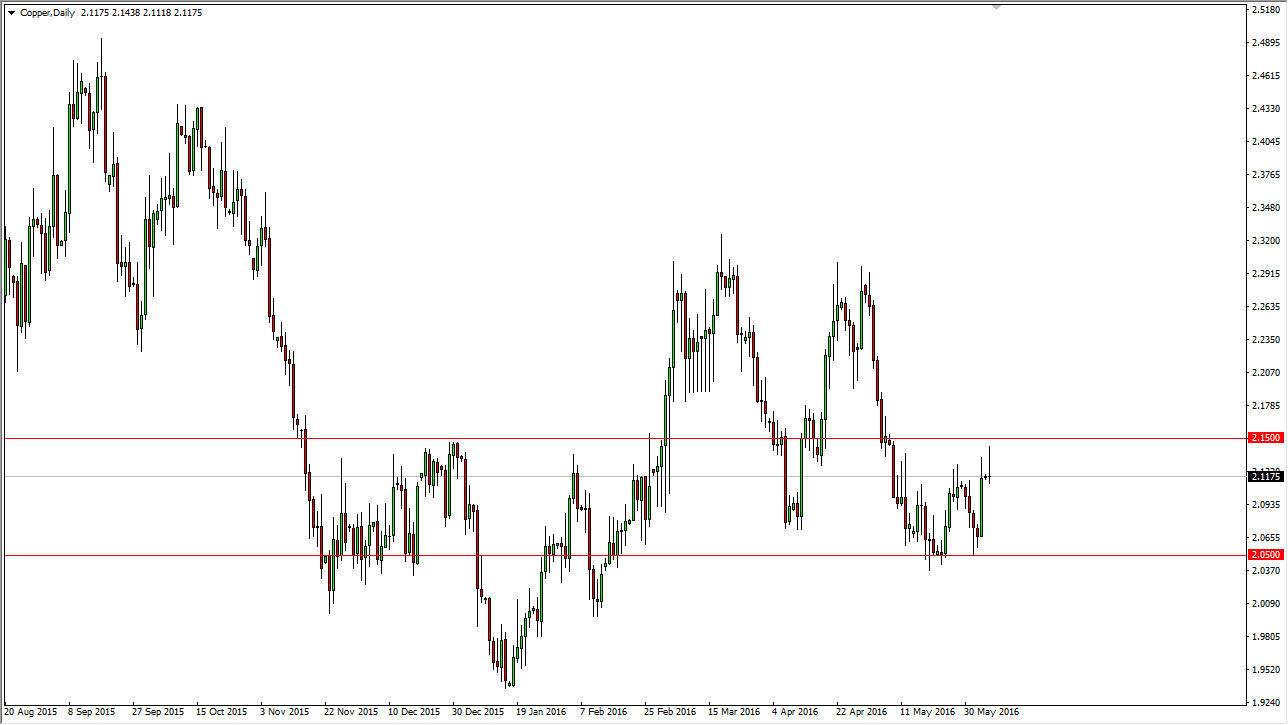

During the session on Monday, the copper markets rallied initially, but turned right back around to form a shooting star. This of course is a very negative candle, and the reason that I bring copper to your attention is that traders who have been dealing with these markets for some time understand that copper is typically a barometer of economic growth. Copper is used in construction obviously, but also electronics, and of course various industrial situations.

The fact that we cannot rally above the $2.15 level suggests that the level is still important, and as a result I think that the market will continue to find sellers near that area. Under there, we have the $2.05 level, which has been supportive. In a sense, I feel that we are simply going to continue to consolidate overall.

Copper is important

Even if you do not trade the copper CFD market, you have to keep an eye on this market as it suggests that the economic growth will continue to slow down and of course the idea that jobs are not been added in the United States gives more credence to the idea of less economic expansion. At the moment, it’s very likely that this market will struggle to gain for any real length of time. Because of this, I think that choppiness will continue to be the main feature of this market and should keep the price of copper between the aforementioned $2.15 level and the $2.05 level. Because of this, I suspect that short-term trading might be the route to go, and of course the binary options markets might be an option as well as you can play short-term movements and define your risk upfront. Futures markets are a little bit tricky when it comes to the copper commodity, because they tend to be very expensive at times. Either way, pay attention to this market, as it shows growth in a global sense.