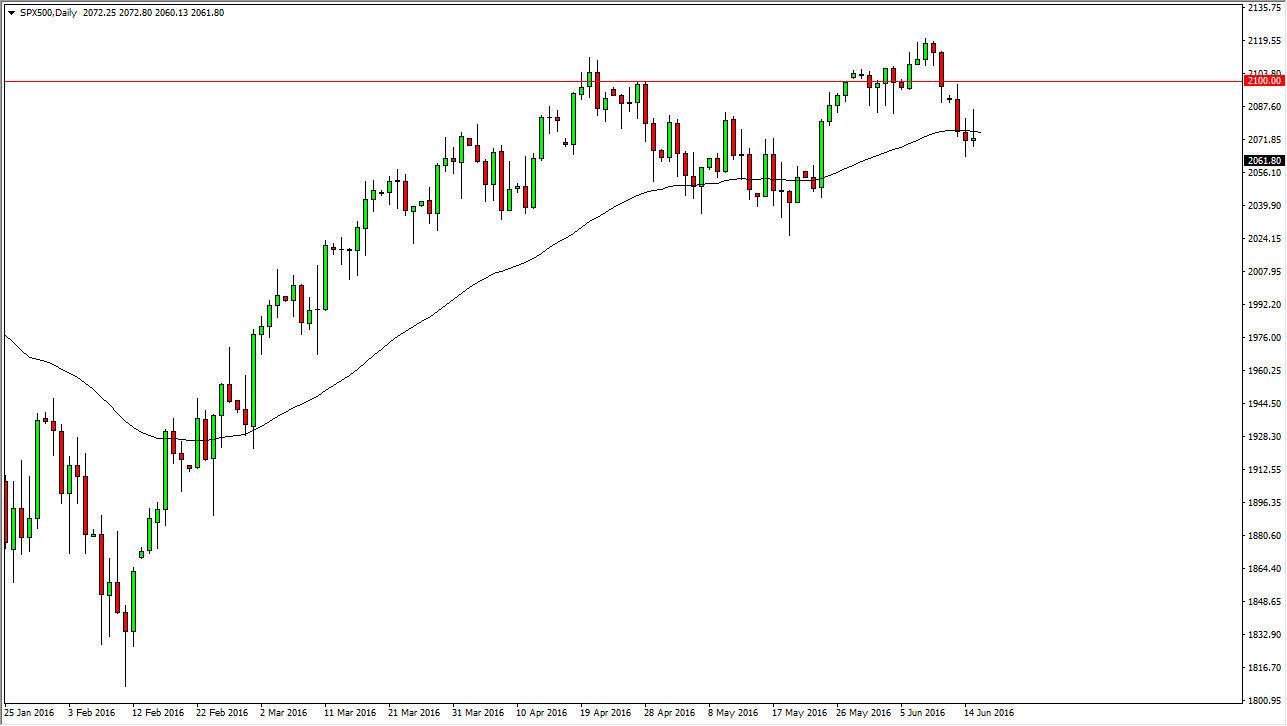

S&P 500

The S&P 500 broke higher during the course of the session on Wednesday, as it appears of the Federal Reserve is stepping away from any idea of raising interest rates in the near term. At this point in time, the market looks as if it is going to reach towards the 2100 level, and then possibly even as high as the 2120 handle. That being the case, the market looks as if it is one that you can only buy, but keep in mind that the market will also be very volatile. The 100 day exponential moving average is offering dynamic support as it has for some time now, and as a result it looks as if the longer-term traders are still very bullish.

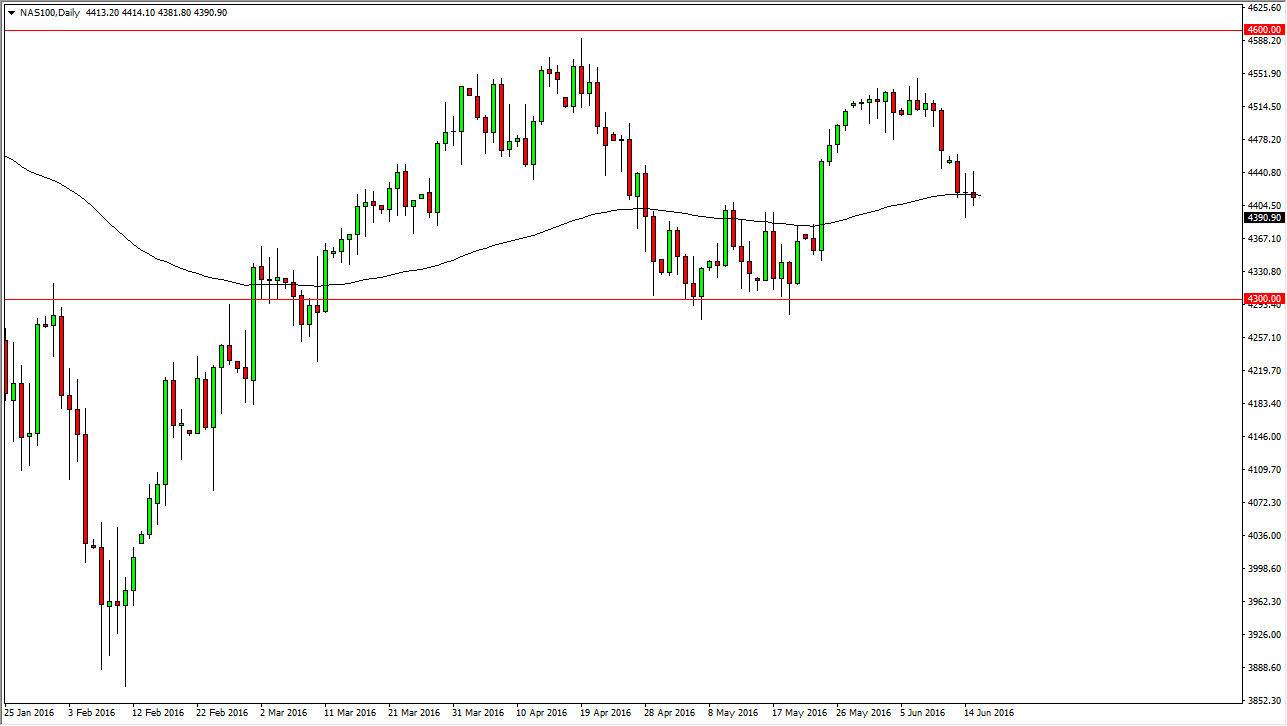

NASDAQ 100

The NASDAQ 100 rose during the day as well, so having said that the market looks as if it is going to go higher given enough time, and a break above the top of the range during the course of the day on Wednesday is reason enough for me to get involved in start aiming for the 4500 level. I think that pullbacks at this point in time will continue to be buying opportunities as there is more than enough support all the way down to the 4300 level to list this market as far as I can see.

I believe that the market is then going to try to reach towards the 4500 level, and then perhaps even the 4600 level. A break above the 4600 level would continue the longer-term uptrend, and therefore attract even more buying pressure. I have no interest whatsoever in selling this market especially now that the Federal Reserve has suggested that perhaps that and interest-rate hike right away is almost impossible to imagine, and therefore the market will continue to favor the upside for the foreseeable future.