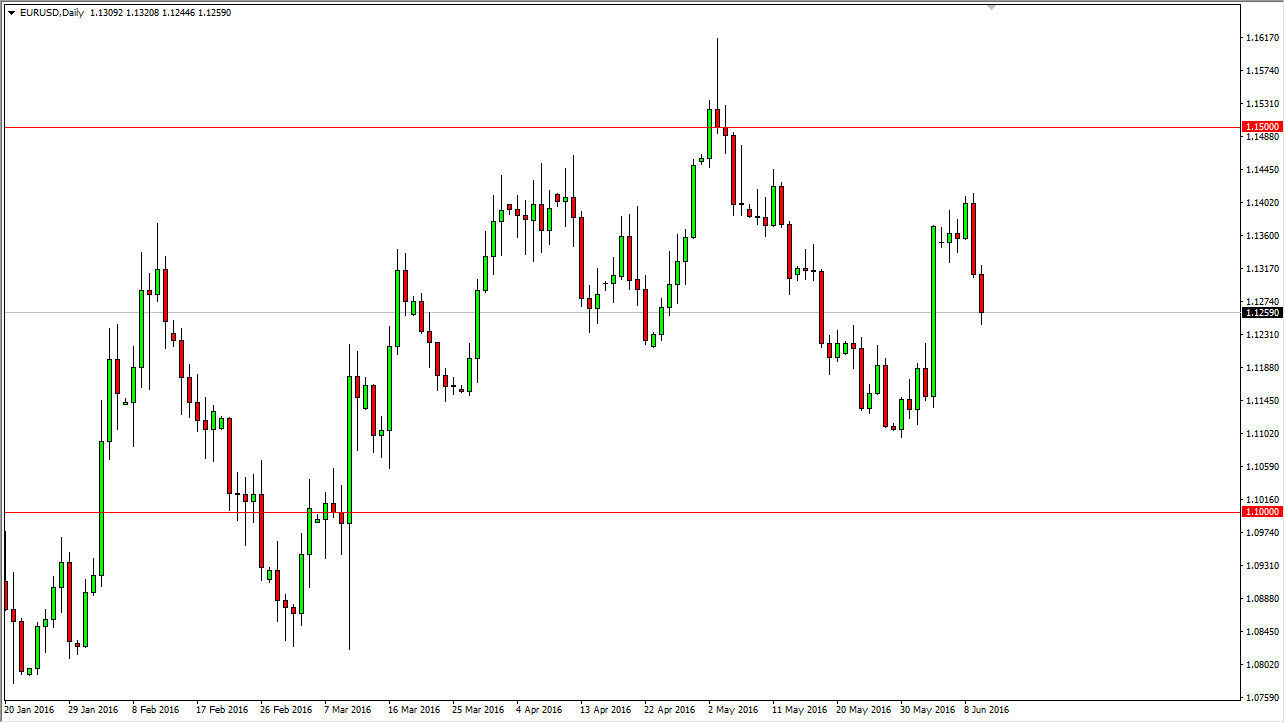

EUR/USD

The EUR/USD pair fell during the course of the day on Friday, breaking down below the 1.1250 level at one point during the day. That being the case, looks as if we are going to grind down to the 1.12 level, an area that should be supportive. I believe that the market will turn back around eventually, because of the Federal Reserve and the lack of ability to raise interest rates quickly. However, we also have some concern with the European Union as the United Kingdom may actually leave that region. Ultimately though, a supportive candle in this general vicinity could be a buying opportunity as the market would bounce towards the 1.14 level again, and then eventually the 1.15 level after that.

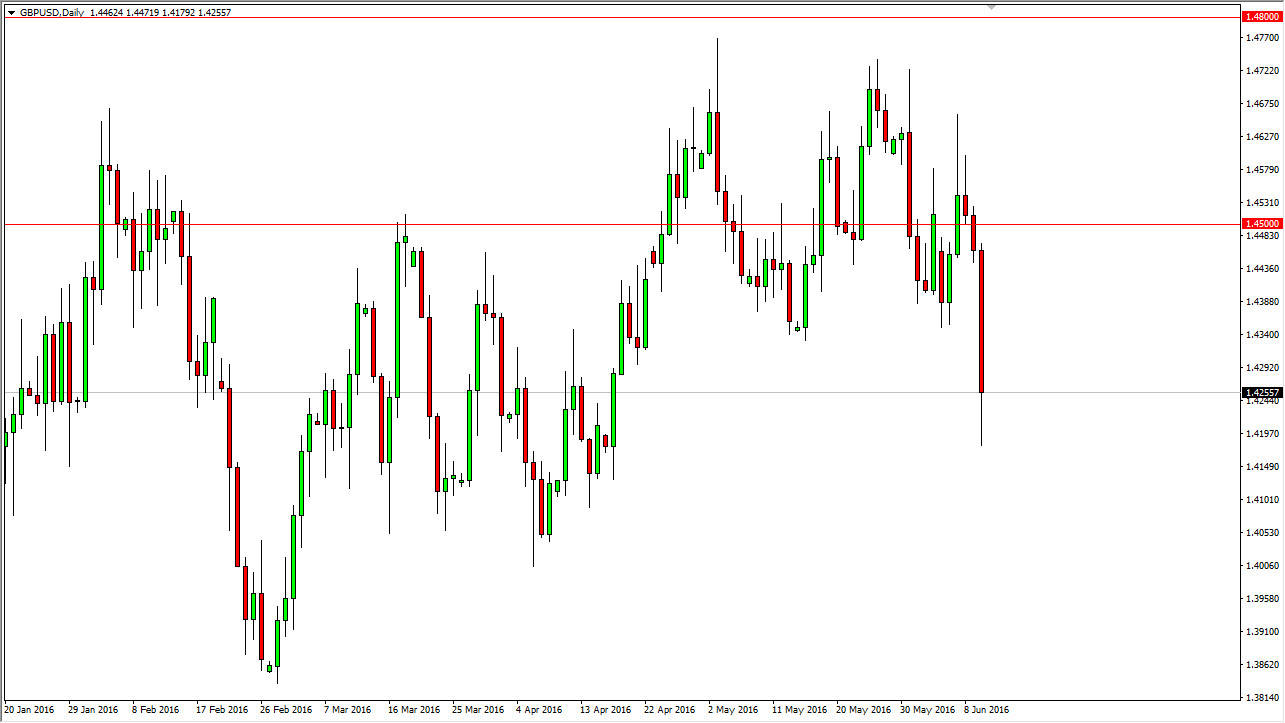

GBP/USD

The GBP/USD pair fell during the course of the day on Friday as it was announced that the “leave” crowd in the United Kingdom is up by 10 points in the most recent polls. Because of this, it looks as if the United Kingdom is getting closer to leaving the European Union, and as a result the British pound has taken it on the chin late during the session on Friday. Ultimately, this is going to be one of those situations where the latest headline will probably move the currency more than another. Ultimately, it looks as if it is easier to sell this marke

On a break down below the bottom of the range during the day on Friday, that would also be a nice selling opportunity as well as the market should then reach towards the 1.40 level below. That’s an area that has a large, round, psychological aspect to it, so having said that I think it will be attractive to the market given enough time.