EUR/USD

The EUR/USD pair rallied during the course of the day on Tuesday, as we broke above the 1.12 level. However, there is an uptrend line that had defined the uptrend recently, and therefore it should now offer quite a bit of resistance. It’s not until we break above that line that I would consider buying. In fact, on the 4-hour chart we formed a bit of a shooting star so it’s very likely that we could pull back. If we can drop below the 1.1150 level, I feel that the market will then drop all the way to the 1.10 level below there. This is a market that has been consolidating lately, and this latest move was in reaction to the anemic GDP numbers out of the United States, but ultimately there are enough problems in the European Union to keep the value of the Euro down.

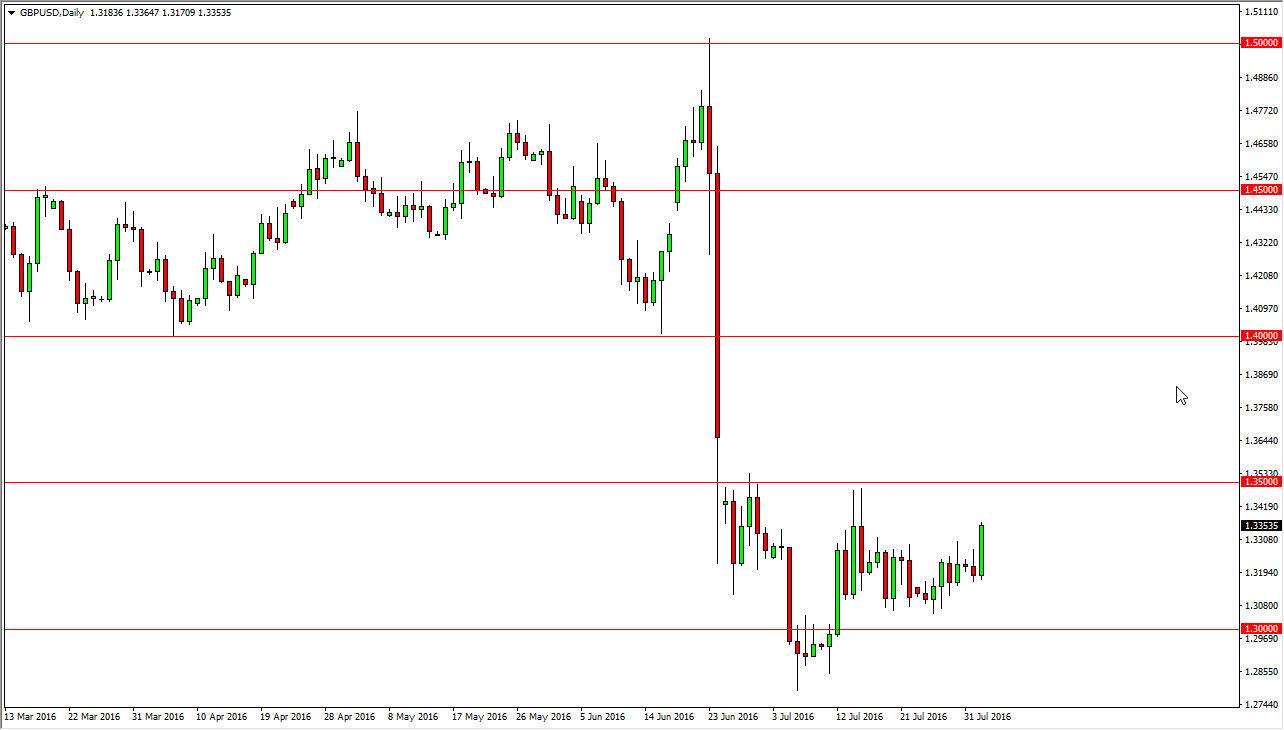

GBP/USD

The GBP/USD pair broke higher during the course of the day on Tuesday, but we still are well within the consolidation area that has been making up the market recently. That being the case, I believe that the 1.35 level above will be massively resistive, so it is probably only going to be a matter of time before the market sells off again. Any signs of exhaustion above here and between here and the 1.35 level is reason enough to start selling. I have no interest whatsoever in buying this market, and believe that the markets will continue to favor the US dollar overall as we have seen quite a bit of concern around the world, which generally works in favor of the US dollar and the “safety trade.” Because of this, I think it’s only a matter of time before we returned to that type of action.

Even if we break above the 1.35 level, there is the matter of the massive gap above there that extends all the way to the 1.3650 level as well. With that being the case, I feel that simply waiting for some type of a negative candle is the only thing you can do.