USD/JPY Signal Update

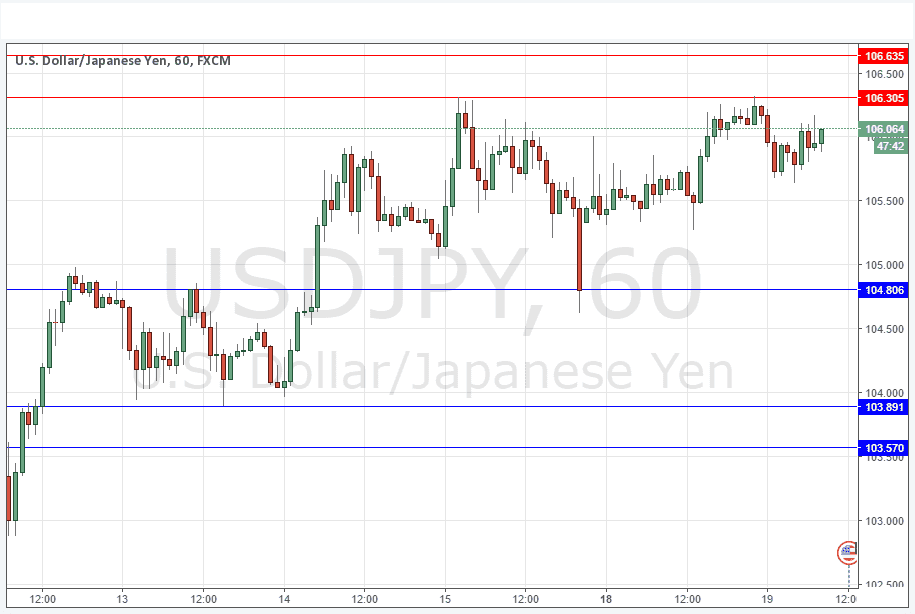

Yesterday’s signals gave a profitable (so far) short entry following the bearish inside candle rejecting the resistance level at 106.30. The stop loss should now be moved to break even as the entry area has already been unsuccessfully retested.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be entered from 8am New York time to 5pm Tokyo time.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 106.64.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 104.80, 103.90 or 103.57.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

I wrote yesterday that I was confident that the resistance level at 106.30 would hold. It has been tested again since I wrote that and so far it has held again. However another attempt at this level may see a successful break, but we have to keep in mind that this band of resistance stretches further still, up to 106.64. Therefore I would not be looking for another short at 106.30 but I would at 106.64. The USD is strong right now but this is a key zone of resistance.

A break up above 106.64 would be a very bullish sign.

There is nothing due today concerning the JPY. Regarding the USD, there will be a release of Building Permits data at 1:30pm London time.