Gold prices settled slightly lower yesterday after shuffling between gains and losses as investors weighed fresh U.S. economic data. The XAU/USD pair initially tried to break out to the upside but the expected resistance at around 1218 kicked in and capped the market, dragging it back to the support at 1208. In economic news on Wednesday, the Institute for Supply Management's manufacturing index came in at 51.3, up from the previous month's 50.8 and above expectations for a reading of 50.5. "Tight labor markets" are pushing up wages, the Federal Reserve said in its latest Beige Book.

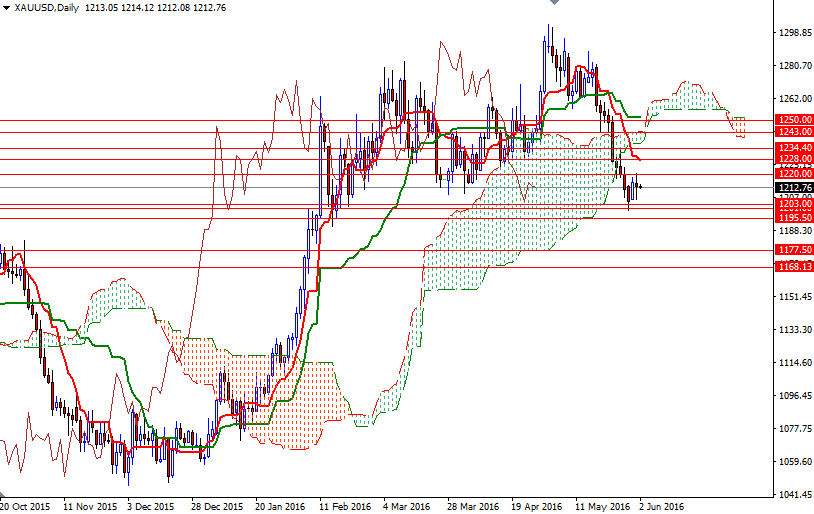

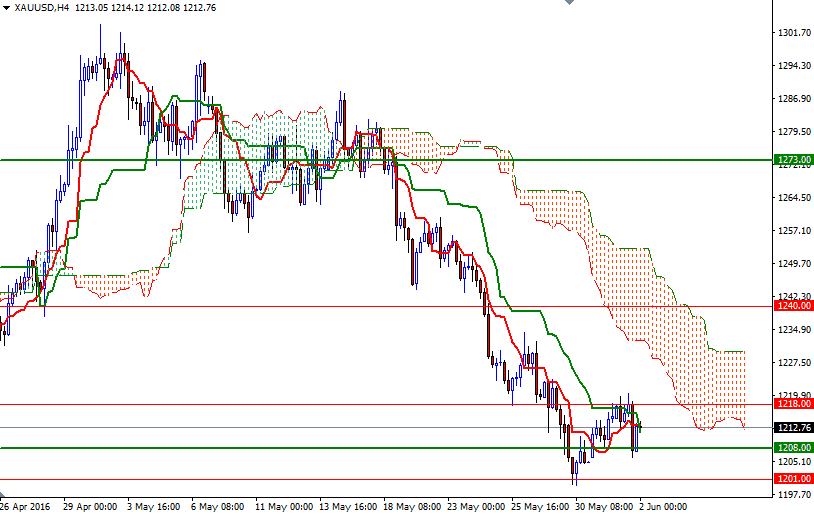

The market is trapped in a narrow trading range as the key levels continue to hold. Investors are awaiting U.S. non-farm payrolls data for May, due on Friday, to gauge the strength of the labor market. Speaking strictly based on the charts, the medium-term technical outlook will remain bearish as long as prices reside below the daily and 4-hourly Ichimoku clouds. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines also underpin this notion.

At this point, the XAU/USD pair will have to either break through the 1120/18 zone and challenge the next barrier at 1228 or drop below the 1203/1 region and test the support at 1195. Penetrating this barrier could foreshadow a move towards the 1234 level. If this resistance is broken, then the 1243/0 area could be the next port of call. On the other hand, breaking down below 1195 could increase speculative selling and drag the market towards the 1177 level.