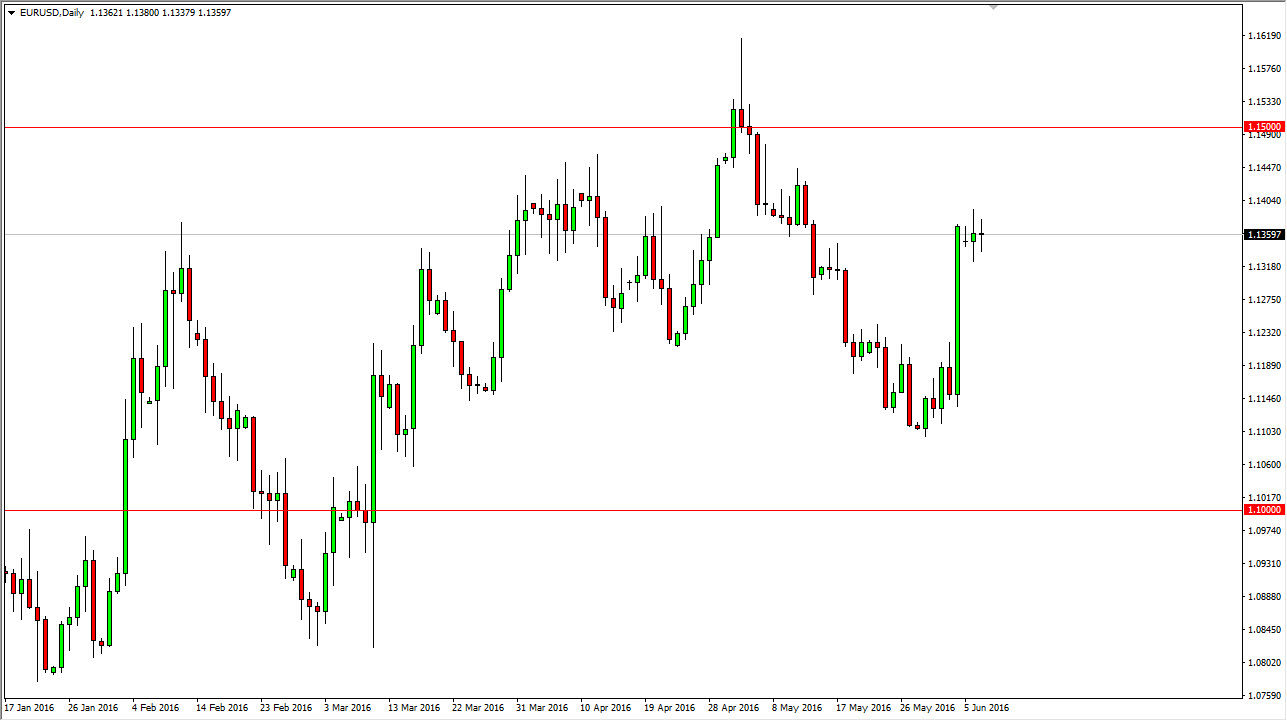

EUR/USD

The EUR/USD pair went back and forth during the course of the session on Tuesday again, as we have simply sat still this week. This is mainly due to the fact that most traders are wondering what’s going to happen next. After all, the jobs number really cause a lot of havoc in this market, and has the US dollar selling off rather drastically. However, there have been mixed messages coming out of the Federal Reserve, and that of course causes most traders to freeze. Personally, I believe that this market is more than likely going to go higher, but we may have to pullback in order to build up enough momentum. I believe in buying pullbacks, but really at this point in time I have no other interest in this market.

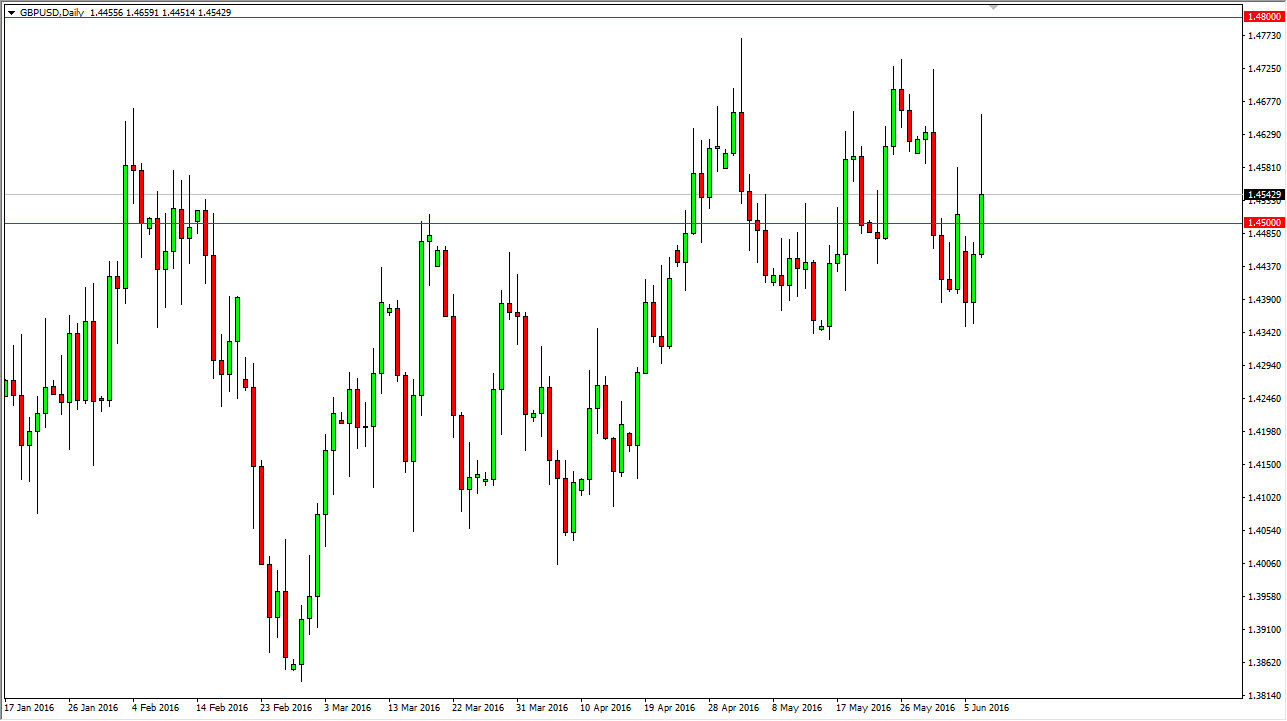

GBP/USD

The GBP/USD pair surged higher during the day on Tuesday, but then gave up about half of the gains. Because of this, it’s very likely that the markets will continue to be extraordinarily volatile, but the biggest problem is that we are going to have to deal with headlines coming out of the United Kingdom which will move the British pound back and forth. It appears that you can throw out almost all technical analysis at this point in time, and simply buy and sell the pound based upon what the latest headlines are involving the boat to leave the European Union.

The European Union vote will push the market higher for the British pound as people suggest that the United Kingdom is going to stay, but if they choose to leave, that drives down the value of the currency. Since the vote is and until the end of the month, I believe that this pair is going to be difficult to deal with, especially considering that the interest-rate hikes coming out of the Federal Reserve are now in question due to the jobs number.