USD/JPY

The USD/JPY pair initially tried to rally during the day on Tuesday, but we struggled as we approached the 108 level. By doing so, we ended up forming a shooting star and I do believe that the longer-term downtrend will continue as we have sold off drastically. The most recent bounce suggests that we are going to try again and again in order to break down. I think at this point in time we are going to break down to the 106 level, and then possibly the 105 level. I have no interest in buying this pair, mainly because of the jobs number that came out on Friday, which should continue to put pressure on the US dollar in general, especially when it comes down to the market involving the Japanese yen as it is a safety currency.

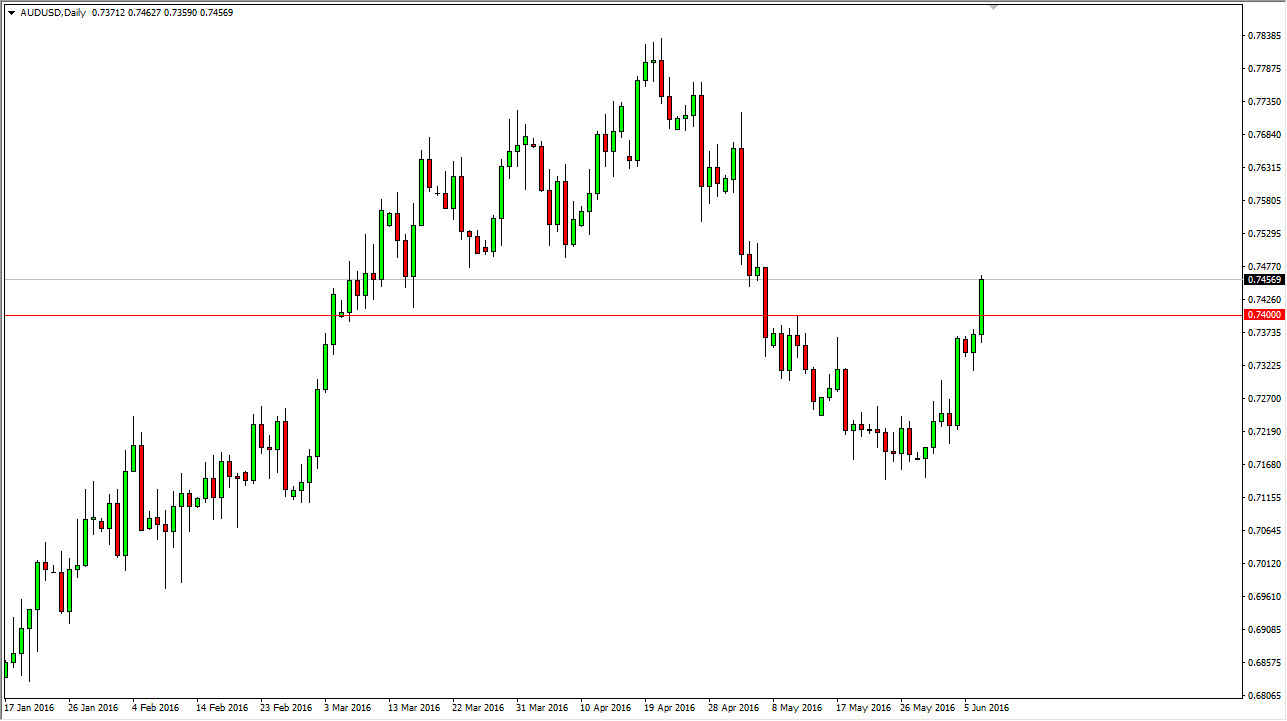

AUD/USD

The AUD/USD pair broke higher during the course of the session on Tuesday, getting above the 0.74 level. At this point in time, the market looks as if we are going to continue to go higher, perhaps reaching towards the 0.75 level next, and then eventually higher than that. The 0.74 level was previously resistive, and it should now be supportive. With that being the case, any pullback at this point in time should have quite a bit of interest in that area by the bullish as the market should continue to reach higher.

I recognize that there is a lot of noise above, probably extending all the way to the 0.7850 level. It might not necessarily be easy to get there, but I do think that’s where we are heading over the longer term. Pay attention to the gold markets, they look very bullish at this point in time, and could very well propel the Australian dollar higher. Typically, that is the correlation, and I don’t see any reason why it will change now.