S&P 500

The S&P 500 initially fell during the course of the day on Wednesday, but bounced significantly after falling in order to form a nice-looking hammer. The hammer of course is a bullish sign, and as a result I believe that this market will continue to go higher over the longer term, and offer buying opportunities again and again. I still believe that we are going to reach towards the 2250 level, and that we have a massive amount of support below, extending all the way down to at least the 2100 level. With this being the case, I think that we will find opportunities to pick up value and of course buying back and forth on dips as the S&P 500 continues to look very healthy and strong.

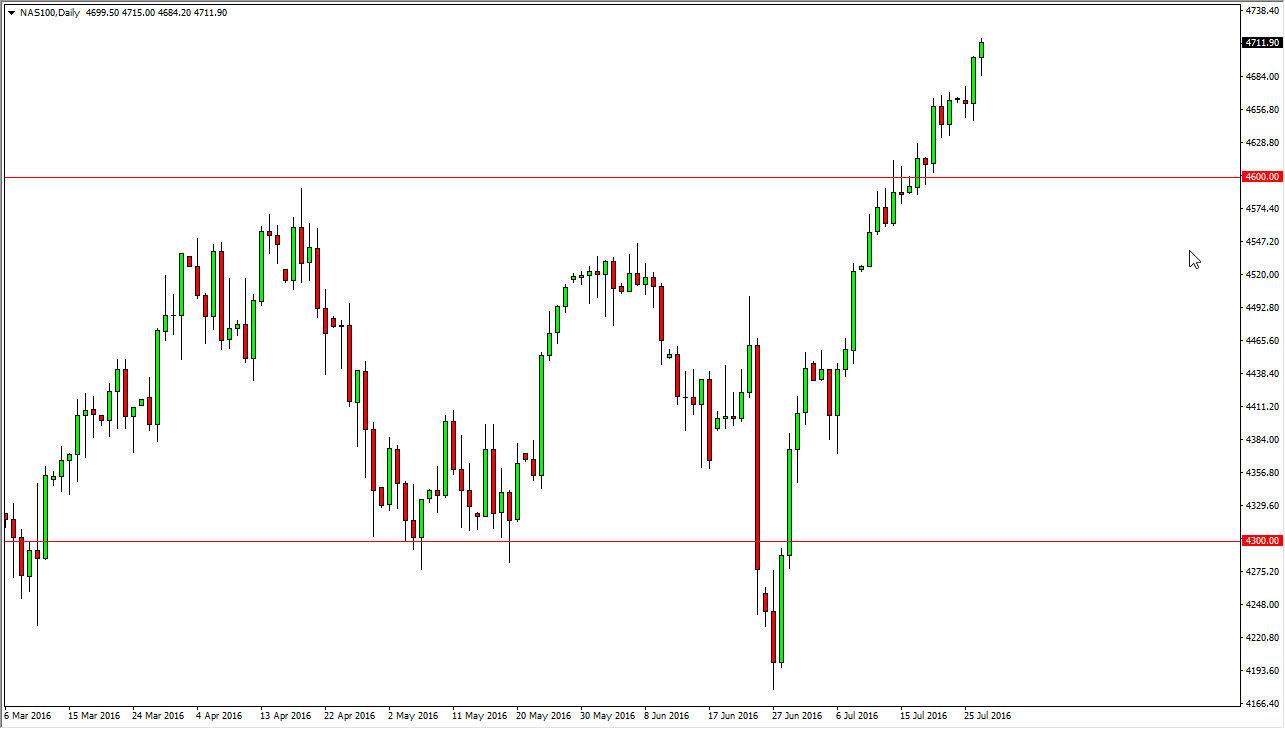

NASDAQ 100

The NASDAQ 100 initially fell but then shot higher during the day on Wednesday, forming a bit of a hammer. The hammer is of course a bullish sign, so I think that the NASDAQ 100 should continue to go higher as we have been trying to catch up to the other American indices. Any pullback at this point in time should find buyers, and at this point I believe that the 4600 level below is massively supportive. I currently have a target of 5000, but that of course is a longer-term target.

If we pullback from here, that should offer value that we can take advantage of, and quite frankly this is a market that is a bit of an overextended one at the moment, but given enough time we will eventually continue the upward move. After all, this type of impulsive move to the upside is very strong, and that generally means that we will continue to see buyers again and again. I have absolutely no scenario in which a willing to sell the NASDAQ 100 ounces point in time.