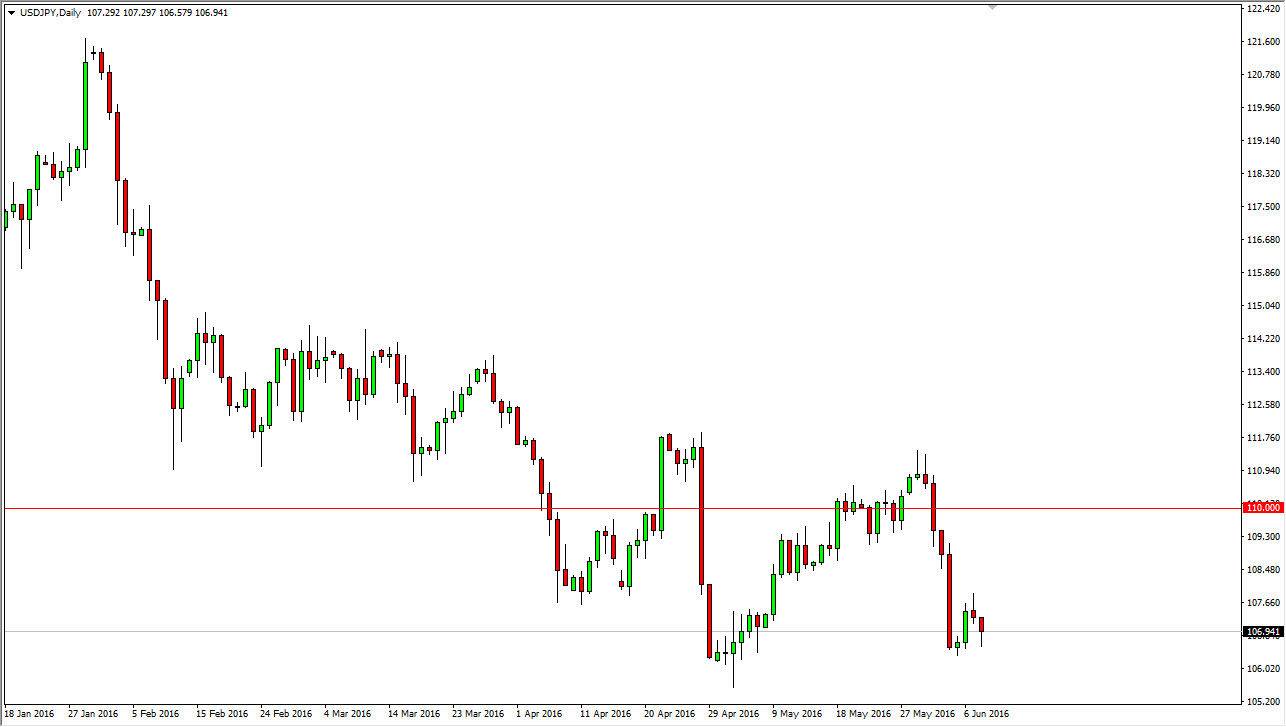

USD/JPY

The USD/JPY pair initially fell on Wednesday but found enough support near the recent lows to bounce a bit and form something akin to a hammer. That being the case, looks as if the market may try to bounce from here but we also have a shooting star from the previous session so more than likely we are going to see is some type of consolidation in this general vicinity. Ultimately, we have to make some type of move, but I don’t think we’re ready to do it quite yet. With that being the case, on the sidelines when it comes to the USD/JPY pair at the moment. Keep in mind that interest-rate differential will come into play, and right now looks like the Federal Reserve is in anywhere near raising interest rates for a significant cycle.

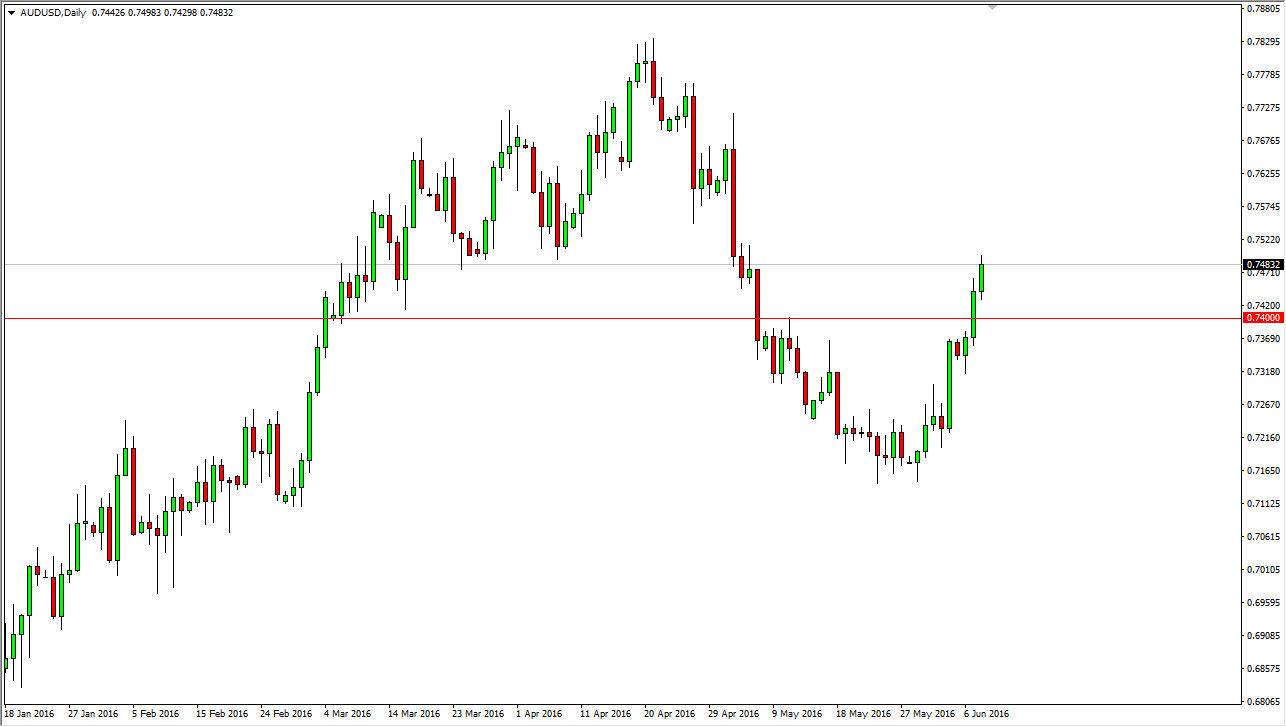

AUD/USD

The AUD/USD pair broke higher during the day on Wednesday, as we have approached the 0.75 handle. That area begins a significant amount of resistance, but at the end of the day I believe that we are going to slice right through that. Granted, there will be pullbacks from time to time but as long as there are concerns with the Federal Reserve not being able to raise interest rates, I think that it makes sense that the US dollar falls, and more importantly gold rises. As gold rises, it tends to drive the value the Australian dollar higher, and I think that’s what’s going on in this particular market. I believe that the 0.74 level will be a bit of a floor, and that pullbacks towards that area will more than likely be thought of as “value” that traders will take advantage of.

Ultimately, I think that we are going to reach towards the 0.75 zero level again, which was the most recent high. It’s going to be choppy and more or less a market that you can buy on the dips, but that’s about as good of an environment as I see right now.