EUR/USD

The EUR/USD pair had a fairly volatile session during the day on Wednesday, testing the 1.10 level. By the end of the day, we turned things back around and ended up forming a bit of a hammer. A break above the top the hammer is a bullish sign of course, but I believe that it’s only a short-term bounce. If we can break above the top is hammer, I believe it’s time to simply wait for signs of exhaustion that we can sell again. This is a market that has been consolidating between the 1.10 level on the bottom and the 1.12 level on the top. I don’t see that changing until we break down to the downside. After all, it’s the European Union that has all of the uncertainty with it at the moment, and people are running to the US dollars for safety. Once we break down below the 1.10 level, the next target will be the 1.09 handle.

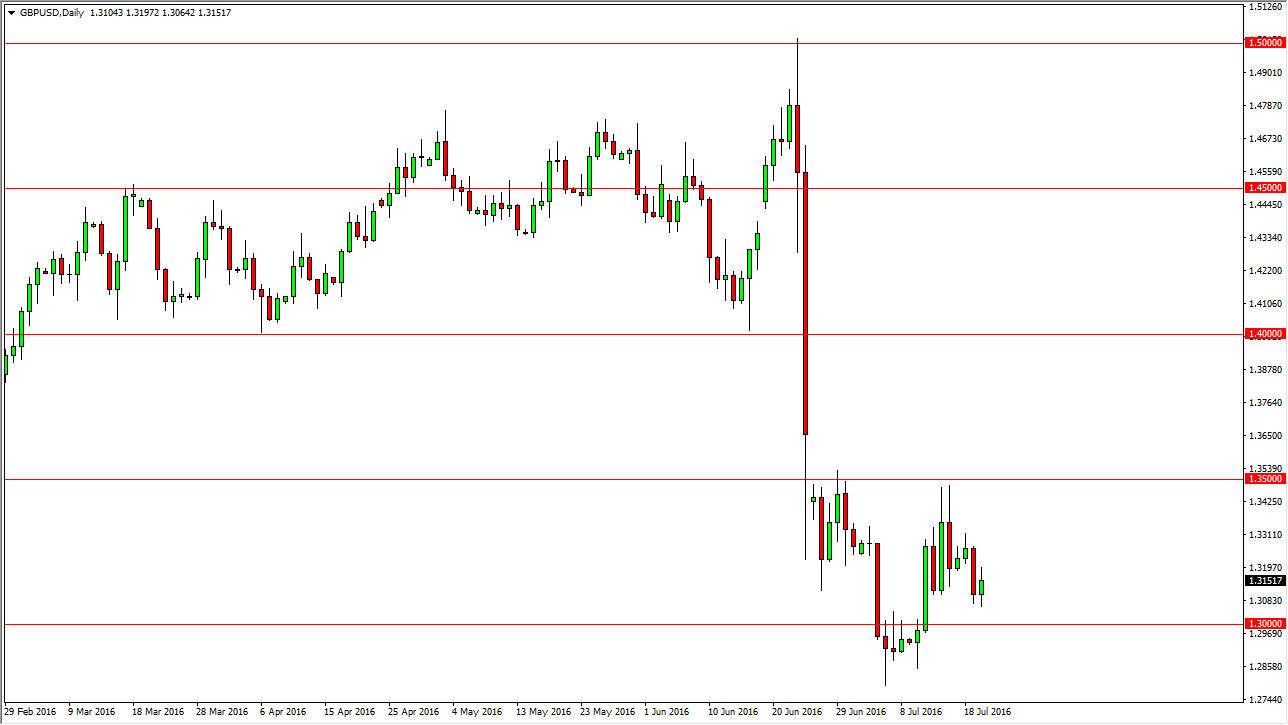

GBP/USD

The GBP/USD pair rallied during the day on Wednesday, as we continue to bounce back and forth. However, I see quite a bit of noise all the way up to at least the 1.35 handle, and quite frankly probably even higher than that, with the gap that extends all the way to the 1.3650 level. With this, the exhaustive candle is more than enough of a reason to start selling as far as I can see. I have no interest in buying the British pound at the moment, I believe that these rallies will only offer opportunities to sell at higher levels. There is so much uncertainty when it comes to the United Kingdom right now that is difficult to own the British pound.

I do believe this is going to continue to be the way forward, and therefore sellers will continue to jump into this market every chance they get. Once they do, they will punish the British pound again and again and run to the relative safety of the greenback.