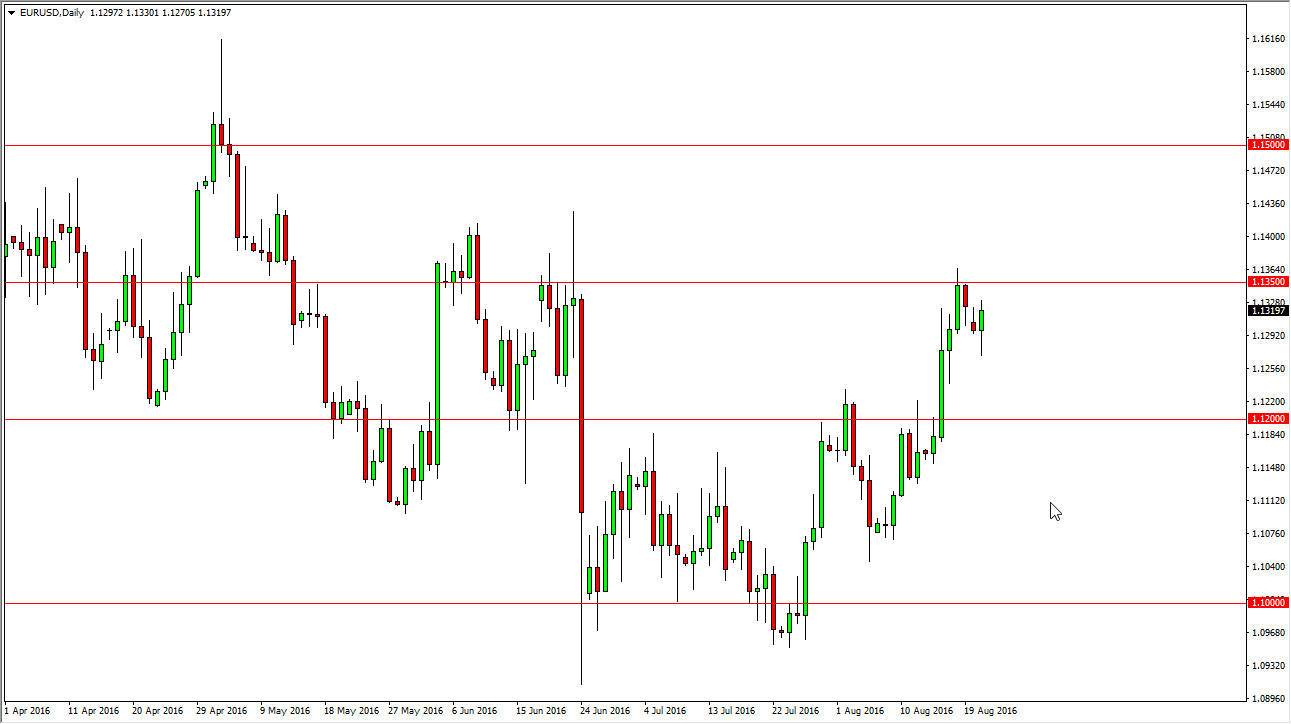

EUR/USD

The EUR/USD pair initially fell during the day on Monday, but then turn right back around to form a hammer as the market decided to bounce. I believe that we are trying to build up enough momentum to break out and above the 1.1350 level which has been short-term resistance. I believe given enough time we should break above there and reach towards the 1.15 handle above. Even if we do pullback from here, I believe that the “floor” in this market is somewhere near the 1.12 handle, and that traders are essentially focusing on the fact that the Federal Reserve cannot raise interest rates this year. As long as that’s the thought, I believe that the Euro will continue to grind its way higher.

GBP/USD

The British pound did bounce during the course of the day on Monday, using the 1.30 level as support. However, I see a significant amount resistance above, and it’s only a matter of time before we run into it and turn things back around with an exhaustive candle. With that being the case, the market should continue to find exhaustion above, and the exhaustion candle would be reason enough to start selling as it simply solidifies the downward trend that we’ve been in for some time. I believe that is not until we break well above the 1.35 level that I believe the British pound could continue to go higher for any real length of time. In the meantime, I believe that you are simply selling short-term exhaustive candles as it continues offer opportunities again and again. With this being the end of the summer, there are a lot of traders away at holiday, so therefore there is no real volume in the market. I think this offers short-term opportunities, but the longer-term move probably won’t reach the markets until September.