EUR/USD

The Euro had a slightly negative session during the day on Monday, as the 1.12 level above continues to offer quite a bit of resistance. Because of this, I believe that the market will continue to fall from here as we continue to consolidate between the 1.10 level on the bottom, and the 1.12 level on the top. With that being the case, it makes sense that we would drift lower from here as we are near the top of the overall consolidative area, which has been fairly reliable. Beyond there, I see a significant amount of resistance due to the previous uptrend line that had been pushing this market to the upside. Have no interest in buying this market until we break above that trend line, which we still aren’t anywhere near.

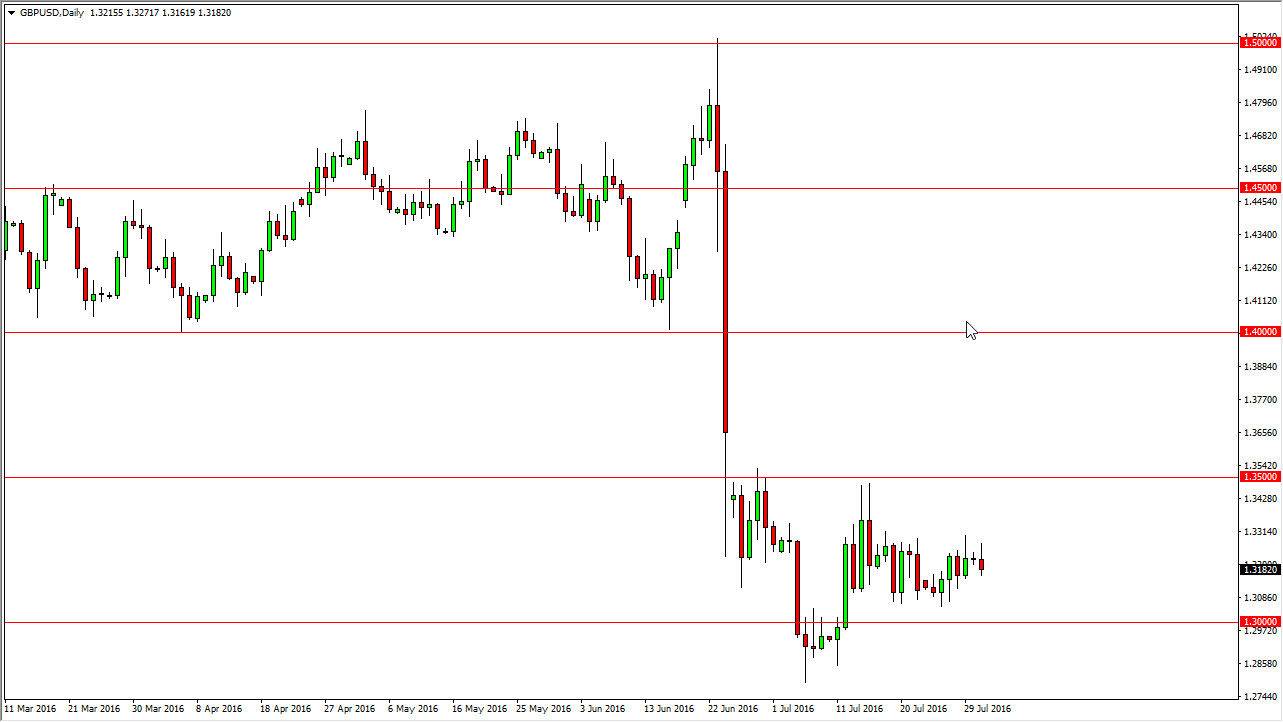

GBP/USD

The GBP/USD pair initially tried to rally during the course of the session on Monday, but then fell enough to form a shooting star. The shooting star of course is a negative sign, but at the end of the day I feel that we are still consolidating overall. The 1.30 level below is obviously supportive, and the 1.35 level above is massively resistive. I think that every time we rally, it’s going to be an opportunity to sell this market as we exhaust any short-term rallies.

If we can break down below the 1.30 level, it’s likely that the support runs all the way down to the 1.28 handle, and therefore I feel that the market will be difficult to sell for a longer-term move to the downside unless we can get below there. With this, I would be willing to sell and hold below 1.28, but until there I feel that short-term bounces are likely and could very well cause problems for sellers. However, if you are willing to wait until the exhaustive candle forms, it’s likely that we could start selling.