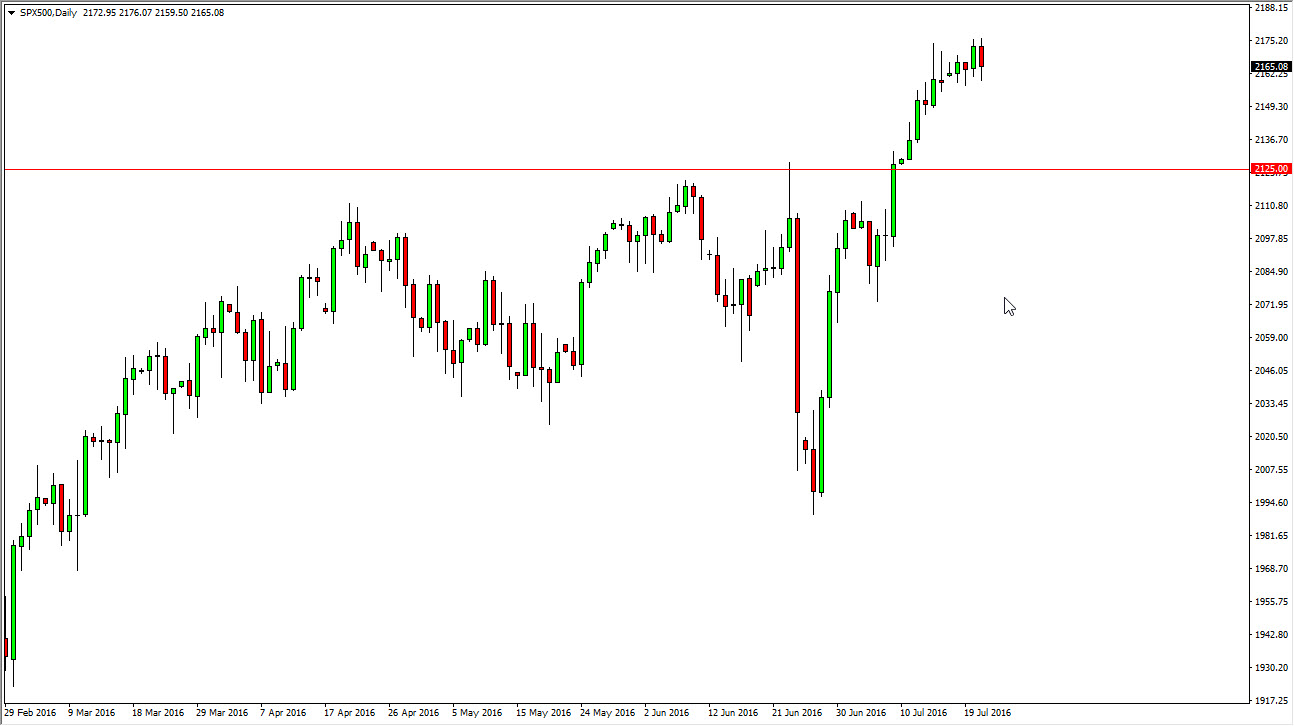

S&P 500

The S&P 500 fell during the day on Thursday, as we continue to grind at higher levels. At this point, I think that we probably need a pullback in order to find a little bit of momentum. With that being the case, I feel that it’s only a matter time before the pullback comes and people start looking for value in this market. After all, the S&P 500 broke out rather drastically from the 2125 level. With this being the case, I feel that it’s only a matter of time before we form some type of supportive candle that we can take advantage of. On the other hand, we could break above the top of the range for the last couple of sessions, and that would extend the move even higher. Keep in mind that the S&P 500 will follow other US indices, so pay attention to what they are doing, it should give you a heads up as to where we are next.

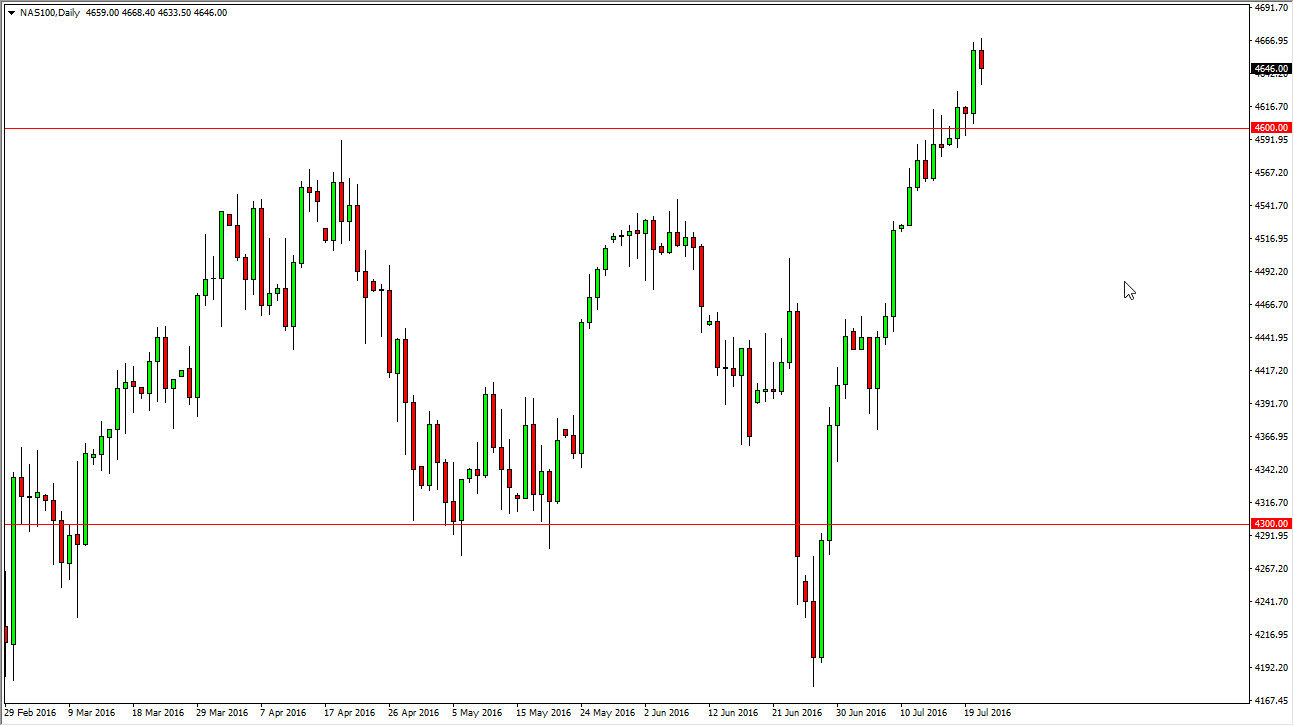

NASDAQ 100

The NASDAQ 100 had a slightly negative session on Thursday, but as you can see towards the end of the day did find value hunters. This is a market that I believe continues to go higher over the longer term, and I believe that the 4600 level begins a pretty significant support barrier. With this, I am looking for supportive candles to serve buying, or a simple bounce. The NASDAQ 100 of course continue has quite a bit of export aspects to it, so it has lagged a little bit behind some of the other US indices such as the S&P 500, and of course the Dow Jones Industrial Average.

This point in time, I believe that the absolute “floor” in this market is somewhere near the 4500 level. With this, the market should continue to see quite a bit of bullish pressure soon enough, and at that point in time I have no interest in selling. If we break above the top of the range for the day, we could perhaps go higher but I would be a little bit hesitant as I think we need to find more buyers.