USD/CAD Signal Update

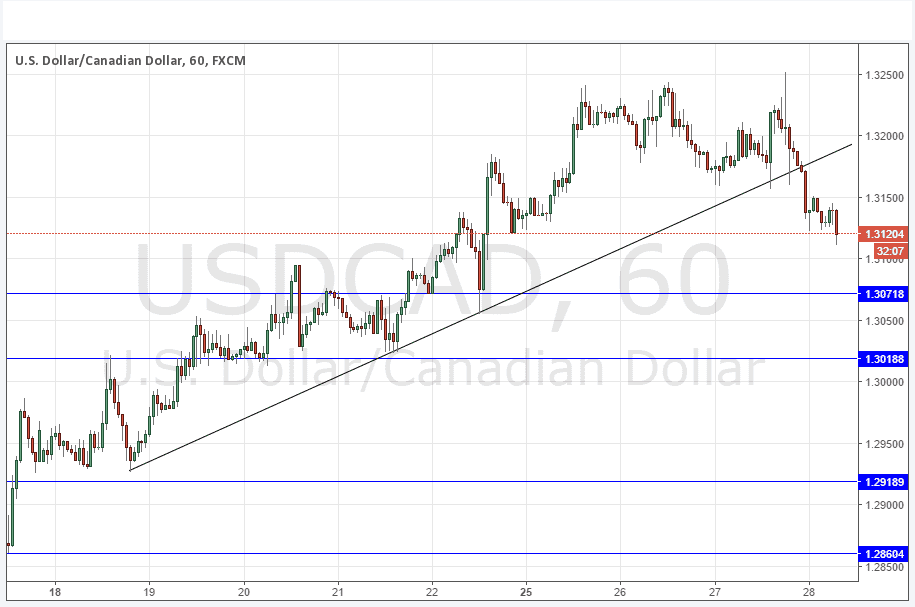

Yesterday’s signals may have given a long trade off the bullish trend line that went nowhere and would have been protected before the FOMC release in any case.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be entered between 8am London time and 5pm New York time today.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 1.3072 and 1.3019.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 1.3400.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

Things continued in a bullish way, with the supportive trend line shown in the chart below touched and holding the price up, until the FOMC release, which has had the effect of sinking the USD for the time being.

We have now seen the supportive trend line broken and the price breaking down towards the next support levels.

Although there is no strong long-term trend, the short-term trend has been upwards, so we can expect a good chance of some long pips from any good bullish reversal at the support levels. It is worth keeping an eye on what happens if and when 1.3072 is reached. The support at around 1.3019 should be even stronger as it has a very large round number right behind it.

There is nothing due today concerning the CAD. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.