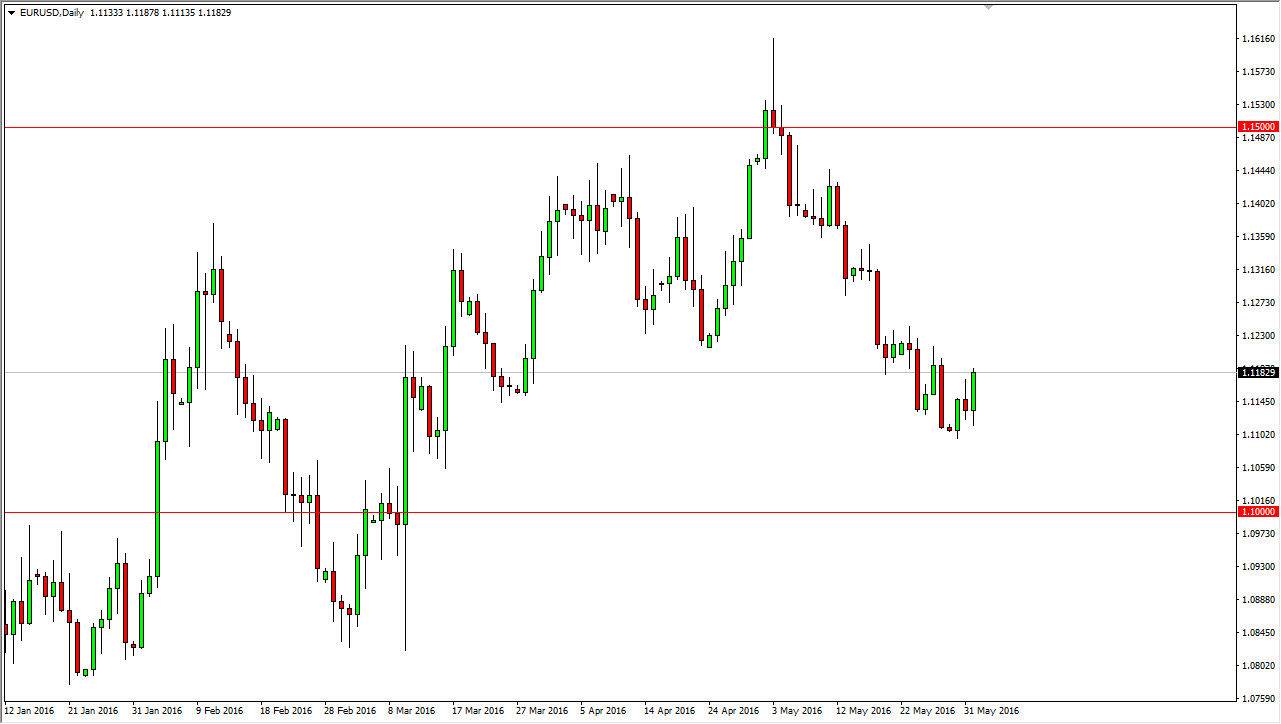

EUR/USD

The EUR/USD pair initially fell during the course of the day on Wednesday but then turned right background break above the top of the shooting star from Tuesday. I think this is a significantly bullish sign, but at the end of the day we need to break above the 1.1250 level in order to continue going higher as there is so much in the way of noise in that region. A break above there could very well send this market looking for the 1.14 level, and that of course would be a longer-term target house there seems to be so much in the way of noise. One thing that I am concerned about though is the fact that we have an interest rate announcement coming out European Support Bank today, and of course the following press conference. Expect a lot of volatility, and resistance at this point in time could very well send the Euro back down towards the 1.10 level.

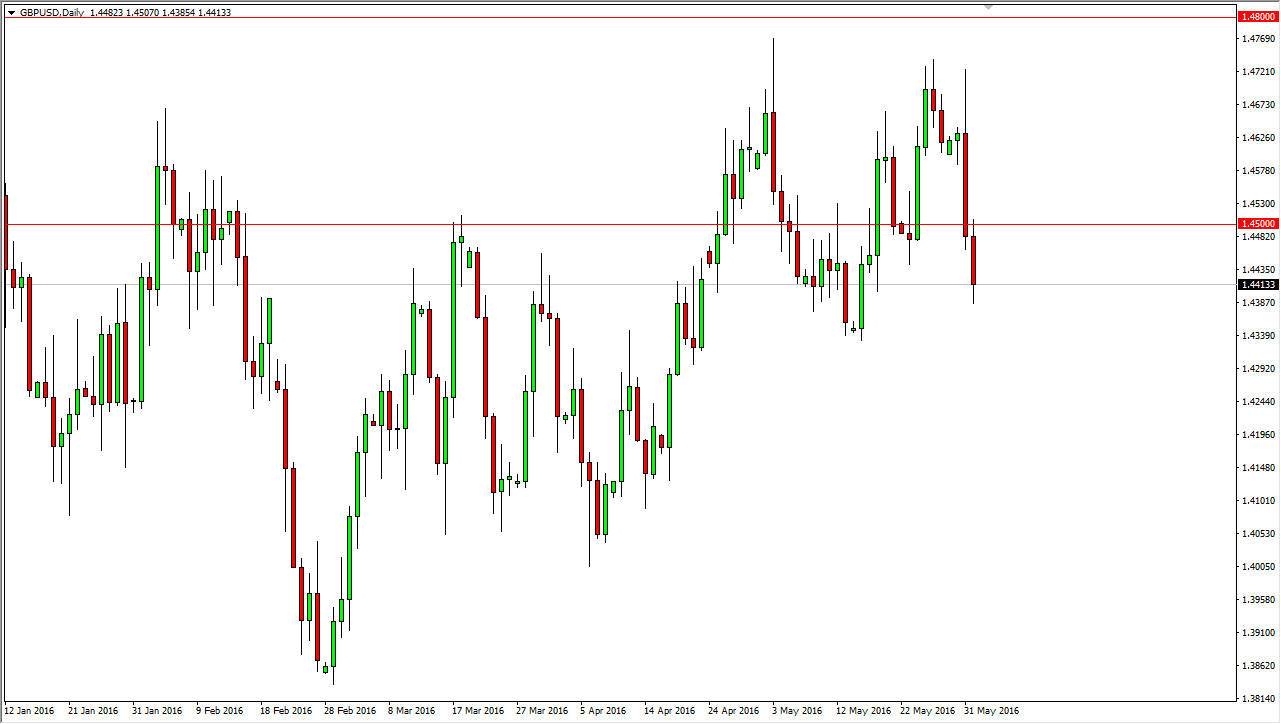

GBP/USD

If you would like to lose money in the Forex markets, this might be your pair. After all, this pair seems to be trading solely upon the most recent poll as to whether or not the British are leaving the European Union. The most recent one obviously suggest that they were, and that brought down the value of the British pound. However, polls come out quite often and of course they can be manipulated, so I suspect that sooner or later we will see a massive move higher, but I really don’t know when. Unless you have the ability to follow every poll coming out of London, this is a pair that will more than likely just cause you trouble.

It does appear that there is a significant amount of support somewhere near the 1.4350 level, and a lot of choppiness below there as well so I think we are setting up for some type of bounce, but I certainly don’t see it in the charts right now.