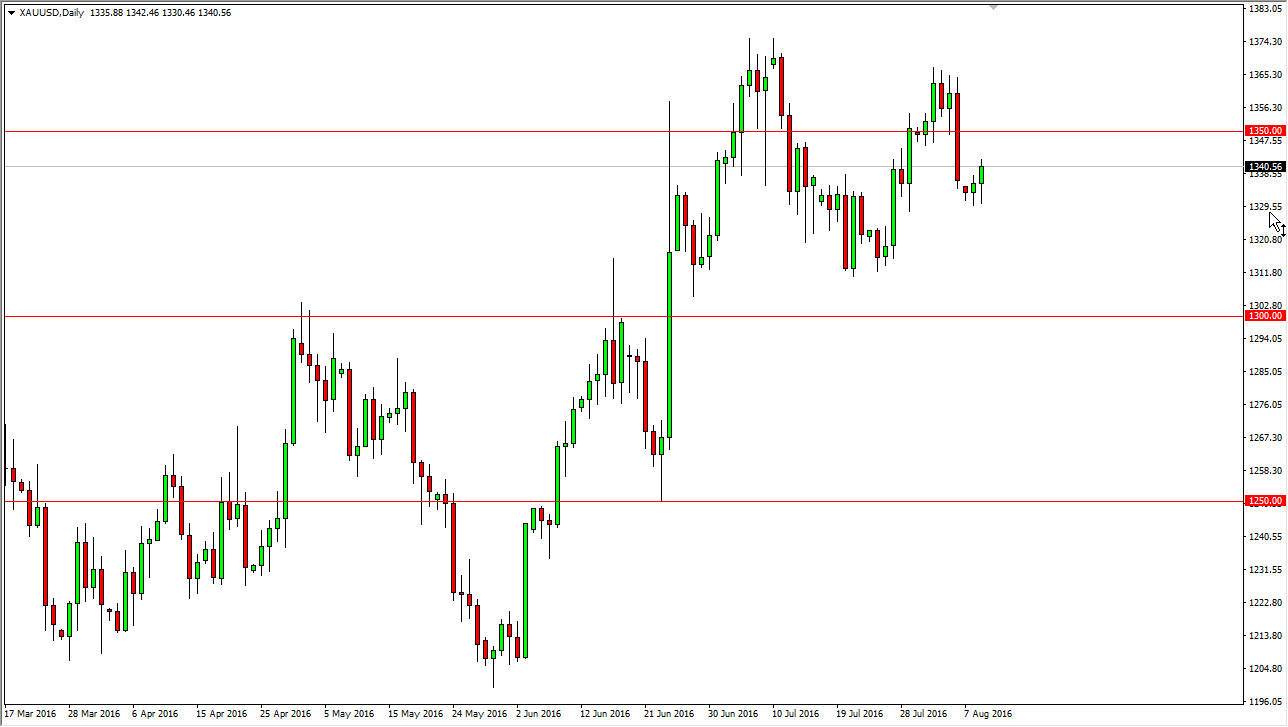

The gold markets initially fell during the day on Tuesday, but we found enough support near the 1325 level to turn things around and bounce to form a bit of a hammer. This being the case, the market looks as if we are going to try to grind our way back to the upside. In fact, we’ve had a nice pullback with a higher low from the previous one. With this being the case, I believe that the market sooner or later breaks out to the upside. After all, there are a lot of reasons to think the gold markets will continue to climb, as they have seen buyers jump into this market every time we pullback.

Fear

The market tends to run to Gold when we are concerned about several currencies at one time, which of course would have been the case during the day. With this being the case, the market should continue to be very bullish of the longer-term, because of the Euro and the Pound both looking very soft. Over the longer term, people prefer to hold “hard currency” instead of the riskier currencies mentioned above.

I believe that we will eventually break out to the upside, perhaps reaching towards the $1500 level by the end of the year. I have no interest whatsoever in selling this market, and believe that every time we pullback it will more than likely be an opportunity to take advantage of value in a market which has been very strong. With this being the case, it’s very likely that the markets will continue to find quite a bit of bullish pressure every time there is perceived value. After all, there is a lot of uncertainty in both the European Union and the United Kingdom, but beyond that there are a lot of concerns when it comes to the Middle East. Quite frankly, the only US dollar there isn’t much more I would be comfortable owning for any real length of time.