EUR/USD Signal Update

Yesterday’s signals were not triggered as there was insufficiently bearish price action at 1.1105 and 1.1119.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken between 8am and 5pm London time today.

Long Trades

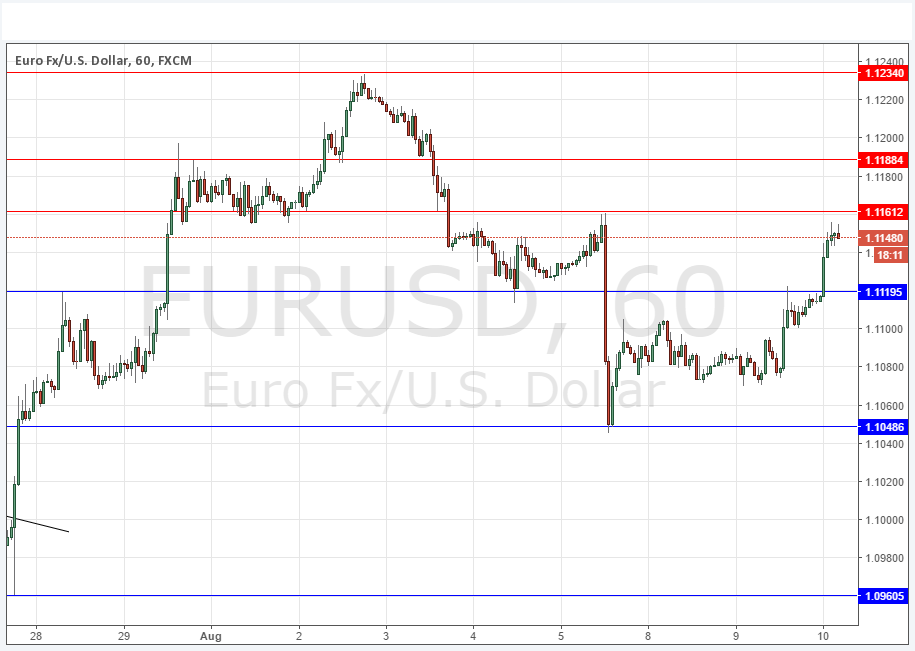

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1120 or 1.1049.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1162 or 1.1188.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

The USD began to weaken not long after New York opened yesterday, before running out of steam towards the end of that session. However, the Asian session then saw an even stronger and unusual weakening of the USD across the board, which the EUR benefited from. This pair broke up above the resistance at 1.1119 and is now not far from the next key level at 1.1161 which could be interesting if reached.

A long-term downwards trend has not developed.

There is nothing of high importance due today concerning the EUR. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.