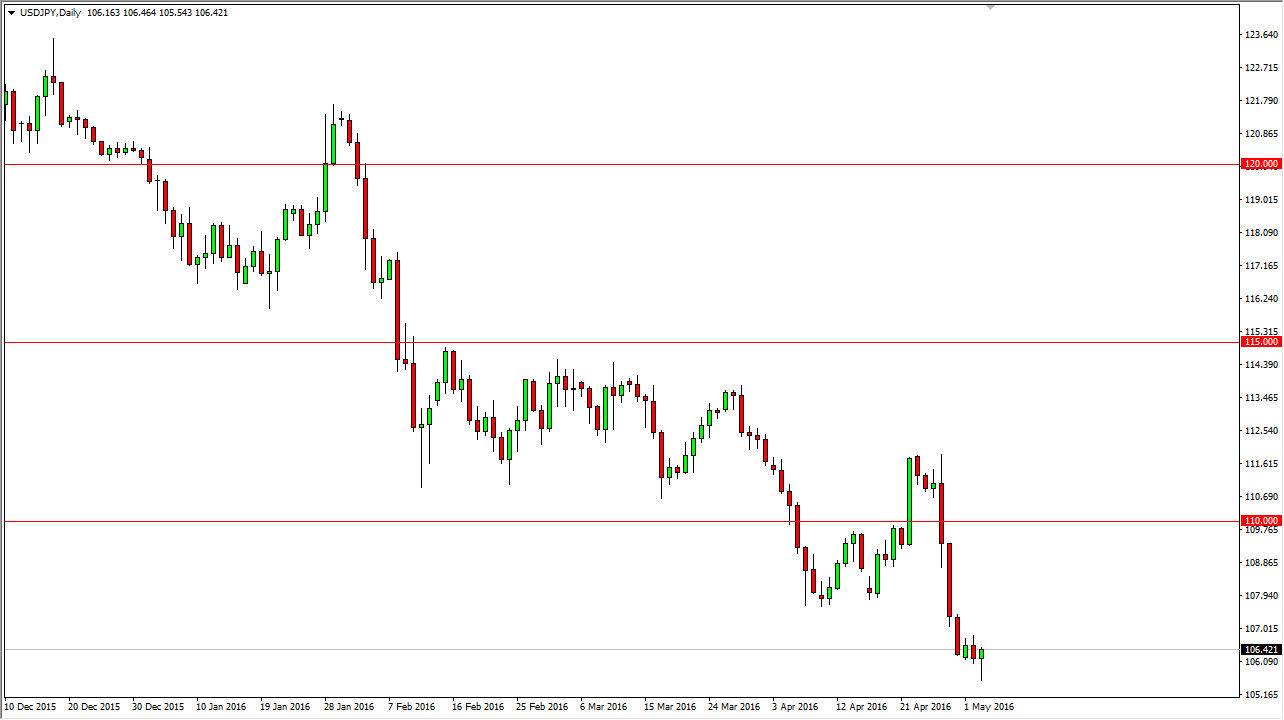

USD/JPY

During the course of the day on Tuesday, the USD/JPY pair fell significantly, reaching towards the 105 level. We ended up forming a hammer, which of course suggests that we could have a bit of a bounce from here. That is a short-term buying opportunity as far as I can see, and I think that the market should then goes to the 108 level. The area above there has quite a bit of noise all the way to the 110 level. If we have a bit of an exhaustive candle in that general region, it will end up being a nice selling opportunity. On the other hand, if we break down below the 105 level, this would be very negative in this market, which should send the USD/JPY pair down to the 102 level, followed by the 100 level. If we break above the 110 level, then the entire complexion of this pair changes.

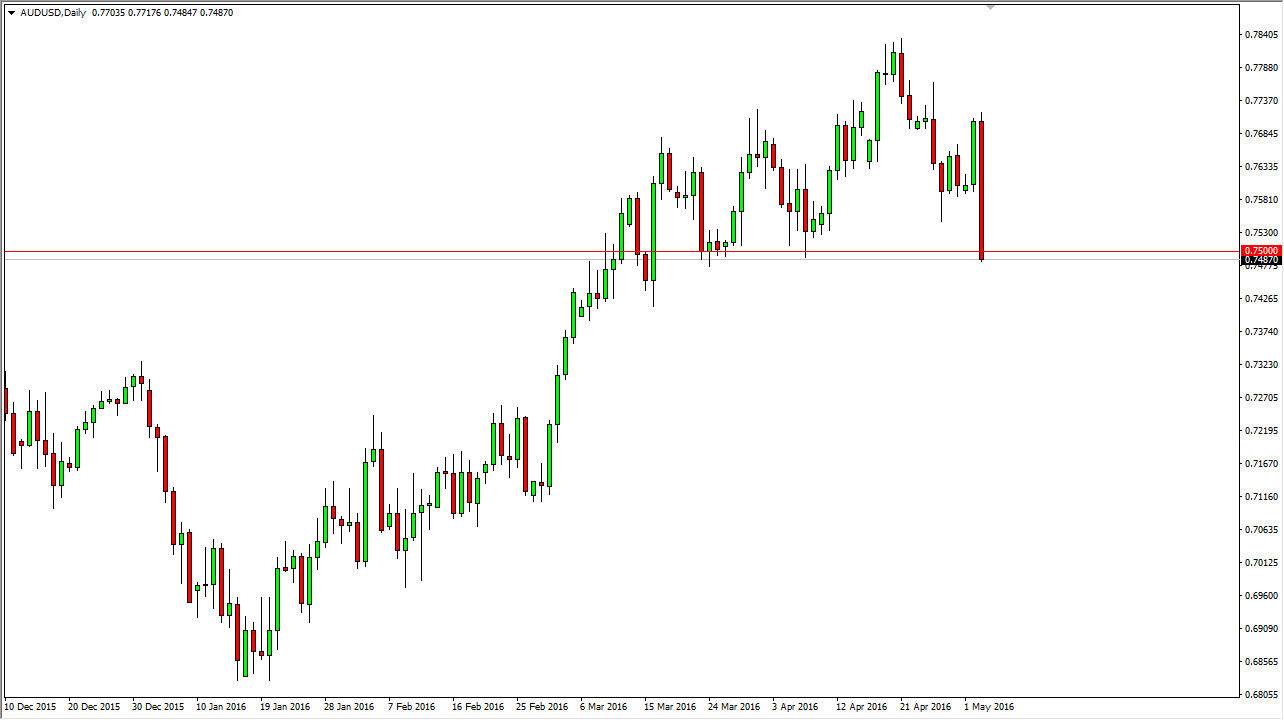

AUD/USD

The AUD/USD pair broke down during the course of the session on Tuesday, breaking below the 0.75 level. There is a significant amount of support all the way down to the 0.74 level however, although things certainly have changed in this market, there is going to be a little bit of a push back when we fall. Keep in mind that the Reserve Bank of Australia cut interest rates just yesterday, and that of course has a negative connotation when it comes to the Australian dollar itself.

However, we do have a bit of a problem when it comes to this pair. Gold markets look very strong overall, and that of course can push the Australian dollar higher. On top of that, this candle is very negative, and as a result I do believe that eventually we will break down and try to test the 0.74 level for support as well. Ultimately, I think that any bounce at this point in time the show signs of exhaustion on the shorter-term chart is probably going to be a selling opportunity.