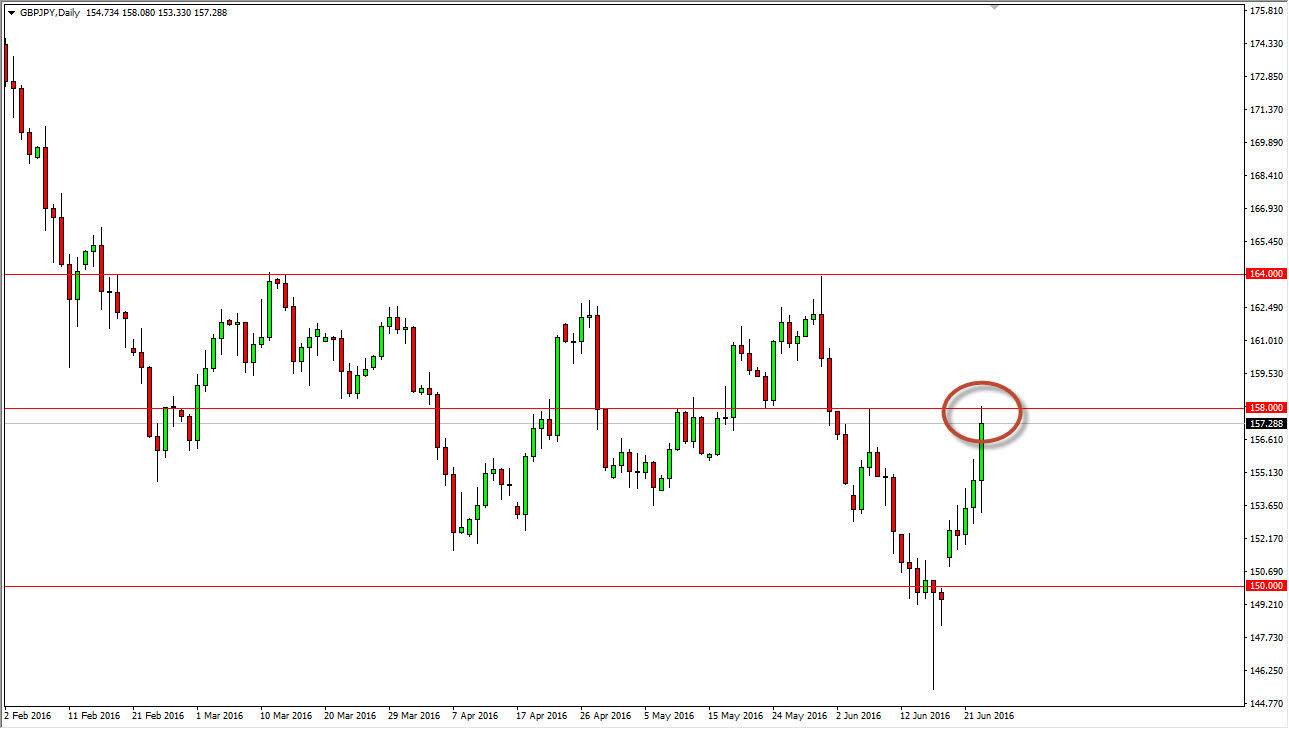

The GBP/JPY pair initially fell during the day on Thursday, but turned right back around to form a very bullish candle. The bullish candle of course is a sign that the trading community believes that the United Kingdom will stay within the European Union, as people have been attempting to front run the announcement and of course has people chasing the Pound in general. Ultimately, you have to look at the 158 level as well, because it is a fulcrum of the market as we have seen quite a bit of support and resistance at that area. Ultimately though, this market will be dependent on what happens with the EU referendum coming out of the United Kingdom, which we do not get the actual announcement of until this morning.

158 and its importance

If we can break above the 158 level for any significant amount of time, I believe that the market will then reach towards the 164 level. Ultimately, the market will more than likely have quite a bit of bullish pressure and it as all of a sudden the British pound might be undervalued if we stay in the European Union. On the other hand, we could get a “leave” vote, and that of course would be very negative as the market would drop from there and perhaps even trying to find the gap below at the 150 handle. After all, gaps do tend to get filled given enough time, and as a result it’s likely that the sellers would be quite aggressive at that point in time.

This is a very volatile market to begin with, and the fact that we have this referendum vote announcement coming out today, that will only push this market back and forth as the market will react to various rumors and hearsay between now and the official announcement. Nonetheless, hang onto there could be fireworks in this particular pair.