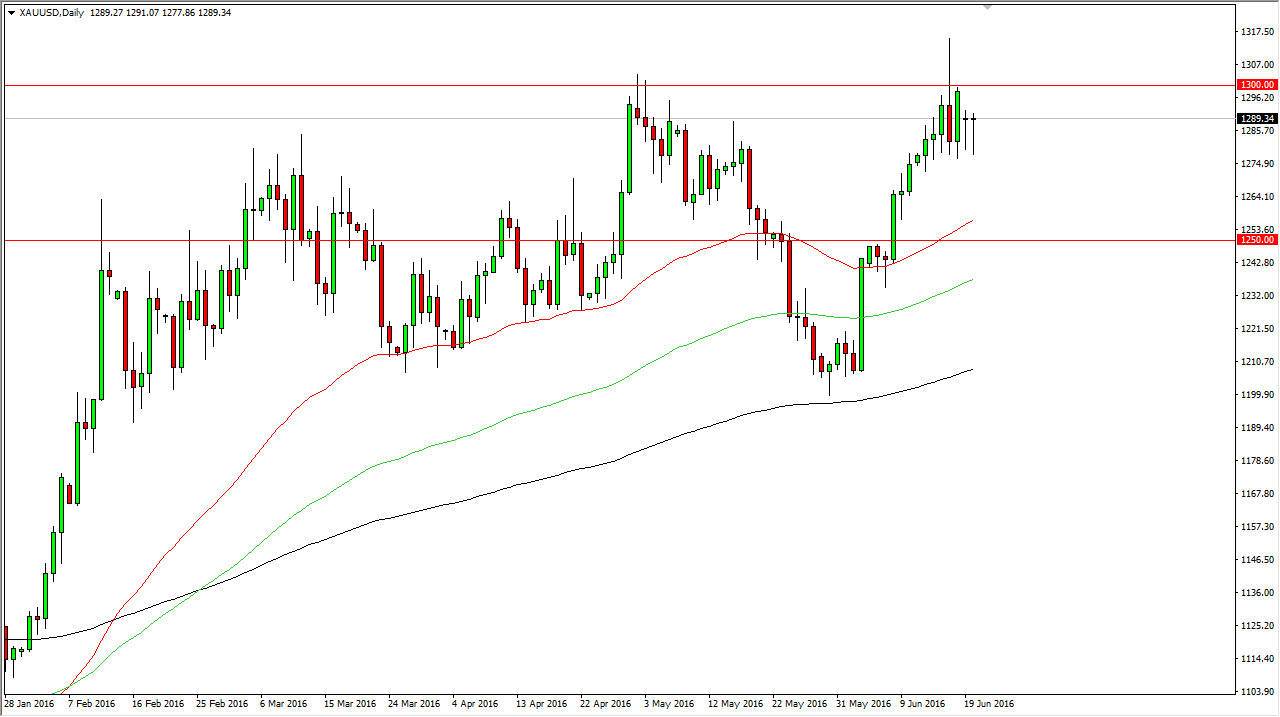

Gold markets initially fell during the course of the session on Monday, but turned back around to form a bit of a hammer. This is a market that continues to find the support somewhere near the $1275 level, and the hammer of course shows that. We also have that same action on Friday, and this is a market that should continue to go much higher. By looking at the last several sessions, the one thing that seems to continue to show in this market is that the buyers are willing to step then again and again. I think that the $1300 level continues to be a significant resistance barrier above, and if we can get a daily close above that level I feel that the longer-term buy-and-hold crowd will return.

Central bank uncertainty

I think one of the biggest reasons that we are starting to see the gold markets rally so drastically over the longer term is that there so much in the way of uncertainty when it comes to central banks around the world. Granted, the one that everybody’s paying the most attention to is the Federal Reserve, which of course recently got very bad economic news with a horrible jobs number which should keep interest rates low in the United States going forward.

When you look at the overall economic activity around the world, the central banks all are struggling with quantitative easing and the lack of the ability to raise interest rates. Because of this, a lot of people are looking for so-called “hard currency”, which could be much more attractive to most traders than currency that has almost nothing as far as interest rates backing it up. Also, there are a lot of people concerned about the EU referendum vote coming up in the United Kingdom, it’s likely that the uncertainty will continue and that gold will continue to be attractive to people as we have no idea what’s happening next and some of the situations.