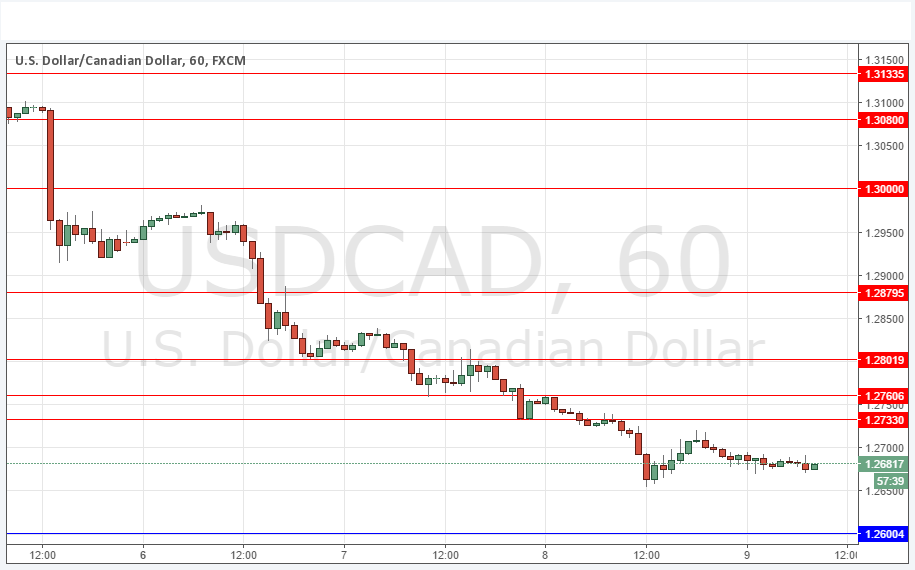

USD/CAD Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at 1.2700.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm New York time today.

Long Trade 1

* Go long after bullish price action on the H1 time frame following the next touch of 1.2600.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

* Go short after bearish price action on the H1 time frame following the next touch of 1.2733, 1.2760 or 1.2800.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

The strong bearish trend continues for yet another day, with the price invalidating the anticipated support at the key round number of 1.2700. However there are high-impact news items due today for both currencies within this pair so sentiment might change, although the U.S. Unemployment Claims is far more crucial than the Canadian item is likely to be.

There is a new likely resistance level at 1.2733.

Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time. Concerning the CAD, the President of the Bank of Canada will be holding a Press Conference at 4:15pm.