NZD/USD Signal Update

Yesterday’s signals were not triggered.

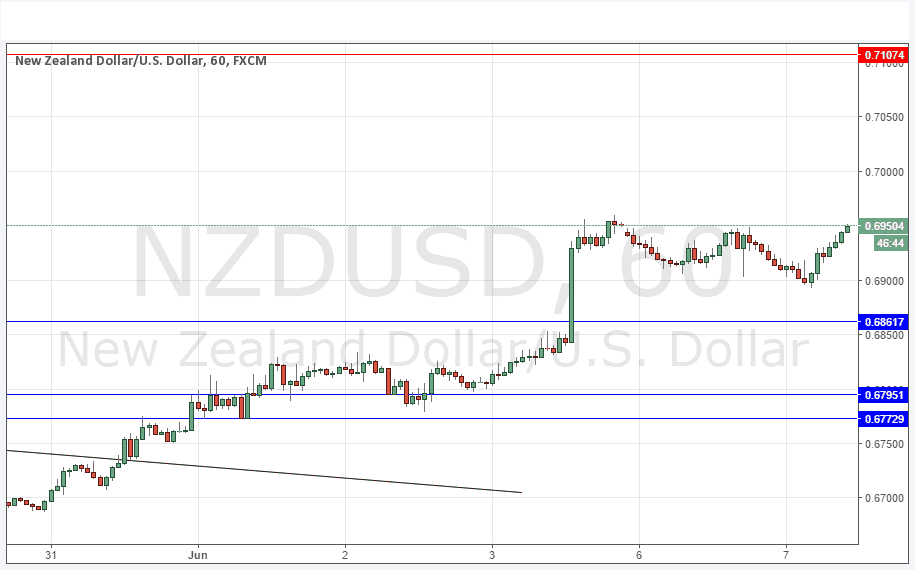

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be entered between 8am New York time and 5pm Tokyo time.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6862, 0.6795 or 0.6773.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7107.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

I wrote yesterday that “the closest round number below at 0.6900 may act as support…” and this has happened, with the chart below showing a steady succession of nicely bullish candlesticks ever since the price turned up once the level was reached.

At the time of writing, the price is testing recent highs at around 0.9650. A break above here looks likely, with a continued move up to at least 0.7000 on the agenda. There is no resistant level there, but a sustained move up to such a key psychological number is likely to see a lot of profit taking when that level is reached.

There is nothing due today concerning either the NZD or the USD.