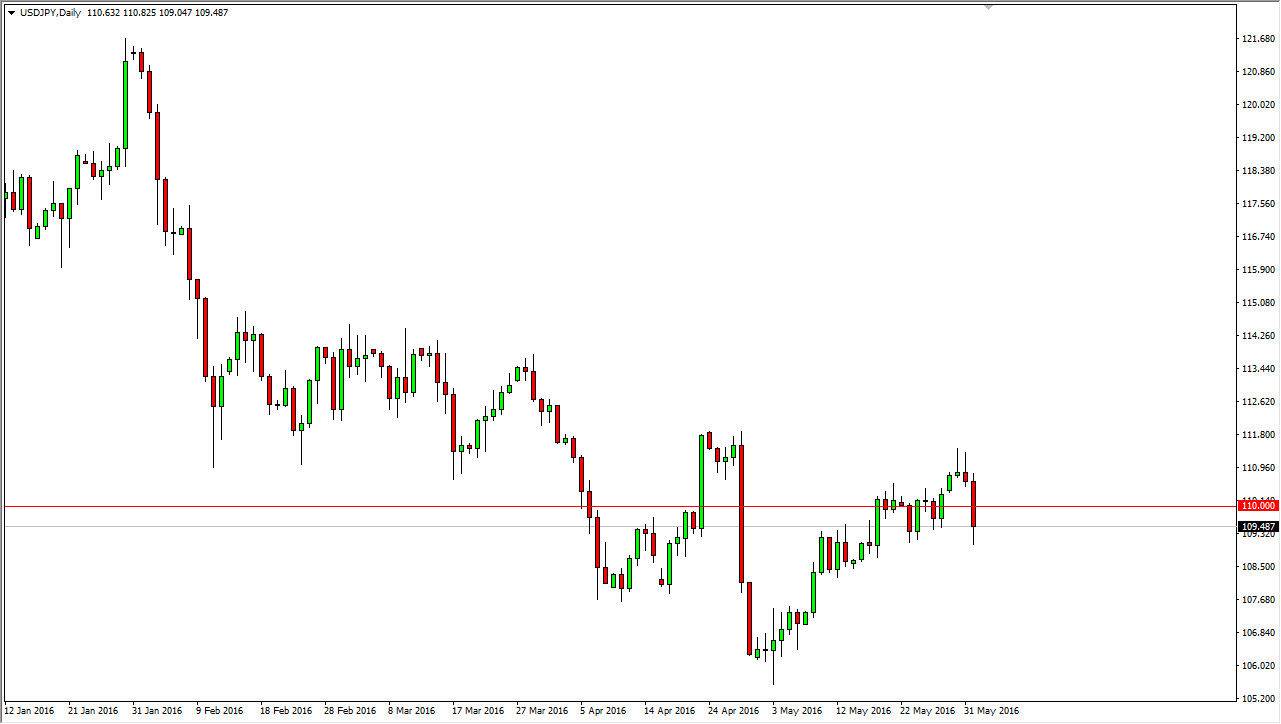

USD/JPY

The USD/JPY pair fell significantly during the day on Wednesday, as we broke down below the bottom of the shooting star from both Monday and Tuesday. This of course is a very bearish sign and probably a result of comments coming from the Bank of Japan that perhaps the sales tax may be put off for a while. Ultimately, there’s of significant amount of support just below so I don’t think that selling is going to be the thing to do at this point in time. We don’t have the right supportive candle though, so I may just simply forgo trading this pair today. I think that the 112 level above is a pretty significant resistance barrier, so it may not be until we get the jobs report that we get any real momentum here.

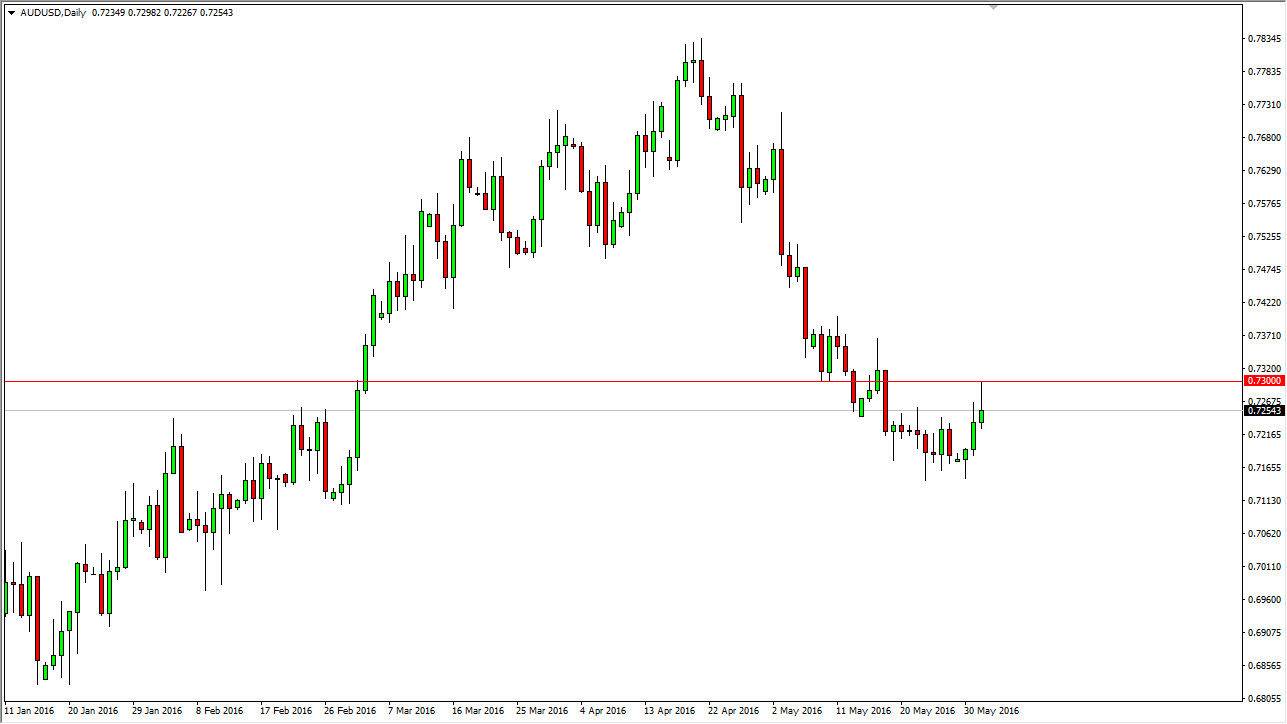

AUD/USD

The AUD/USD pair initially tried to rally during the course of the day on Wednesday but slammed into the 0.73 level as it was a significant support and resistance barrier over the longer term. Keep in mind that the GDP announcement coming out of Australia was stronger than expected, and that had a lot to do with the bullish pressure that we have seen. However, there was a bit of a knee-jerk reaction and quite frankly there are a lot of concerns around the world right now which typically works against the value of the Australian dollar.

The commodity markets and most notably the gold markets tend to affect the value of the Australian dollar, so keep in mind that the markets will be very volatile as we continue to weigh global growth, but at this point in time I think you have to air on the side of caution when it comes to the Aussie dollar as there are so many things that can go wrong at the moment. On the other hand, if we did break above the vital 0.73 level, I think there is significant resistance all the way to the 0.74 level, so it’s not really until we get above there that I’m comfortable buying. I think signs of resistance should be sold but keep in mind probably be a lot of volatility so therefore it’s probably a lot of short-term trades waiting to happen.