USD/CHF Signal Update

Yesterday’s signals were not triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Long Trades

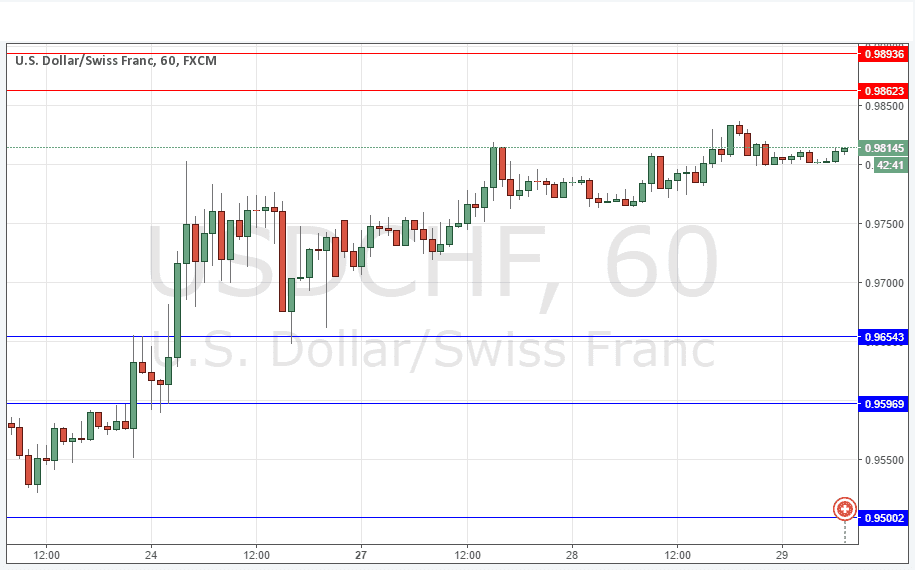

Go long after bullish price action on the H1 time frame following the next touch of 0.9654 or 0.9597.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9862, or 0.9894.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

It is hard to say much about this pair. Both currencies are strong in the current “risk off” environment. However the price keeps edging up and by now we have to admit the level at 0.9800 which was quite resistant has fallen away. The spotlight now moves up to the next levels starting at 0.9862.

Unfortunately it is hard to identify any obviously supportive levels anywhere nearby before 0.9654.

Like the EUR/USD, over the long-term this pair has no strong trend.

There is nothing due concerning the CHF. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.