EUR/USD

The EUR/USD pair broke higher during the day on Wednesday, as it looks like we are trying to break out of the consolidation area that we had been in over the last several sessions. After all, this week has been fairly quiet after a significant move higher on Friday, as the Bureau of Labor Statistics in the United States announced that the Americans that only added 38,000 jobs in the month of May. However, the 1.14 level offered quite a bit of resistance but we did pierce that area during the day on Wednesday. I think the pullbacks will continue to offer buying opportunities, and that the market will try to reach towards the 1.15 level again. I am not interested in selling this pair at the moment but recognize there will be pullbacks.

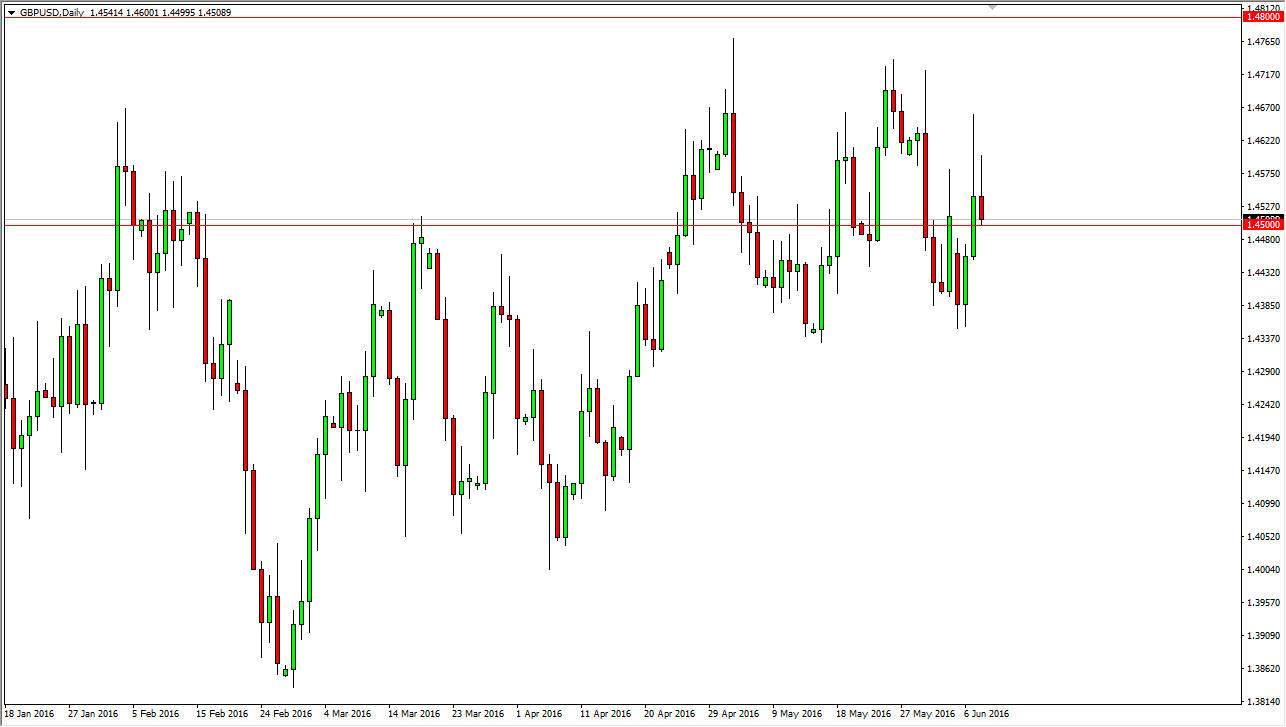

GBP/USD

The GBP/USD pair initially tried to rally during the course of Wednesday, but turned right back around to form a shooting star. The shooting star sits on top of the 1.45 level, which has been both supportive and resistive lately, and with that being the case I believe that if we break down below that level, the sellers will come into the marketplace and drive this pair down to the 1.44 level, and then possibly lower than that. However, this is a particular currency pair that are not that interested in trading because of a couple of different things going on at the same time.

Firstly, you have to worry about the boat in the United Kingdom as to whether or not they are going to leave the European Union. That has caused quite a bit of volatility when it comes to the British pound in general, and as a result has essentially made the British pound a “sell only” currency. However, that brings us to the second issue: The Americans probably are going to be raising interest rates as quickly as once thought, so at this point in time it’s likely that the currency pair will continue to go back and forth as both currencies are being beat up at the moment.