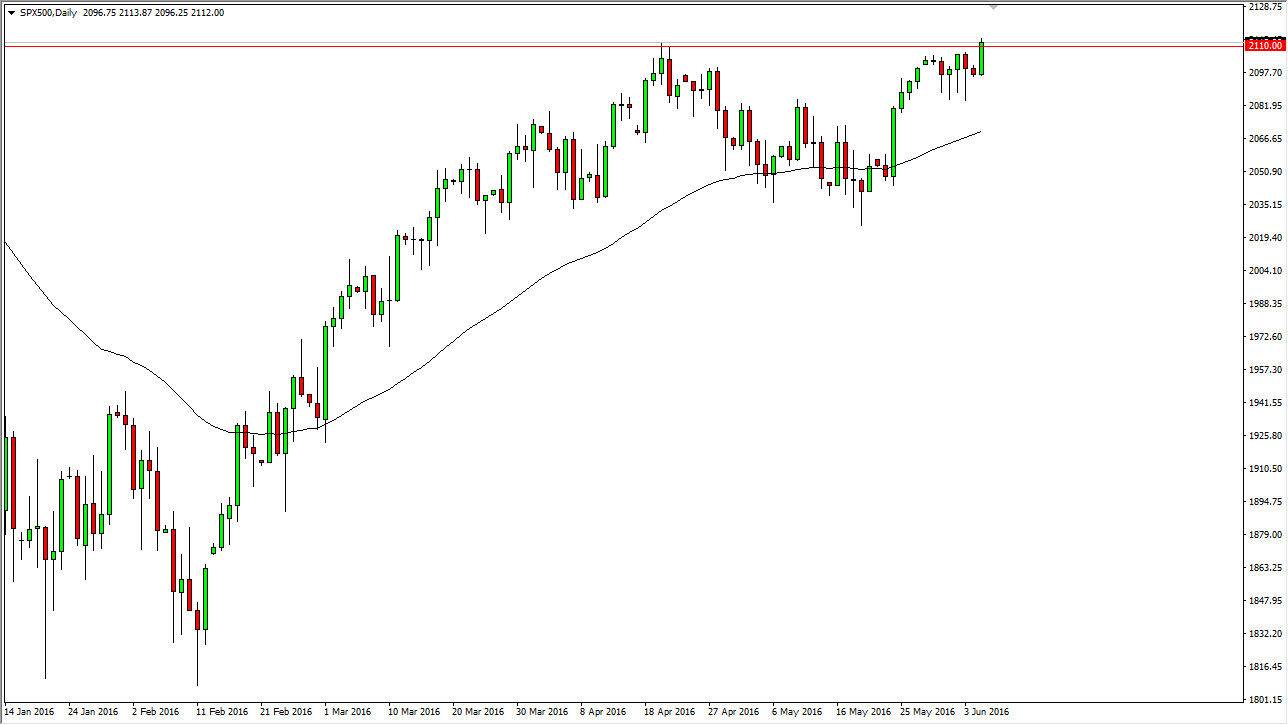

S&P 500

The S&P 500 broke higher during the course of the session on Monday, breaking above the 2110 handle which has been so important recently. Now that we have made a “fresh, new high”, and looks as if the market is ready to continue going higher and more than likely this has a lot to do with the fact that the US dollar is falling apart and that the jobs number was so horrifically down, the Federal Reserve simply cannot do anything as far as interest rates are concerned according to most traders, and with that being the case it looks as if the S&P 500 is very likely to continue going higher and should be a market that attract buyers again and again.

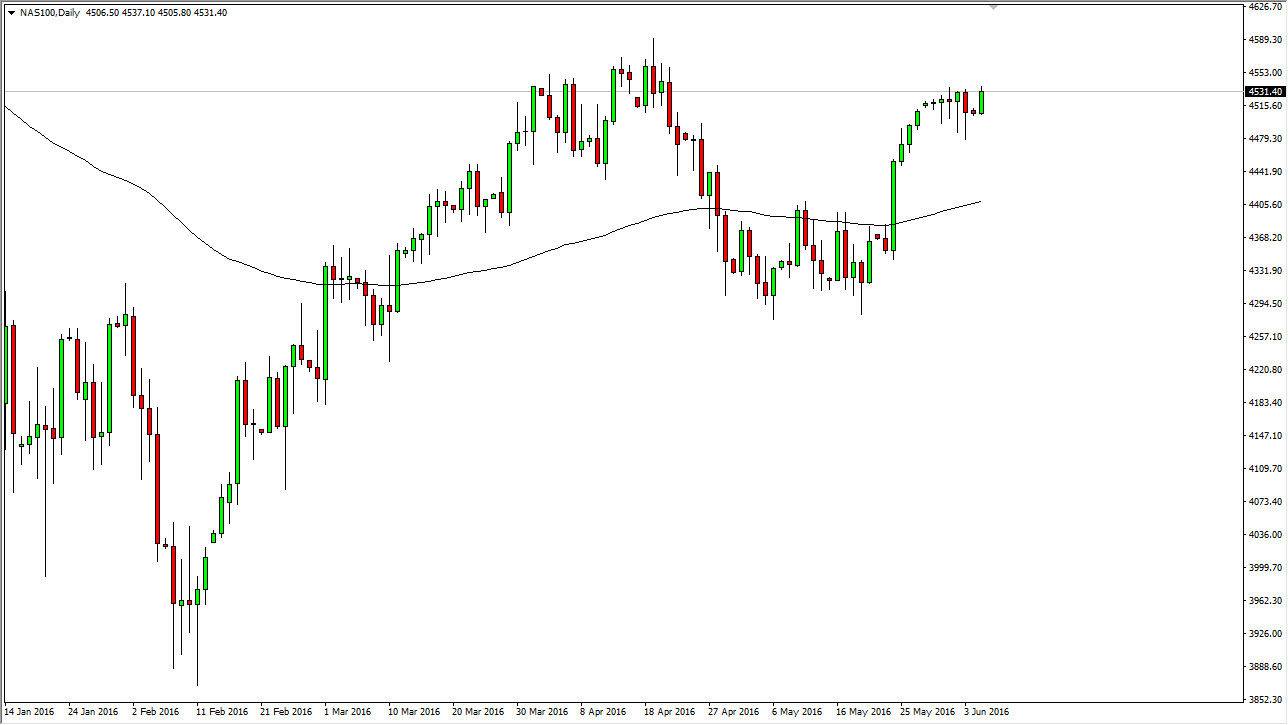

NASDAQ 100

The NASDAQ 100 is trying to break out as well, but there is a significant amount of noise between here and the 4600 level, so it’s not really until we break above there that we have the same situation that we see in the S&P 500 right now. Pullbacks should be supported, but quite frankly this is probably going to play second fiddle to the S&P 500 as it is apparently much stronger than the NASDAQ 100.

This is a market that should continue to go higher though, so short-term pullbacks will probably be buying opportunities. I have no interest whatsoever in selling this market, because it is obviously very bullish as US indices all continue to look like they are going to benefit from a low interest rate environment for some time. I have no designs on selling the NASDAQ 100, but I am the first to admit that you are probably going to be better off trading the S&P 500 initially, as it has cleared a significant barrier during the day. Ultimately, “a rising tide lifts all boats.”