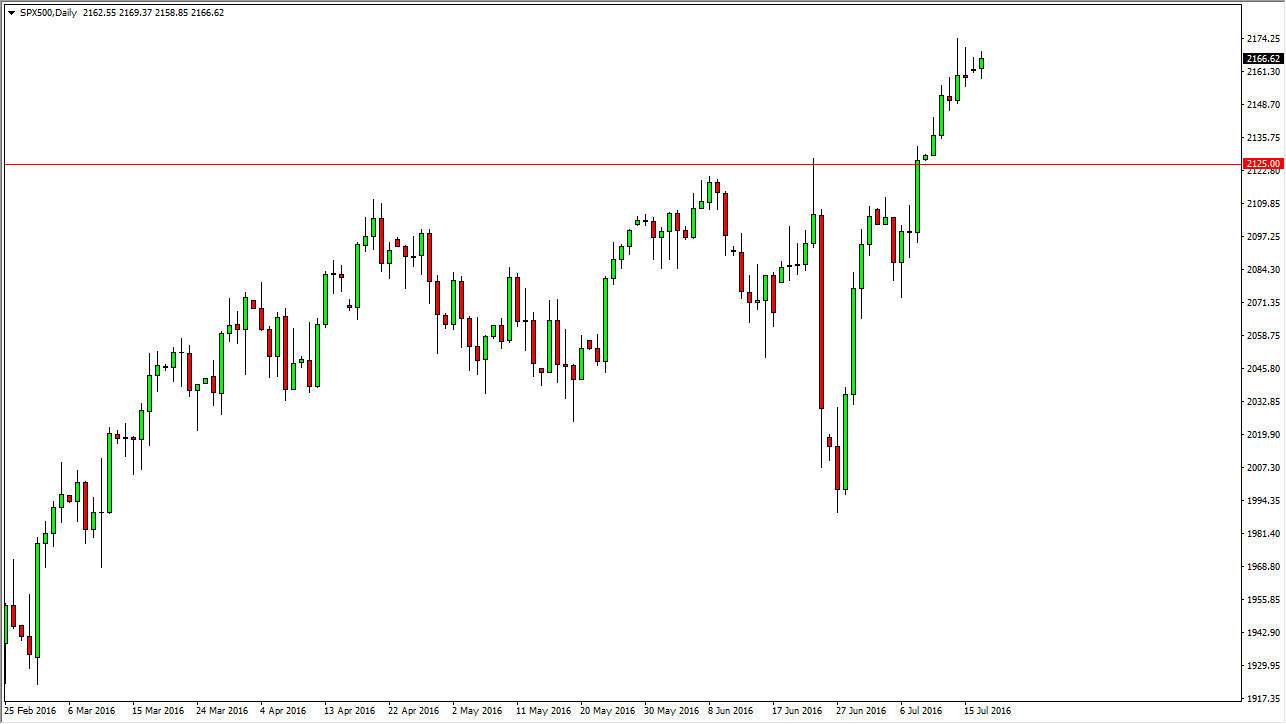

S&P 500

The S&P 500 did very little during the course of the session on Monday, but it did settle on a slightly positive candle. Ultimately, this is a market that looks like it is ready go higher given enough time but we are a bit exhausted at the moment. If that’s the case, then it makes a lot of sense that we could pull back and go looking for support below. The 2125 level below is previous resistance, so now it should be a bit of a “floor” in this market. On top of that, it appears that most stock traders around the world are trading money at the United States as it is considered to be the safest area to be investing and at the moment I have no interest in selling, and simply look for pullbacks to show signs of support as value.

NASDAQ 100

The NASDAQ 100 of course broke out during the course of the day on Monday, clearing the top of a couple of shooting stars. On top of that, we are closing above the 4600 level for the first time during this recent assault, and as a result I believe that this market does continue to go higher. Pullbacks at this point in time should be a buying opportunity, and that there should be a massive amount of support all the way down to the 4500 level. The NASDAQ 100 is a market that I have no interest in selling, and I do believe that we will eventually go much higher, probably 5000 given enough time.

Keep in mind that the market will probably be very choppy on the way up, so there should be more than enough opportunities to go long based upon value all the way up to the aforementioned 5000 level. The NASDAQ 100 could very well end up being one of the better trades this year.