GBP/USD Signals Update

Yesterday’s signals were not triggered.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Protect any open trades by 6:30pm.

Long Trades

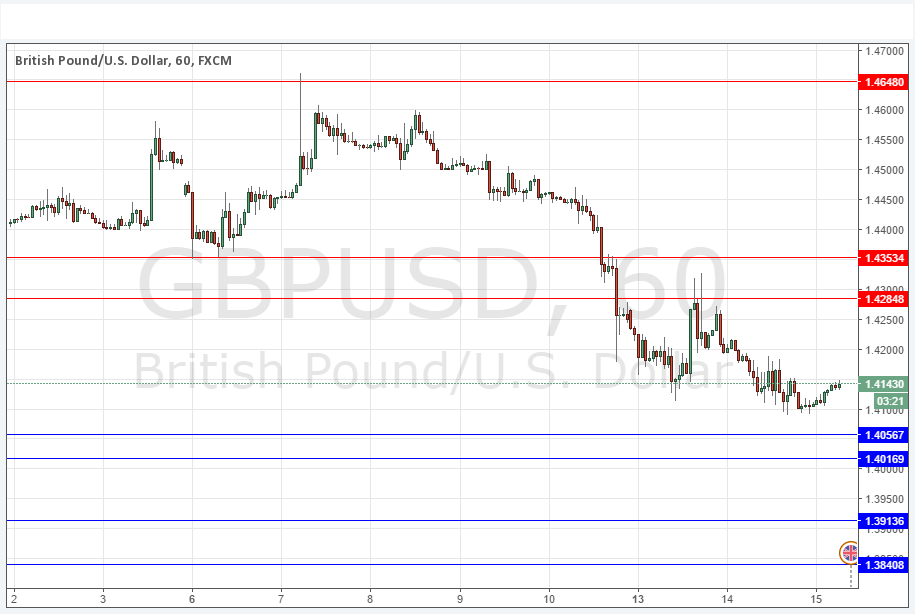

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4057, 1.4017, 1.3914 or 1.3841.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4285 or 1.4353.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

Again, there was little change over the past 24 hours, and trading remains fairly thin and erratic.

Until the British referendum on 23rd June, the GBP is going to be wild and dangerous to trade in general.

A new poll released yesterday showed the “Leave” vote extending its lead to 7 percent, although the price is holding fairly steady. Online betting firms however are pricing the chance of Leave winning at only 40%.

If tonight’s FOMC releases strengthen the USD, this could be a good pair to go short of, provided there are no new polls showing a firmer Remain vote.

Concerning the GBP, there will be a release of Average Earnings Index and Claimant Count Change data at 9:30am London time. Regarding the USD, there will be a release of PPI data at 1:30pm London time, followed later at 3:30pm by Crude Oil Inventories. At 7pm there will be the release of the Federal Funds Rate, FOMC Statement and FOMC Economic Projections, followed by the usual press conference.