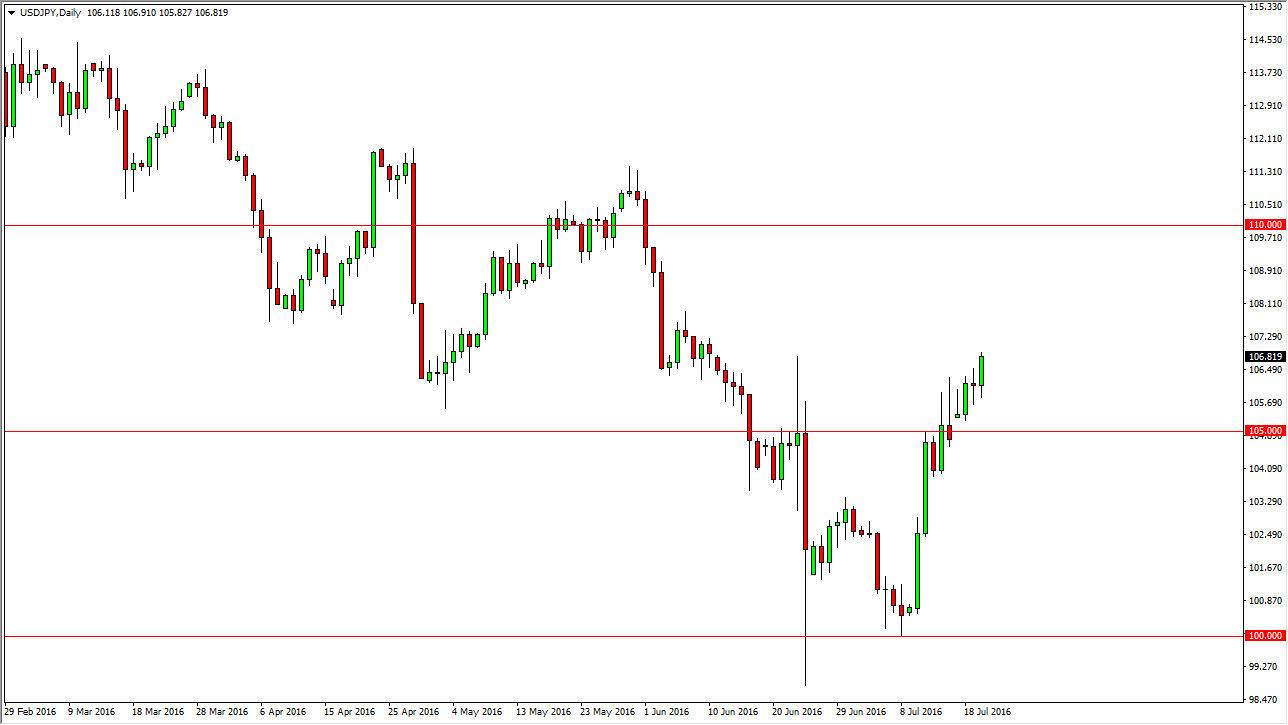

USD/JPY

The USD/JPY pair initially fell during the day on Wednesday but turned around and ended up forming a fairly bullish candle. By doing so, we broke out to the upside and tested the 107 level. This is an area that has quite a bit of noise in it but I do believe that we eventually overcome this area and then try to reach towards the 180 handle. Keep in mind that the Bank of Japan has been threatening to get involved in this market, and that of course has scared a lot of traders. With this, I have no interest in selling this market, and believe that the ever present threat of the Japanese central bank will keep market players from holding onto short positions for any real length of time. With that, I look at pullbacks as potential buying opportunities.

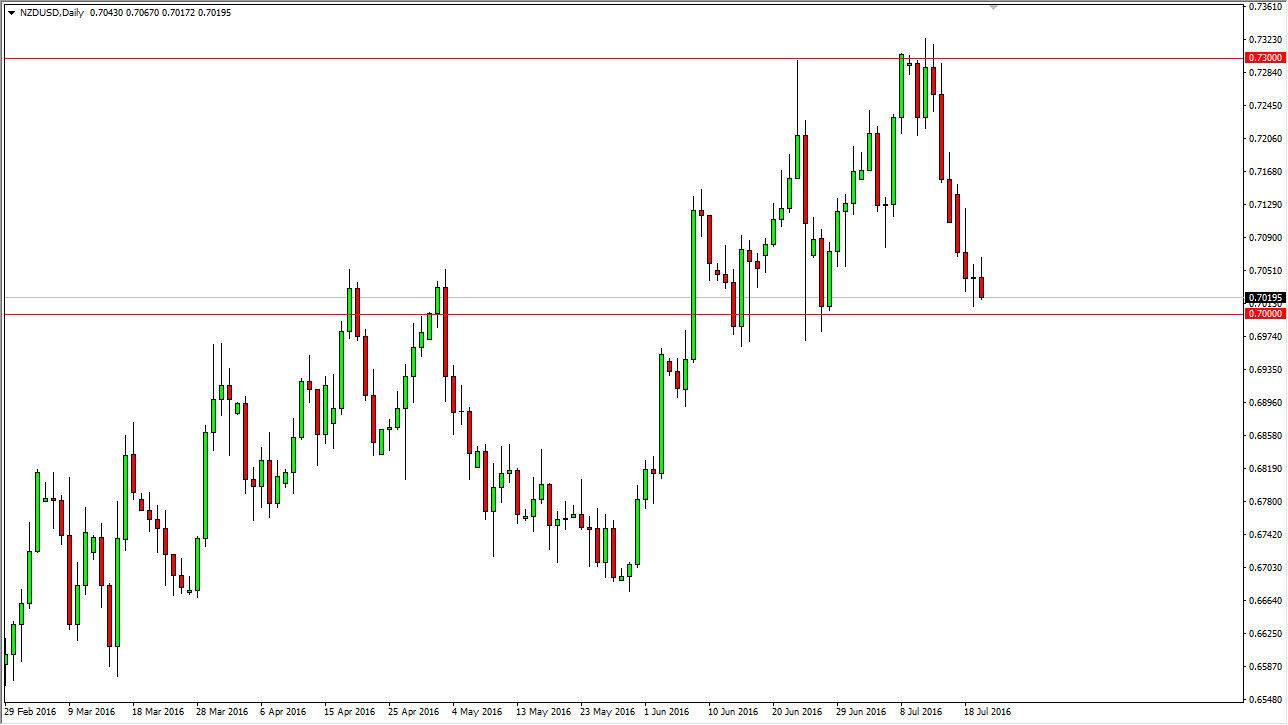

NZD/USD

The New Zealand dollar initially tried to rally during the day but then turn right back around to form a bit of a shooting star. The shooting star sits just above the 0.70 level, which of course is a large, round, psychologically significant number. This area tends to attract a lot of business, so with this being the case it would not surprise me at all to see some type of bounce in this general vicinity. If we can break above the top of the range during the course of the day on Wednesday, I feel that this market could continue to go much higher.

I don’t really have any interest in selling until we break down below the 0.6950 level, which of course would represent a significant breakdown of support. With this in mind, I’m essentially looking to buying this market given the chance, but quite frankly I don’t have a signal to do so yet either. Because of this, I am on the sidelines right now.