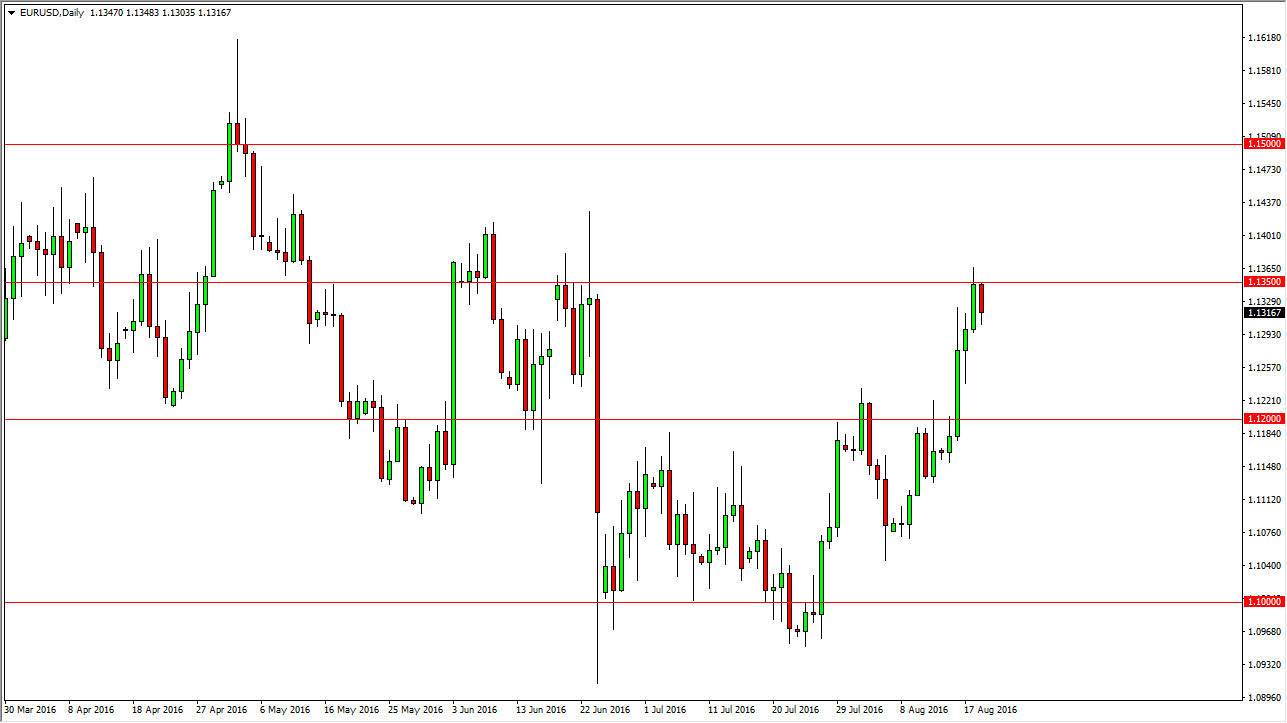

EUR/USD

The Euro fell during the course of the day on Friday, breaking down as the 1.1350 level above has offered far too much resistance. The 1.13 level below is massively supportive from the short-term perspective, but quite frankly I feel that the real “floor” in the market at this point in time is the 1.12 handle. With this, I expect a little bit of volatility in this pullback could be an opportunity for the market to try to build up enough momentum to break out to the upside. It will be volatile, and we are in the late summer months which of course means that we are in holiday season so volatility will probably be somewhat muted. With this, I believe that short-term pullbacks offer short-term buying opportunities.

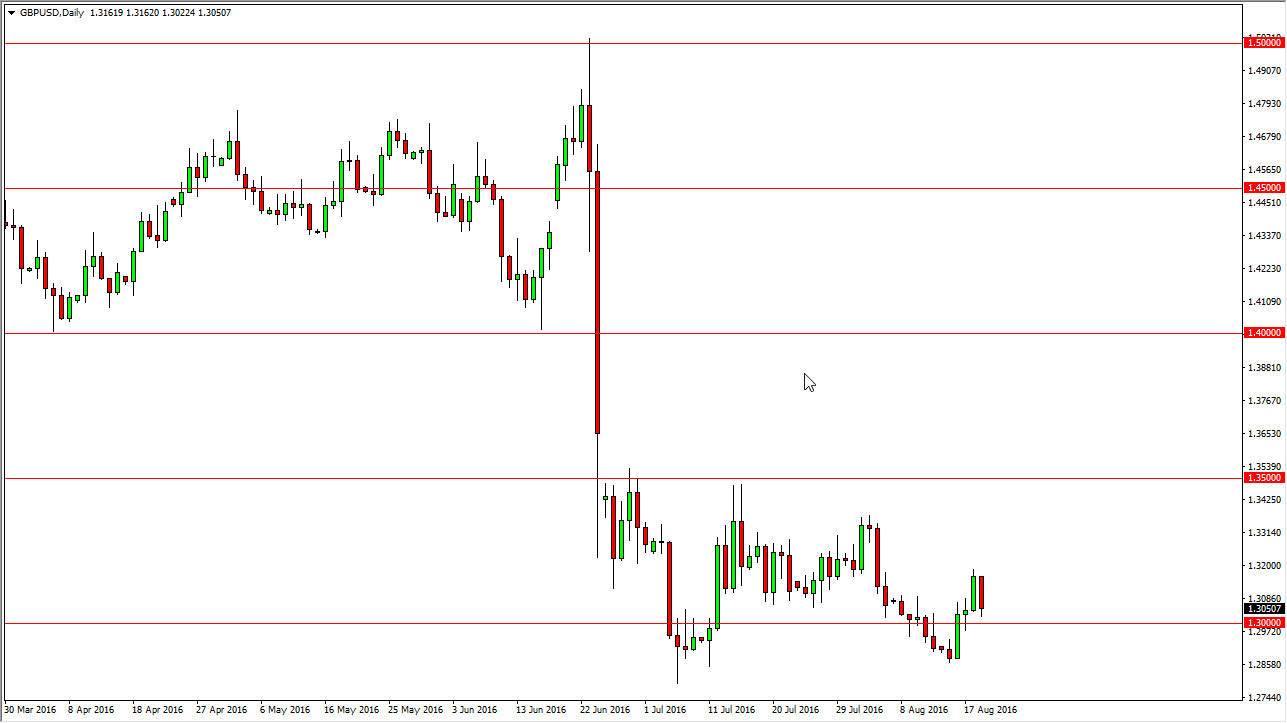

GBP/USD

The GBP/USD pair broke down during the course of the session on Friday, testing the 1.30 level. This is an area that has a certain amount of psychological importance, and I do think that there is quite a bit of support all the way down to the 1.2850 level. If we can break down below that level, it would be a very negative move and we should continue to go much lower, perhaps reaching down to the 1.25 handle. Any rally this point in time will have to worry about exhaustion, and those are the types of moves that I am looking for in order to start selling the British pound again and again. The fact that we are in the holiday season tells me that short-term traders will probably be the best way to go, and therefore that’s what I’m looking for, short-term exhaustion that I can sell and pick up “value” in the US dollar.

The British pound will continue to suffer due to the fact that the British have voted to leave the European Union. With this being the case, the market looks very likely to continue to punish the GBP.