USD/JPY Signal Update

Yesterday’s signals may have produced a shoe from the rejection of the 107.50 level, which would have been a losing trade.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time to 5pm Tokyo time only.

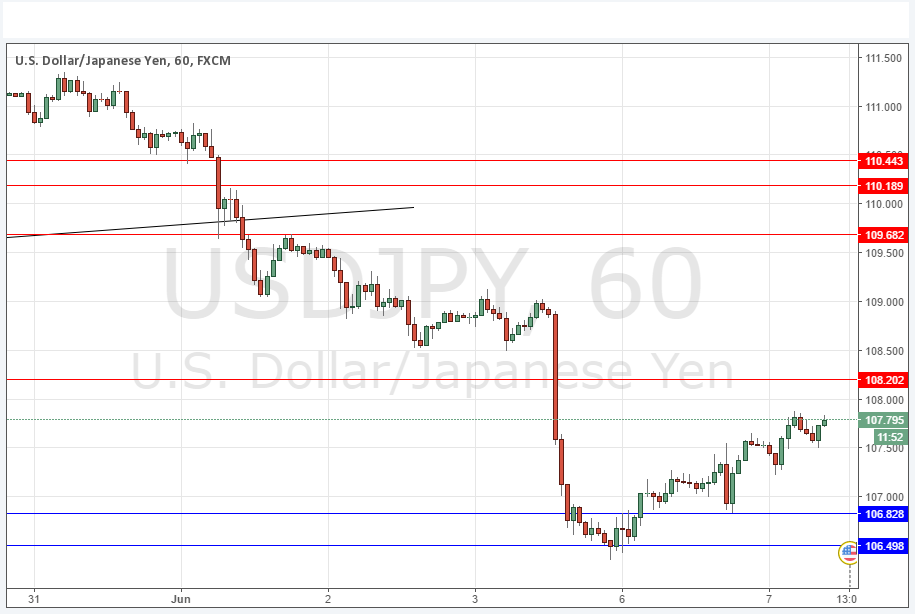

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 108.20.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 106.50 or 106.83.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

Yesterday I was looking for a short from 107.50. There was a bearish reaction here but it happened while Yellen was speaking during a period of relatively high volatility so it was not very reliable or exploitable.

The fact that the price managed to get above there, and the chart is showing a fairly steady sequence of higher lows and higher highs on a short term chart since the turn at 106.50, are signs that the short-term trend is upwards. A sharp bearish turn will still be a logical future development to watch for, with 108.20 being the most probable area for this turn to happen.

There is nothing due today concerning either the JPY or the USD.