By: DailyForex.com

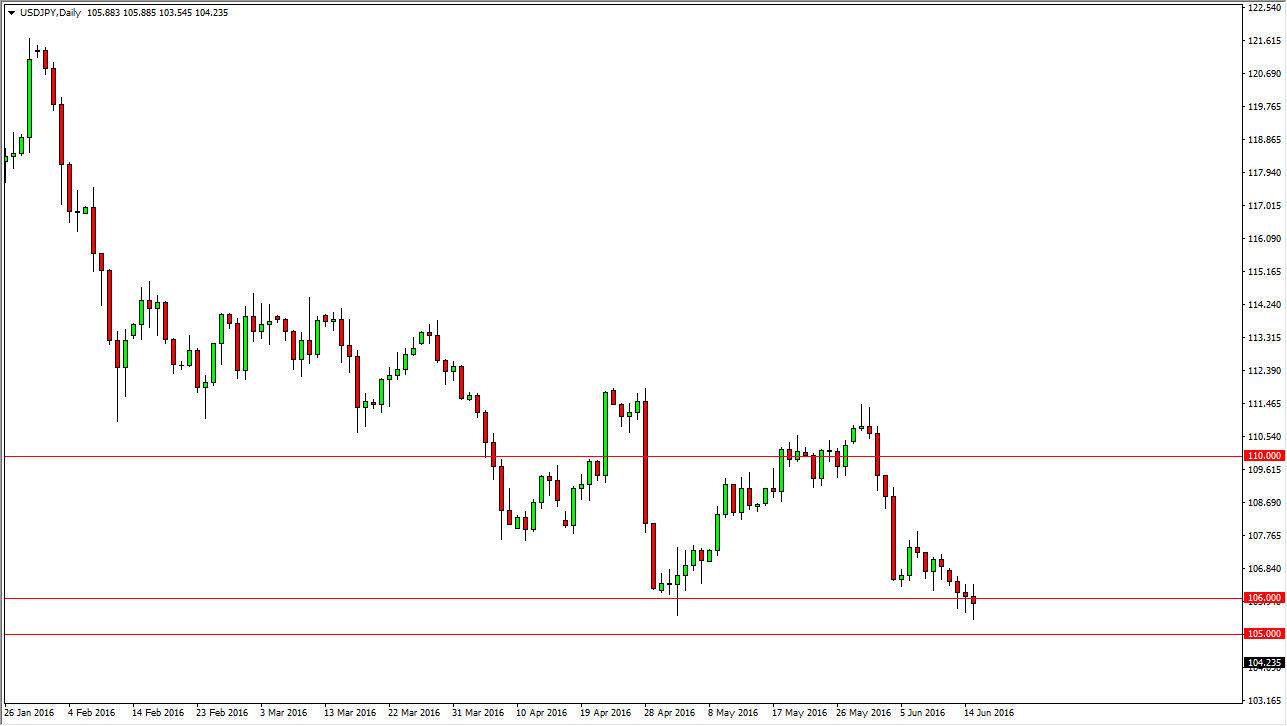

USD/JPY

The USD/JPY pair initially tried to rally during the course of the day on Wednesday, but turned right back around. The pair was fairly muted during what could’ve been a volatile day, as the Federal Reserve chose not to raise interest rates. The market still expects at least one increase during 2016, but at this point in time even that is in doubt. Because of this, it makes sense that we should continue lower and as a result on a fresh, new low, I am a seller as the market will target the 105 level, and then eventually break down below there. Short-term rallies could end up being selling opportunities on exhaustive candles as well, as I believe that the Federal Reserve simply cannot do anything at the moment.

AUD/USD

The Australian dollar broke above the 0.74 level during the day and as a result we broke the top of a couple of shooting stars. That’s a very bullish sign and I feel that we will probably reach to the 0.75 level next, as it was the most recent high. We can break above there I think that we will continue to go higher, probably reaching for the 0.78 level but it will be choppy on the way up. Because of this, most people will probably stick to short-term charts just a short-term trade from time to time.

I think there is a significant amount of support at the 0.73 level, so there should be plenty of buying pressure above there. Ultimately, this is a market that has been very volatile but it appears that we are starting to turn around and change the trend from down to all as the most recent low has certainly been much higher than the previous one. However, expect a lot of volatility as there is so much uncertainty in the world at the moment.