EUR/USD

The EUR/USD pair broke down during the course of the day on Wednesday, as we continue to see a lot of volatility in this particular pair. The breaking back down of course sends the market into what is essentially a “2-day shooting star”, which of course is negative. It is simply just a shooting star that formed over 48 hours instead of 24. With this being the case, looks like the market very well could break down, and if we break below the bottom of the range for the day on Wednesday, I’m willing to sell and start aiming for the 1.10 level below, which should now be very supportive. As far as buying is concerned, I don’t have any interest in buying this market until we clear the top of the previous uptrend line, which of course has been so important in the past.

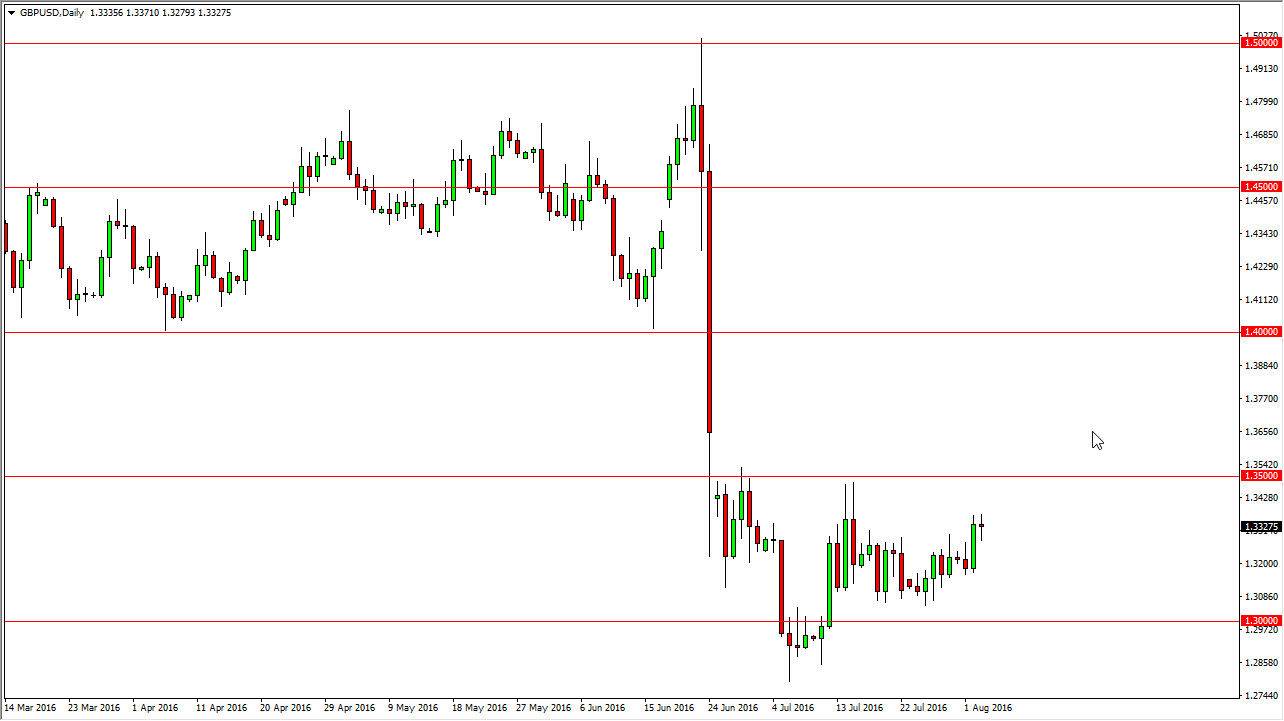

GBP/USD

The GBP/USD pair went back and forth during the course of the day on Wednesday, ultimately ended up forming a neutral candle. I believe that if we rally from here, it will more than likely give us an opportunity to start selling again, because at that point in time we will reach towards the 1.35 level, an area that has caused quite a bit of resistance in the past. There is also a huge gap above there, and that gap of course will be resistive as well. In other words, I am simply waiting for some type of exhaustive or negative candle in order to start selling yet again. The 1.30 level below is massively supportive, so at this point in time I think we will simply bounce around and go back and forth overall. I believe that the support starts at the 1.30 level and extends all the way down to the 1.28 level below. If we can break down below there, we can finally continue the longer-term downtrend that I expect to see in this market.