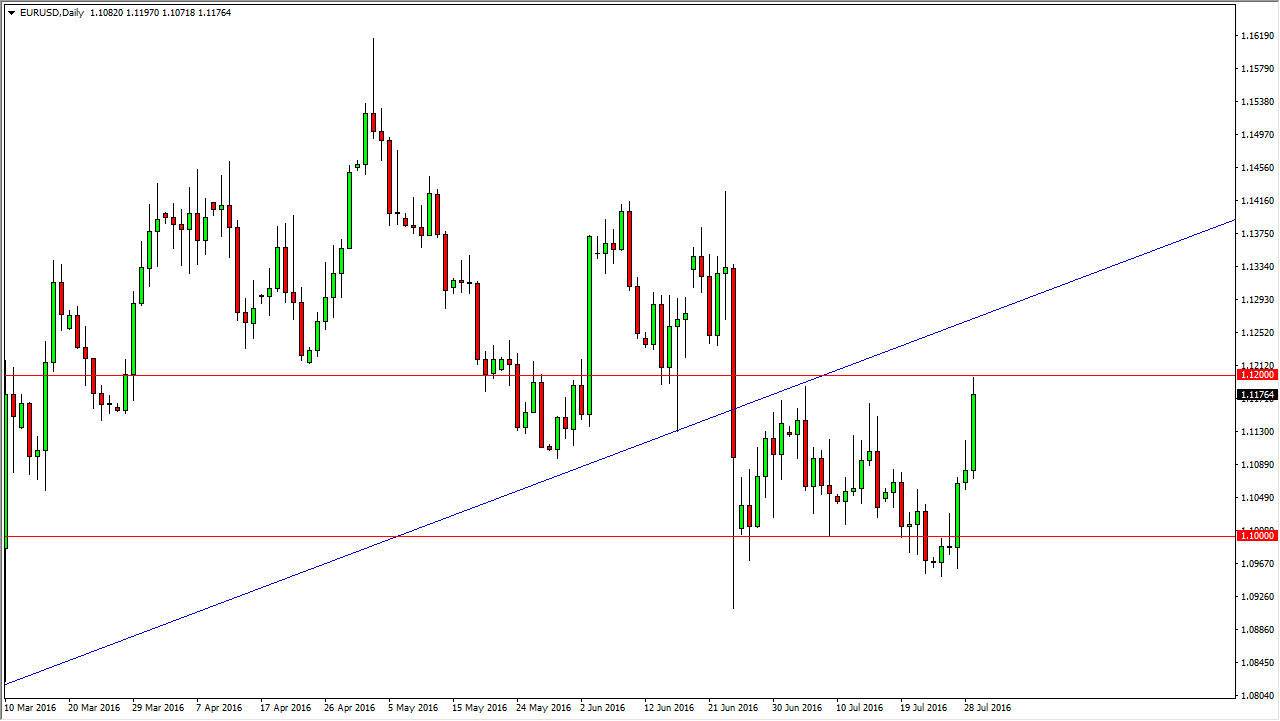

EUR/USD

The EUR/USD pair had a very strong session on Friday, as we continue to see quite a bit of bullish pressure. However, I do not think that this will last for a long, because not only is the 1.12 level resistive, but I also recognize that the previous uptrend line should continue to work against the value the Euro anyway, as it should offer resistance. Because of this, I am simply waiting to see whether or not we get some type of exhaustive candle that we can search selling. I believe that longer-term the Euro will continue to struggle against the US dollar as the greenback of course is a safety currency. The Euro of course has to deal with fact that it represents the European Union, and there’s a lot of uncertainty there. Because of this, I am patiently waiting for a selling opportunity.

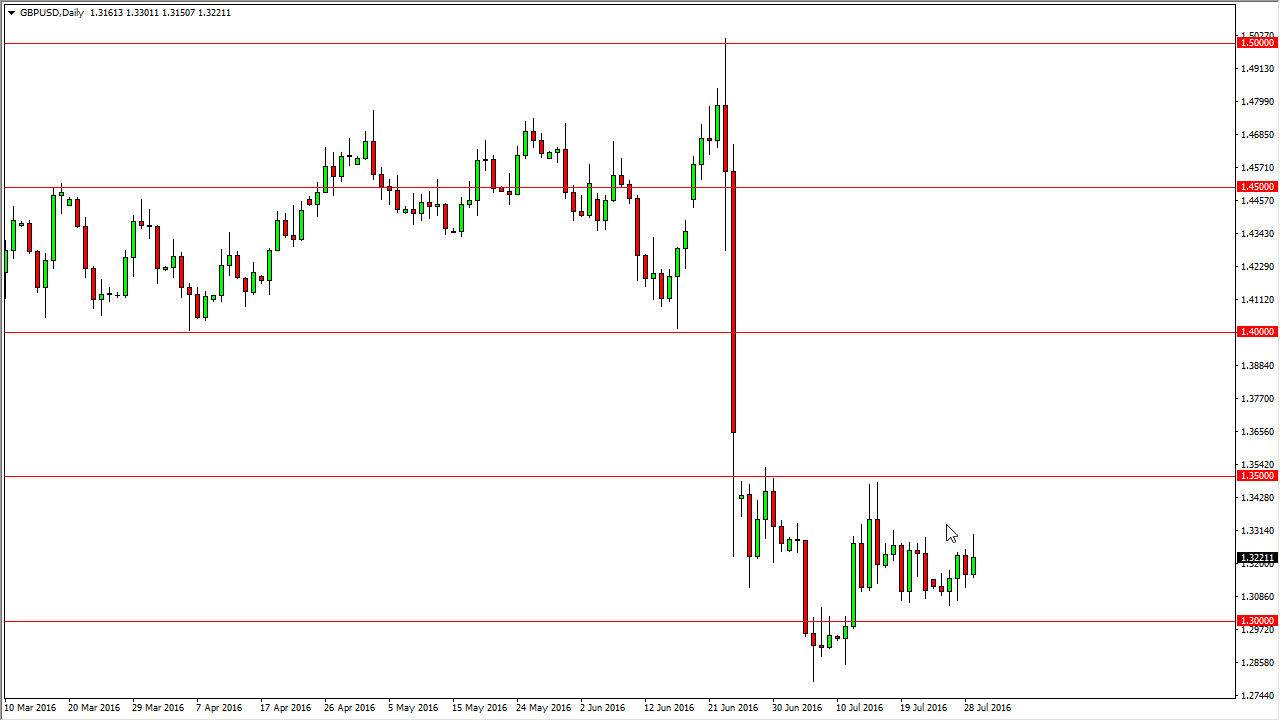

GBP/USD

The GBP/USD pair initially tried to rally during the day, but did get back over half of the gains. By doing so, we ended up forming a bit of a shooting star, and that of course is a very negative sign. With this being the case, I think that this market is going to continue to offer selling opportunities every time we rally. After all, the British pound is more or less the “whipping boy” of the Forex world right now as the British leaving the European Union has quite a bit of negativity built into the British pound.

However, you have to keep in mind that we have fallen quite a bit so most of the extreme ends sudden damage has already been done. I think that this becomes a literal grind to the downside, and that given enough time we will break down but I don’t expect it to happen overnight. In fact, I think that we will probably down to around between the 1.30 level and the 1.35 level above over the next several weeks. I do however believe in the negative bias.