USD/CHF Signal Update

Last Thursday’s signals produced a losing long trade shortly after London opened.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trade 1

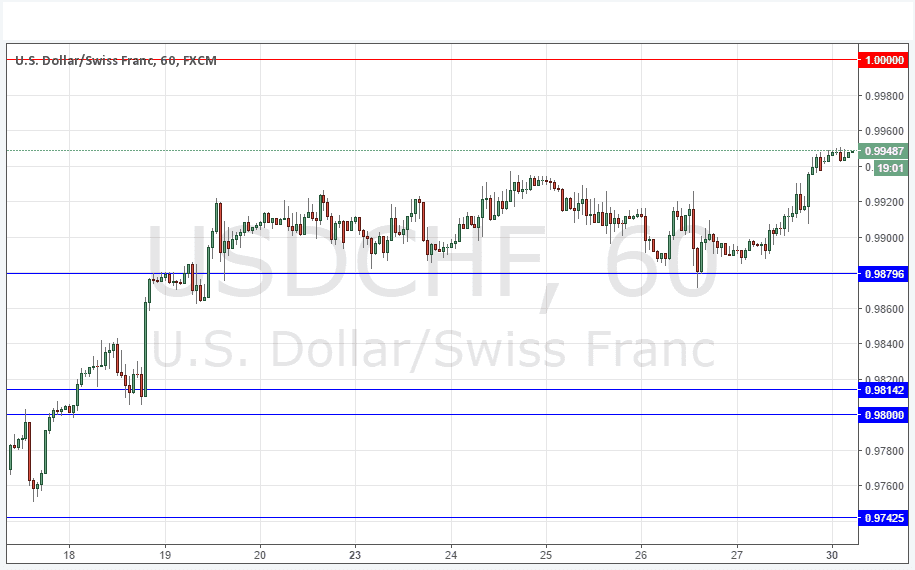

Go long after bullish price action on the H1 time frame following the next touch of 0.9880.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 1.0000.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The impulsive move dominating this pair has been upwards, so although there is something of a long-term downwards trend, it has made sense to be bullish as the price keeps printing new support eventually. This is exactly what happened last week as the price made a few false starts in moving up beyond the 0.9900 area but finally did. A dip back down below 0.9900 and to 0.9880 would probably produce an attractive buying opportunity if supported by bullish price action there.

Meanwhile, the price looks to be heading for 1.0000 which may act as a ceiling.

It is likely to be very quiet today as both London and New York are on holiday.

There is nothing due today concerning either the CHF or the USD. It is a public holiday in both London and New York.