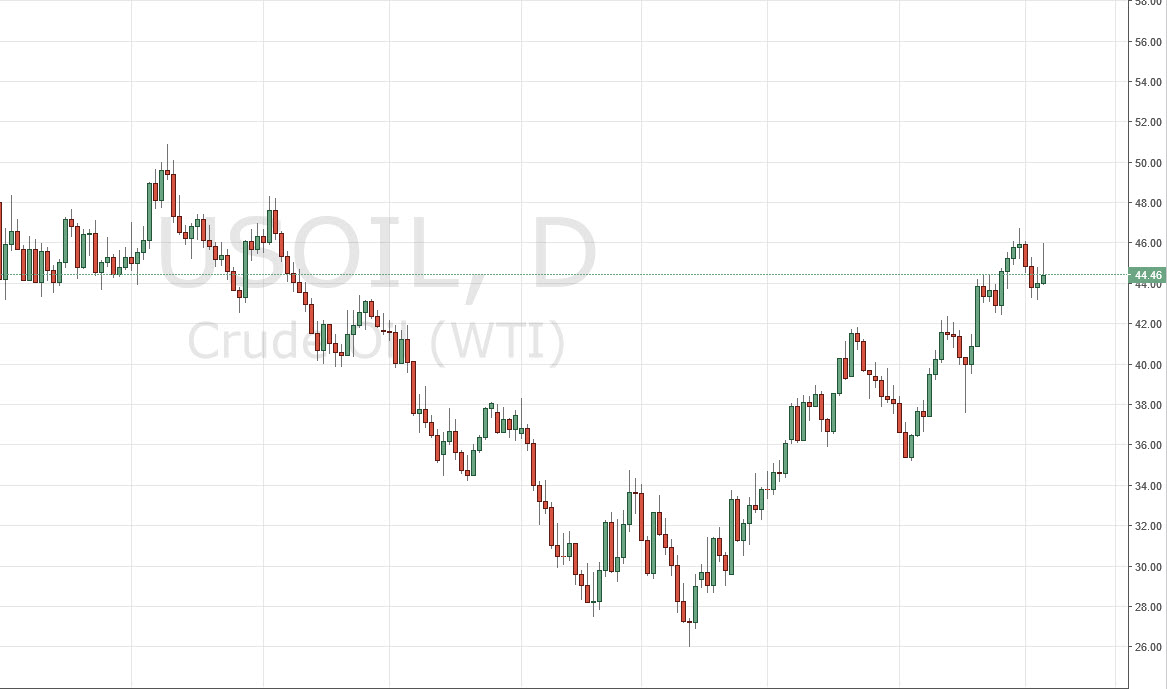

WTI Crude Oil

The WTI Crude oil market initially tried to rally during the day on Thursday, but the $46 level was a bit too resistive. Because of this, the market ended up turning back around and forming a shooting star. The shooting star of course is a very negative sign but there is quite a bit of support just below to keep me from shorting this market. I think that perhaps part of what has happened is that traders have squared up positions before the jobs number today. At this point in time, I believe the buyers will return if we fall, perhaps somewhere near the $42 handle. We could go higher, but there is a large amount of resistance all the way to the $50 level above. No matter what happens, it’s going to be choppy.

Natural Gas

Natural gas markets initially tried to rally during the day on Thursday, but then turned right back around to form a relatively negative candle. At the end of the day, we are still consolidating in this general vicinity, so I’m not really interested in trading this market for anything more than a quick scalp in one direction or the other. I essentially believe that the $2.20 level is resistance, while the $2.00 level below is massively supportive. With that being the case, I think that short-term scalpers will continue to go back and forth in this particular contract, at least until we get some type of defendant of pressure in one direction or the other.

For myself, the $2.00 level been broken to the downside is exactly what I would need to see to have a longer-term trade form. I prefer selling overall, because after all we are still in a downtrend, and there is so much natural gas out there that storage is a bit of an issue at times.