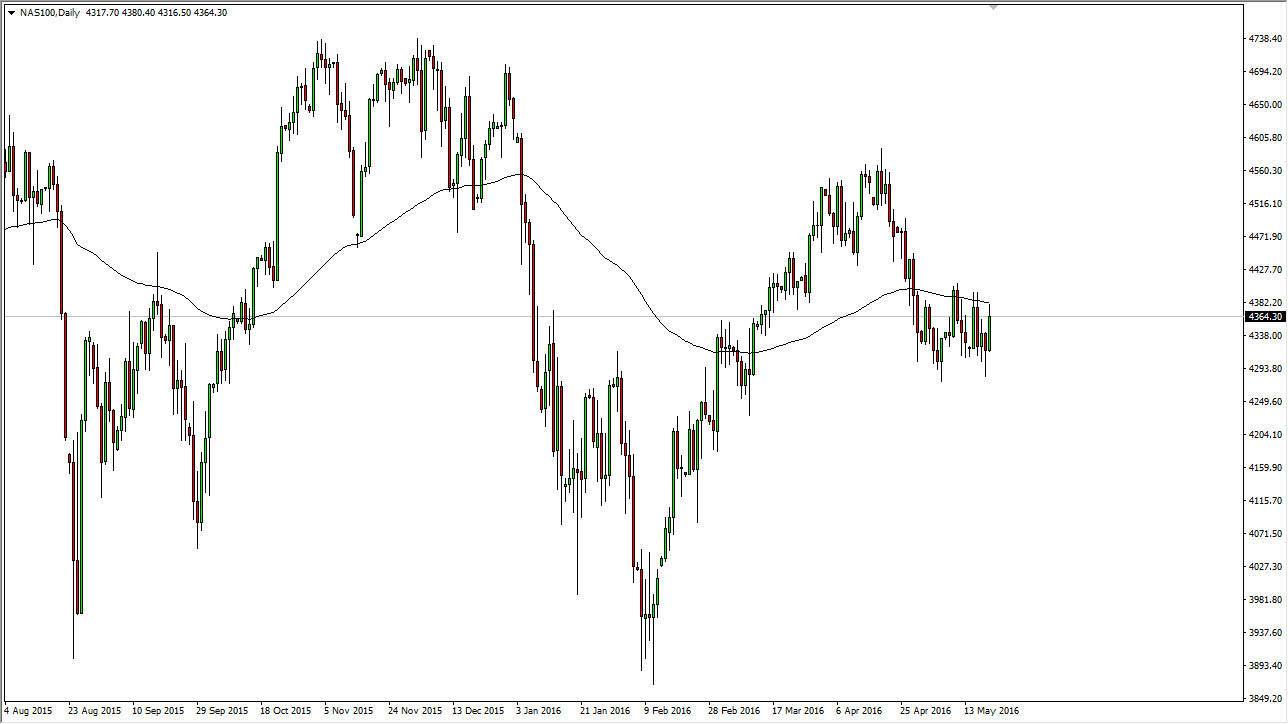

NASDAQ 100

The NASDAQ 100 rallied as well on Friday, breaking above the top of the hammer that had formed on Thursday. Much like the S&P 500 we are simply consolidating but unlike the S&P 500 we are but needs to the 100 day exponential moving average. If we can break above the current resistance, which I see as the 4400 level, the NASDAQ 100 should be ready to go higher and perhaps reach as high as the 4500 level.

If we pullback from here I would expect to see support down near the 4300 level, and therefore any short-term bounce would be reason enough to go long. Don’t really have any interest in selling, mainly because there so much in the way of support based upon the noise in the beginning of the year. I think that it is going to be much easier to go higher than lower, but we may have to be patient as we need to build up more momentum to get above the recent and current resistance.