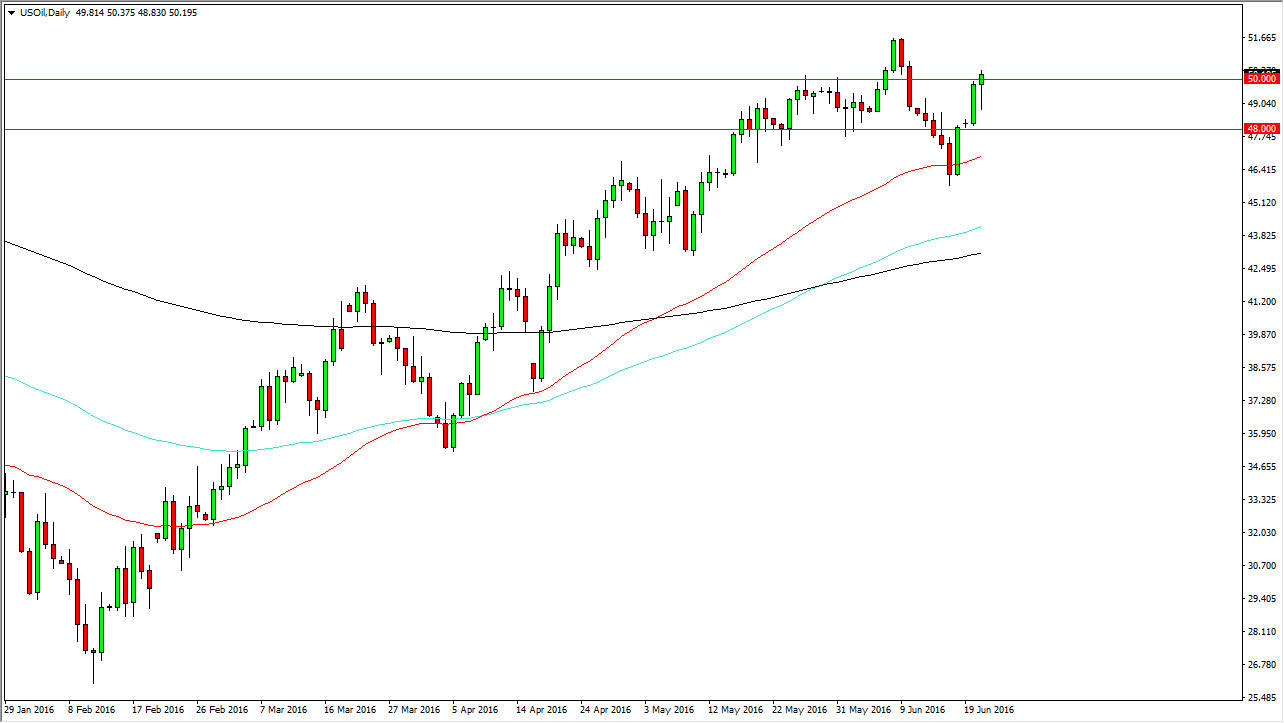

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Tuesday but found enough support just above the $40 level to turn things around and form a hammer. That of course is a positive sign, so we can break above the top of the hammer I believe that the market will continue to grind its way higher, perhaps trying to continue the longer-term uptrend. Ultimately, pullbacks will continue to be very important as they represent value in this very bullish market. I believe that given enough time we could break out, but if we end up making a “lower low” at the $46 level, that could be the beginning of a very negative move. Ultimately, the market looks like it is going to be very volatile in the short-term, so having said that it’s likely that short-term charts will probably be the best way to go.

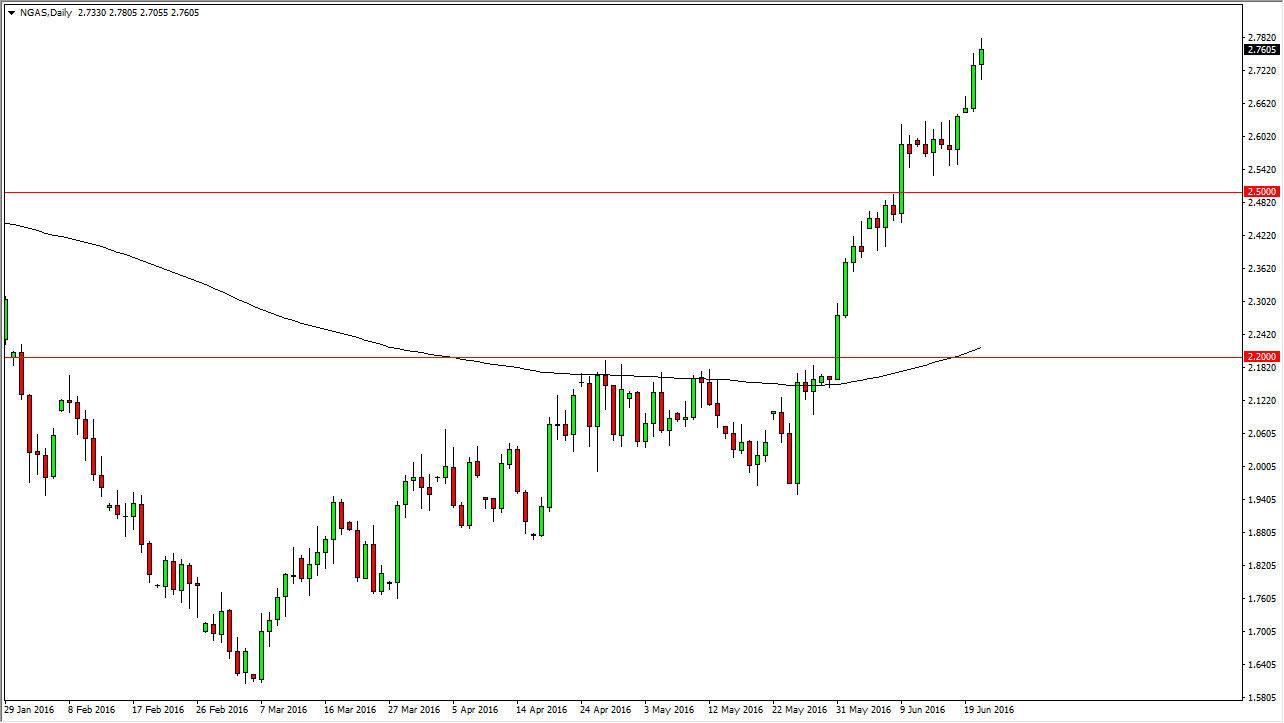

Natural Gas

Natural gas markets went back and forth during the day but eventually ended up forming a fairly positive candle. Because of this, I believe that we continue to go higher, but thousand recognize that there is a massive amount of trading being done down at the $2.60 level, so it should be relatively positive and very supportive. The $2.50 level is the bottom of that range, and as a result, I believe that this is a “buy only” market at this point in time. However, eventually we could get a bit of a turnaround but that’s a longer-term call not something that I expect to see anytime soon. In the meantime, the market should continue to go higher and perhaps show bits and pieces of bullishness as the market certainly has broken out to the upside.

At this point in time, I would need to see some type of longer-term sell off signal to get involved and start shorting again. Given enough time, it will happen due to the fundamentals, but it’s not happening anytime soon.